22 Sep 2016

The Future of Retirement: Hopes and dreams

- Posted by Dejan Pekic BCom DipFP CFP GAICD

We are in the business of helping clients achieve their goals and objectives but we are not in the business of miracles.

There are always limitations to the balance sheet and cash flow and how hard a client permits us to invest their capital.

HSBC has published a study on ‘The Future of Retirement Global Report’.

We have attached an extract from the research which lists buying a new car, living abroad, starting a business, learning a foreign language, writing a book and further education as the top 6 things that retires have been unable to achieve in their retirement.

The good news is that we help with the car and living abroad but the rest will have to be driven by the client.

16 Sep 2016

Australian Federal Budget 2016: Superannuation Reform

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The Federal Treasurer Scott Morrison has just announced that the proposed lifetime $500,000 non-concessional cap has been scrapped which presents a unique opportunity this financial year.

Specifically, an individual under age 65 can trigger the current 3 year bring-forward option to contribute up to a maximum $540,000 into superannuation as a non-concessional contribution before 30 June 2017. Conditions apply.

See Superannuation Fact Sheet 04.

This is exciting news right now because the Federal Government intends to introduce legislation to stop individuals with a total superannuation balance of more than $1.6 million from making any further non-concessional contributions into superannuation from 1 July 2017.

WARNING, these comments do not constitute Personal Advice.

13 Sep 2016

The Wisdom of Great Investors: What you need to know

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The wisdom in the commentaries that we have just shared is remarkable yet the insight from these Great Investors is deceptively simple.

What you need to know to invest-

- Avoid self destructive behavior– Benjamin Graham (1894-1976)

- Don’t attempt to time the market– Peter Lynch (born 1944)

- Be patient– Jesse Livermore (1877–1940)

- Don’t let emotions guide your investment decisions– Warren Buffett (born 1930)

- Recognise that short-term underperformance is inevitable– John Maynard Keynes (1883–1946)

- Disregard short-term forecasts and predictions– John Kenneth Galbraith (1908–2006)

The underlying message is that investing is boring. It is about compound interest over time and not about sexy.

If it talks about being sexy, RUN and try to remember that it is when fear and panic take hold that an investor is presented with the best opportunity to buy more quality assets at reasonable or better still discounted prices.

8 Sep 2016

The Wisdom of Great Investors: Part 6 of 6- Disregard short term forecasts and predictions

- Posted by Dejan Pekic BCom DipFP CFP GAICD

John Kenneth Galbraith (1908–2006) was a North American economist who taught at Harvard for many years.

He wrote a number of book with his most famous works being the popular trilogy on economics, American Capitalism published in 1936, The Affluent Society published in 1958 and The New Industrial State published in 1967.

John Kenneth Galbraith is quoted as saying that…“The function of economic forecasting is to make astrology look respectable.”

6 Sep 2016

The Wisdom of Great Investors: Part 5 of 6- Recognise that short-term underperformance is inevitable

- Posted by Dejan Pekic BCom DipFP CFP GAICD

John Maynard Keynes (1883–1946) was an economist best known for his economic theories, Keynesian economics on the causes of prolonged unemployment.

He wrote ‘The General Theory of Employment, Interest and Money’ published in 1936 which proposed a solution for economic recession based on a government-sponsored policy of full employment.

He is considered one of the most influential economists of all time.

John Maynard Keynes is quoted as saying that… “The social object of skilled investment should be to defeat the dark forces of time and ignorance which envelope our future.”

2 Sep 2016

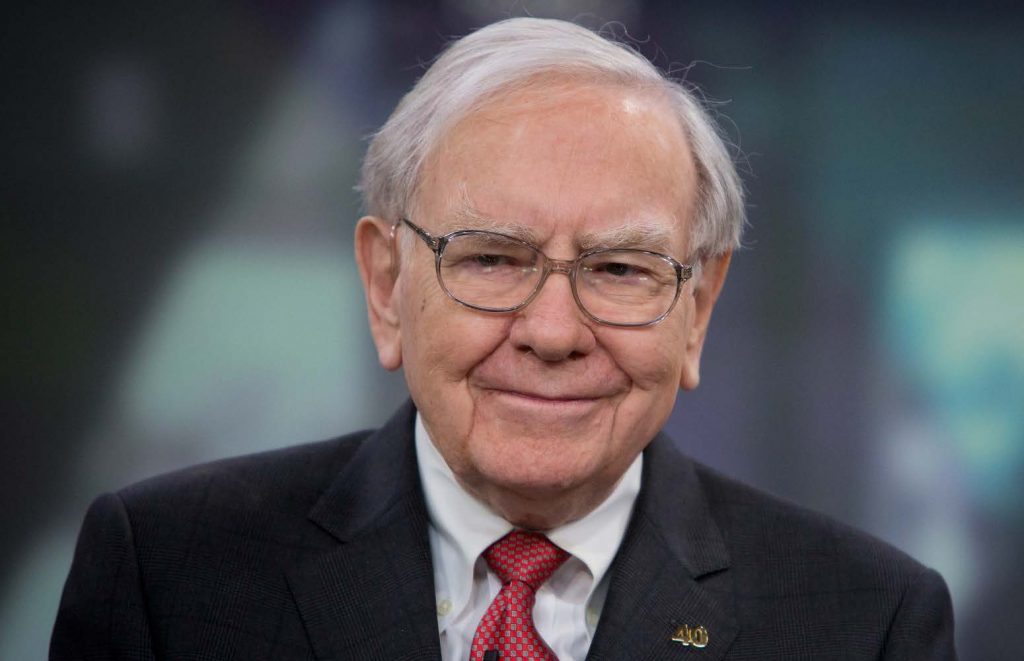

The Wisdom of Great Investors: Part 4 of 6- Don’t let emotions guide your investment decisions

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Warren Buffett (born 1930) is both one of the World’s most successful investors and one of the World’s richest men with an estimated net worth of US$66 billion.

Warren Buffett has many quotes but one of his great quotes is…“Be fearful when others are greedy. Be greedy when others are fearful.”