15 Mar 2018

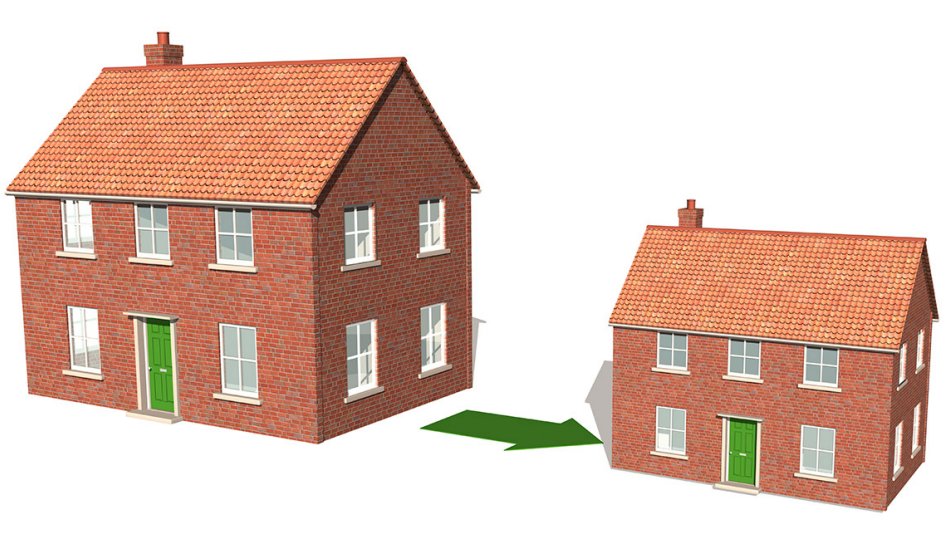

Superannuation Reform: Downsizing

- Posted by Dejan Pekic BCom DipFP CFP GAICD, Senior Financial Planner

Downsizer superannuation contribution legislation has been passed which means that from 1st July 2018 (which is only three months away), if you are 65 years old or older you can choose to make a downsizer contribution into superannuation of up to $300,000 from the proceeds of selling your home.

This only applies to the sale of your primary residence and provided that the exchange date (not settlement date) occurs on or after 1st July 2018.

This is an opportunity for clients who do not qualify for the Age Pension because it does not count towards the individual total super balance cap of $1.6 million.

However it will count towards the $1.6m transfer balance cap which means you will still not be able to make more than the maximum initial contribution of $1.6 million into the pension phase of superannuation.

The numbers however are not ideal when it comes to clients who qualify for a part Age Pension.

The attached table demonstrates that you what gain in additional income from the downsizer superannuation contribution you lose in Age Pension income due to the increase in assets under the Asset Test.

Click to read.

Yes it is all a challenge to navigate but that is why you have us.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.