Archives

- August 2025 (1)

- July 2025 (2)

- June 2025 (3)

We are most likely at a turning point.

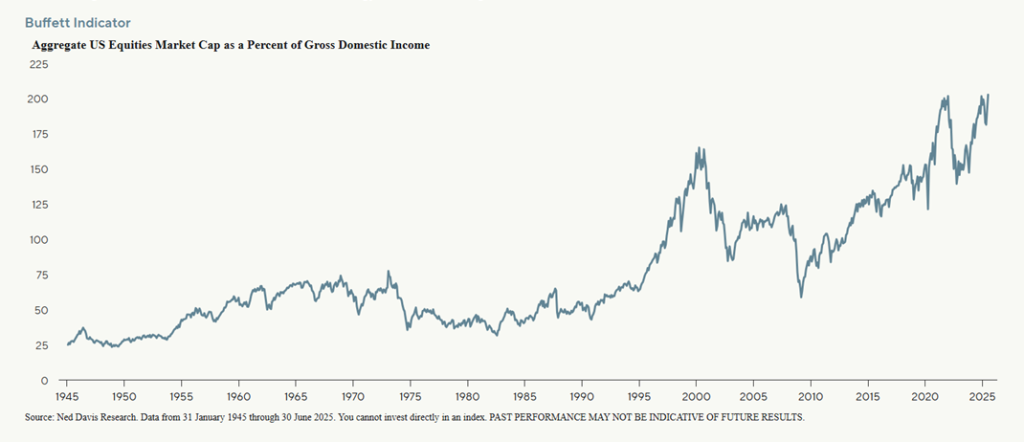

The Buffett Indicator is a measure of the total value of all publicly listed companies in a country divided by a country’s Gross Domestic Product (GDP) to provide an indicator of whether publicly listed companies are overvalued or undervalued.

A value over 100% is a sign of being overvalued while well under 100 in undervalued.

The current US Listed Companies Market Cap to GDP Ratio is 203% as at 30 June 2025 which means it is stretched higher than previous asset price crashes.

Question. Do you speculate and make changes prior to some unknown as yet future financial markets catastrophe?

No, absolutely not.

Benjamin Graham’s Value Investing Principles teach us to remain invested according to our appetite for volatility and when fear and panic next take hold, react by buying more quality assets at discounted prices.

WARNING, this does not constitute Personal Advice. To discuss if this is an appropriate strategy for your given circumstances, please do not hesitate to contact us directly.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.