15 Apr 2024

Market Metrics: Inflation

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Financial experts never seem to know what is going on right now but in hindsight they are perfect.

For example, the United States was forecast to go into recession in 2022 after the Russian invasion of Ukraine which resulted in supply shocks and rapid global interest rate rises but the United States did not fall into recession.

Again, the United States was forecast to have a recession in 2023 but it did not happen.

Why because no one had worked out that the insane printing of money by Governments during COVID-19 period had left consumers with excess savings. This excess has now been depleted expect for Australia.

Click for excess savings charts.

Our point is that financial experts almost never know what is going on in the present.

Markets have been forecasting (and are still forecasting) that inflation has peaked, that it will fall and consequently interest rates will be cut in 2024.

For goods inflation we agree however not for services inflation.

Wages increases are high and showing no signed of reduction in the short term which means that inflation (the sum of goods plus services) will remain high and that means no interest rate cuts in 2024. In fact, interest rates are more likely to increase in 2024.

Click for services inflation charts.

If correct and interest rates do increase in 2024 then it will again mean a correction/crash for assets prices.

What action does one take?

None, just follow Benjamin Graham’s value investing principles and remain invested according to your appetite for volatility and look to buy more quality assets when prices fall.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

10 Apr 2024

2024 US Presidential Election: Biden vs Trump

- Posted by Dejan Pekic BCom DipFP CFP GAICD

We keep being asked the question, what happens if Trump wins?

Donald Trump brought chaos and disorder to the Office of the President of the United States and will likely again if elected again.

Attached is a matrix of potential winners and losers of Biden versus Trump and a reminder that the US Federal Reserve has changed interest rates in every Presidential Election year since 1980 except for 2012.

Meaning that although the US Federal Reserve is expected to reduce interest rates in 2024, they could still end up increasing rates instead.

Click for Biden vs Trump.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

4 Apr 2024

Low hanging fruit: Superannuation

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Many of you a are too young to remember but I was there advising on the 1st July 1992 when the Superannuation Guarantee (SG) began.

Today superannuation holds $3.5 trillion in assets and by 2048 it is forecast to grow to $13.6 trillion.

Click for charts.

Why does it continue to multiply? Because it is financially gorgeous.

Just imagine, you can invest in this thing called superannuation and only be charged a maximum tax rate of 15% on earning compared to the top 45% marginal rate for individuals.

And then when you begin drawing an income the tax rate drops again to 0% on everything- capital gains, distributions and withdrawals.

It does not get much better than this.

Apart from tax free capital gains on the primary residence in Australia there is no other legal way to reduce tax on earnings to 0% and that is the reason for so many restrictions on superannuation.

The math’s however is simple, we each get a $1.9m cap (meaning $3.8m for couples) and the Federal Government will not force you to take advantage of this low hanging fruit.

The best part is that you do not have to get on a ladder, you do not have to climb a tree, just reach up and take advantage of this opportunity.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

20 Mar 2024

Decarbonisation: Climate Change

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The United Nations Framework Convention on Climate Change (UNFCCC) estimates that US$125 trillion in investment is needed to achieve net-zero on a global scale by 2050.

Why are they planning this spending?

Because scientific report after scientific report keeps warning on climate change.

For example, the WMO (World Meteorological Organisation) has just published that 2023 was the warmest year on record, global sea level have reached record high, Antarctica sea ice reduced further 1 million square kilometers from previous recorded low and increased extreme weather is threatening food security.

Click to read.

Pollution caused by humanity is at the the heart of this problem and the subsequent spending of US$125 trillion to achieve net-zero by 2050 will present enourmous investment opportunities.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

14 Mar 2024

Cryptocurrency: Bitcoin

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The printing of vast quantiles of money (issuing I-owe-you paper called notes, bills, bonds) by Central banks around the World has been the key driver behind Bitcoin and associated cryptocurrencies but remember that Bitcoin price relies on The Greater Fool Theory.

The Greater Fool Theory is where a purchaser/investor buys an item/asset in the belief that the next purchaser/investor will buy it from them at a higher price.

That fact about Bitcoin is that only 21 million can be mined in total and so far 19.6 million have been collected which makes it rare and as long as there is a group who want to trade in this limited edition rarity (think of it as a collator’s item) there will be a price.

Once there is no longer a group that wants to trade in this collector’s item the price will evaporate.

Don’t know how cryptocurrency will end but we do know what Benjamin Graham taught and that was to not speculate. Instead remain invested according to your appetite for volatility and when fear and panic take hold, react by buying more quality assets at discounted prices.

Click to read.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

5 Mar 2024

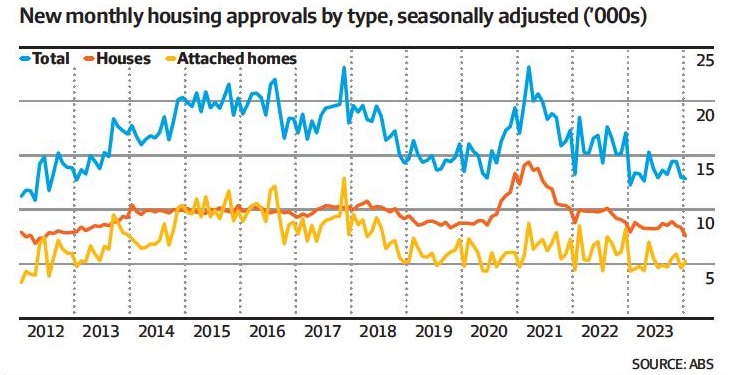

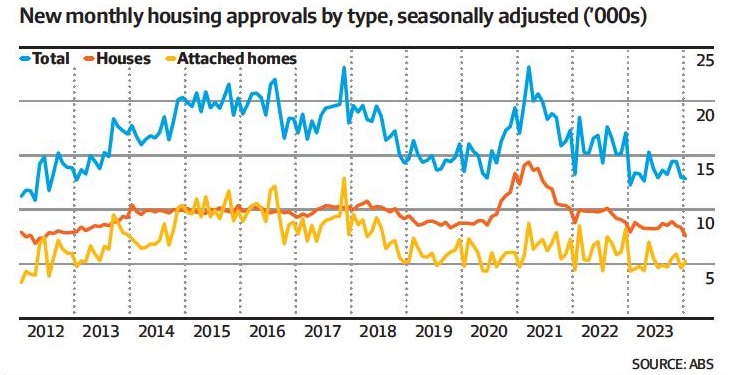

Australian Residential Property: 12 year low

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Residential property prices (especially Sydney and Melbourne) just keep increasing and everyone without property keeps complaining.

If the Federal Government wants to stop steep rises in residential property prices and steep rises in rents then it will need to either cut immigration immediately or streamline the building of more residential property which is currently at a 12 year low.

Building more residential property (increasing supply) is preferable because it brings economic benefits but it takes years to deliver supply of new residential property.

Click to read.

Ongoing reduction in residential property supply is not good because humans need shelter to live.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

20 Feb 2024

The Age of AI has begun: The convergence

- Posted by Dejan Pekic BCom DipFP CFP GAICD

There have been moments in history when everything changed.

Right now we are living in one of these moments.

‘Software is consuming the World’ and this software is bringing everything together into a technological convergence that is and will continue to drive economic growth by creating trillions of dollars of sales revenue.

Click for chart.

This is being called the start of the 4th era in computing, Artificial Intelligence.

If you are not a Newealth client and want to take advantage of the convergence then please contact us.

16 Feb 2024

Friday Tidbit

- Posted by Dejan Pekic BCom DipFP CFP GAICD

It is next to impossible to always pick the winners.

This was the explanation that we gave to one of our clients who asked about making large individual investment bets.

This not only applies to individual investments but also to indices.

For example, how many times has the US stock market posted the highest calendar year return in the past 30 years?

The answer is none, not once did it deliver the highest return for investors.

Click for table.

The message, it is smart to diversify.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

12 Feb 2024

Asian Century: China Property Collapse

- Posted by Dejan Pekic BCom DipFP CFP GAICD

This is expected to be the Asian Century given that half of the World’s population live in this region however China may not be as dominant as has been previously forecast for the following reasons.

Firstly, the One-Child Policy implemented between 1980 and 2015 to curb the country’s population growth will have dramatic negative impact on China’s working age population.

Secondly, the unfolding property collapse due to over building. Evergrande Group was China biggest property developer and has been ordered into liquidation by a Hong Kong court owing an estimated US$300 billion. Country Garden owes US$191 billion and is next with creditors applying for its liquidation.

This is a financial disaster for China which will cost in the trillions of dollars making it much larger than the 2008 Global Financial Crisis.

The World is currently holding its breath because financial markets do not know how to price this property collapse given China’s closed financial system.

The upside will likely be for buyers with large amounts of property being sold at fire sale prices.

Click to read.

Just remember, when asset prices fall due to some financial disaster, the outcome is always the same, investors are presented with an opportunity to buy more quality asset at a discounted price.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

6 Feb 2024

Market Metrics: Commodity Prices

- Posted by Dejan Pekic BCom DipFP CFP GAICD

This is another excellent example of why investors should avoid chasing sectors.

Investing in sectors sound sexy and yes an investor can take their block of capital and invest it all in either consumer discretionary or consumer staples or energy or healthcare or information technology or real estate or utilities or financials or industrials or materials or communication services.

This is what happened in 2022 when Russia invaded Ukraine.

Material prices boomed for both hard and soft commodities because of the fear that the reduced supply would be permanent and so investors bought big but this all reversed in 2023 with commodity prices subsequently being crushed.

Click for chart.

The lesson is not to chase sectors and not to invest all the capital in one sector but instead to invest in a number of businesses that repeatedly produce profit from the sale of goods and or services.

That is how you manage risk, that is how Benjamin Graham did it and that is how Warren Buffet has done it.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.