Archives

- December 2025 (4)

- November 2025 (4)

- October 2025 (4)

- September 2025 (4)

At a time of global instability, market volatility and cost-of-living pressures, it’s easy to feel overwhelmed and apprehensive when it comes to our finances. This economic uncertainty may not only impact our current financial position but, it seems, our future financial security.

With financial markets consistently in a state of flux, economic uncertainty is natural – and something best addressed with a calm response, considered long-term goals and strategic financial planning.

By accepting that the economy is something we can’t control, and focusing instead on what we can, it’s possible to successfully navigate every financial challenge.

As prices plummet or savings stall, it’s easy to forget that uncertainty is a normal part of economic cycles.

Financial markets are cyclical and continually impacted by global events, leading to booms, swings and crashes. During downturns in particular, it’s difficult to know where the market is heading and what to expect. We can’t control this economic uncertainty. What we can do is ensure we react carefully and not carelessly.

After every downturn comes recovery. So, while it can be tempting to run from the market during market falls, a rash decision may place you in a worse financial position once the market recovers.

It’s important to recognise that market falls may also provide a prime opportunity to purchase, with prices at their lowest. With an expert financial planner by your side, it’s possible to move through economic uncertainty, take advantage of opportunities and emerge feeling confident and financially secure.

The emotional impact of uncertainty – fear, anxiety, even depression – typically makes us look only to the short term. We watch markets fall, see the immediate effects on our savings and investments, and we want to act. However, these knee-jerk reactions aren’t always in our best financial interests.

To handle this financial uncertainty, a good strategy is to focus on long-term goals. Financial challenges aren’t easy, but acknowledging that this is a temporary situation helps minimise anxious thoughts that lead to reckless actions.

Whether you’re saving for a new property, building family wealth or planning for retirement, a big-picture approach helps you stay grounded and on track to your financial goals.

At Newealth, our expert financial planning employs disciplined, diversified and proven investment strategies to help build generational wealth and security. Our priority isn’t short-term gains. Instead, we help you define your long-term goals – and reach them with well-considered decisions that build sustainable financial outcomes.

To navigate financial challenges, it’s important to be prepared, and this is where a robust financial plan comes into play.

At Newealth, we help you work out what’s important now, and what you want for the future. We then design and implement a financial plan with considered investments, and the level of risk that you’re comfortable with.

A well-structured financial plan – and ongoing, trusted, tailored advice – ensures you’re in the best position to meet whatever the market throws at you. It helps you move calmly through financial challenges with clarity and confidence.

With over 35 years in financial planning, we’ve seen plenty of booms and busts, swings and downturns. We’ve also helped our clients stay on course during every market challenge.

We’re a client-first financial partner, which means we focus on relationships, not transactions. We provide expert financial planning services and generational wealth management, and we guide you towards your goals with strategic investments, holistic financial services and ongoing support, particularly through economic uncertainty.

At Newealth, we stay with you through every financial challenge to ensure you always feel in control of your financial planning.

General Advice Warning:

The information in this blog is general in nature and does not take into account your personal objectives, financial situation or needs. You should consider whether the information is appropriate for you and seek professional advice before making any financial decisions.

Newealth Pty Ltd ABN 61 091 100 275 | AFSL 231297

While more Australians are choosing electric vehicles (EVs) each year, upfront costs, infrastructure and range capacity have been the primary issues stalling greater consumer uptake.

With lowering upfront vehicle costs and a rollout of charging stations across the country – the federal government is accelerating rural charging station construction via its Driving the Nation Fund, while the NSW government has committed $199 million to help build infrastructure across the state – battery capacity remains the major sticking point for many drivers.

BMW is addressing that issue directly with its recently released iX3, which has capacity for up to 805 km on a full charge, and 400 kW charging power. That’s a huge leap above typical EV capacity. The current leader of the pack is the Tesla Model 3, with a potential range of 750 km, while SUV EV battery ranges generally sit between 500 km and 700 km.

According to Australia’s Electric Vehicle Council, as of September 2025, we had more than 410,000 EVs in the national vehicle fleet, while there were record EV sales in the 2024–25 period. Australians bought 72,758 battery electric vehicles (BEVs) and plug-in hybrid vehicles (PHEVs) in the first six months of this year, a jump from the 24.4% figure from the same period last year.

While the BMW iX3 has features you would expect from a luxury brand, including a handy Intelligent Personal Assistant, the eco credentials are impressive. In addition to increased storage, the 800-volt, lithium-ion cells feature rapid charging capabilities. The product carbon footprint over its life cycle is 34%smaller than its predecessor. And it can also calculate and program the most efficient route in terms of charger location and costs.

With demand for EVs set to soar over the next decade, there may be investment opportunities, not just with car makers but with other manufacturers in the EV space. If you’re looking to invest or to buy an EV yourself – which may affect your cash flow and have tax implications for business owners – we’re here to help with investment advice and strategic financial planning.

General Advice Warning:

The information in this blog is general in nature and does not take into account your personal objectives, financial situation or needs. You should consider whether the information is appropriate for you and seek professional advice before making any financial decisions.

Newealth Pty Ltd ABN 61 091 100 275 | AFSL 231297

True wealth isn’t built overnight. It’s built over time with expert financial planning, patience and discipline. Markets fluctuate; trends change. For financial success, remaining focused and resolute is key.

Dejan Pekic has been helping clients build generational wealth for over 35 years. His top tips for long-term wealth management? A strategic financial plan, a steady finance strategy and consistent and composed actions – and reactions – during every stage of market activity.

Building wealth means staying the course, even in uncertain times. With planning, purposeful decisions and patience, sustainable financial outcomes are possible.

A strategic and holistic financial plan

Financial security starts with a well-considered financial plan tailored to you and your family, your current financial position and long-term objectives. This may change as your life does, which is why reviews are important.

At Newealth, we help you refine clear and achievable financial goals – not necessarily dollar figures, but a financial position aligned with what you value. We then formulate investment strategies grounded in Benjamin Graham’s value investing principles. We help you plan for long-term financial security and capital preservation with diversified investments and a disciplined margin of safety.

We also take a holistic approach to wealth management, providing comprehensive advice across savings and investment, retirement, estate planning, superannuation and insurance.

An effective financial plan isn’t just about investments, and it’s not about chasing short-term goals. It’s a robust foundation to help you build generational wealth, and to feel confident and secure with your finances.

A steady finance strategy

Creating a strong financial plan is the first step. Equally important is having a steady finance strategy – and sticking to it.

Building wealth takes a holistic approach, and your finance strategy might include a financial plan, diversified investments, savings, debt reduction, tax breaks, insurance and retirement planning.

As a long-term financial partner, our aim at Newealth is to help you build sustainable wealth. We help you recognise what you want, implement an achievable financial plan to help you get there, and importantly, guide you through complex decisions, shifting priorities and key milestones.

Whether buying a home, pivoting a business or stepping into retirement, we help you stay on course to meet your goals with a steady and successful finance strategy.

Consistent and composed financial decisions

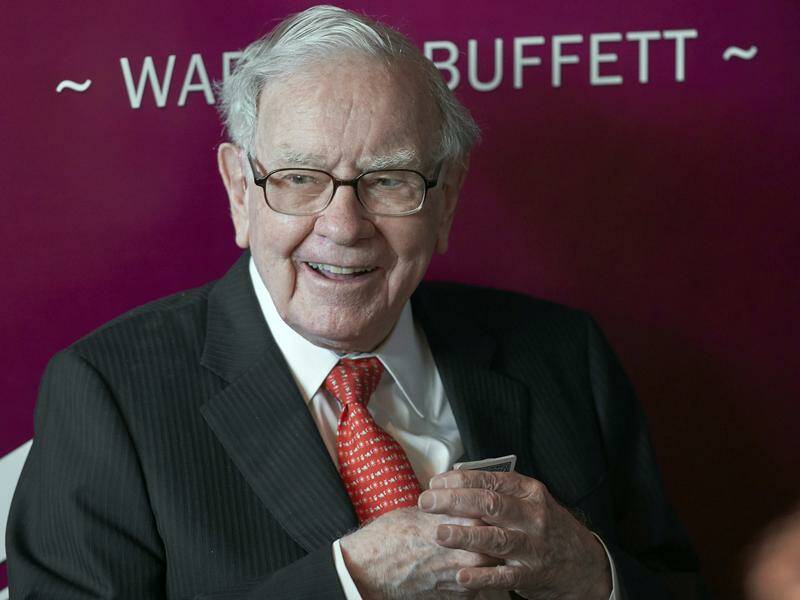

Warren Buffett, the most high-profile investor of all time – and the most successful – often speaks of the need for patience when investing. “Patience in investing is like planting seeds,” he said, “you must nurture them over time for a bountiful harvest.”

One of the biggest threats to patience is unpredictability, and unfortunately, that’s a natural part of market cycles. Market volatility can tempt even seasoned investors to act irrationally, whether by selling during a downturn or overextending as the market accelerates. In unpredictable markets, it’s natural to look to immediate gains or losses, and tempting to act impulsively. Short-term thinking can have long-term consequences, however, and it’s the best way to throw a solid strategy off course.While markets are constantly moving in waves, they tend upwards over the long term, which is why patience pays off. Wealth management is a lifetime strategy, and consistent and composed financial decisions will ultimately bring you the best outcome.

We know that investing is a long game – and often an emotional one – so we stay with you when everything is tracking well, and when things are unpredictable.

Building wealth, the smart way

At Newealth, we help you build wealth and long-term financial security with patience, discipline and consistency, not through short-term reactions or speculation.

And just as we stay with our clients through market volatility and personal milestones, our clients stay with us, sometimes for decades.

If you’re looking for a partner to help you build a robust financial plan and smart financial strategy – and to stay the course – we’re here to help. Simply put, we empower you to build wealth and reach your financial goals with clarity and confidence.

General Advice Warning:

The information in this blog is general in nature and does not take into account your personal objectives, financial situation or needs. You should consider whether the information is appropriate for you and seek professional advice before making any financial decisions.

Newealth Pty Ltd ABN 61 091 100 275 | AFSL 231297

Recent research published by BloombergNEF indicates global grid investment could top $470 billion in 2025, an increase of 16% this year on top of last year’s 15% growth. A portion of this growth is due to stalled infrastructure projects from equipment costs and rising inflation, but it also reflects the massive grid and power investment needed moving forward.

The grid is central to delivering renewable energy connections, reaching electrification targets and connecting data centres to power, driving this year’s 16% increase in grid investment.

A significant part of this power demand is generated from the rising adoption of artificial intelligence, with data centre projects already reshaping electricity demand in the United States. This huge growth reflects both a surge in data centres and the increasing size of those centres.

Projection figures from EEI Industry Capital Expenditures also indicate accelerated grid requirements, pointing to US$1.1 trillion in US investor-owned electric utilities between 2025 and 2029. This far exceeds the US$1.3 trillion in actual capital expenditures over the previous ten years.

Locally, it was reported this week that AI companies could be required to invest in renewable energy, amid a forecast the technology could use 12% of the Australian power network.

Key takeaways from BNEF

At Newealth, we stay on top of global investment news to provide you with clear, comprehensive and tailored financial advice.

General Advice Warning:

The information in this blog is general in nature and does not take into account your personal objectives, financial situation or needs. You should consider whether the information is appropriate for you and seek professional advice before making any financial decisions.

Newealth Pty Ltd ABN 61 091 100 275 | AFSL 231297

So, you’ve noticed current market volatility. Having concerns about your investments is normal, but downturns are not unusual – and not a reason to panic.

Expansions and contractions, peaks and troughs; they’re all part of the economic cycle. Downturns have been happening for as long as there has been an economy. As history has shown us, they don’t last forever, and every downturn is followed by recovery.

Understanding the way the market moves is important so that you know what to expect, how to prepare and how to respond. With a solid financial plan, strategic investments – and calm – it’s possible to navigate any market downturn.

We’ve all seen the headlines when markets fall. It’s common to feel disappointment, even shock, and that’s why it’s helpful to understand exactly what’s going on.

A financial downturn is a period when prices fall across assets. It’s usually accompanied by increased market volatility, those unexpected swings that make the market harder to predict. A downturn is an economic slowdown.

There are various factors that impact downturns. Economic bubbles, with periods of inflated prices, will ultimately result in a price correction. Major world events – wars, natural disasters, the pandemic – can trigger market meltdown. Interest rate increases, accelerating inflation and government policies also play a role.

During these uncertain times, economic growth slows as people spend less and company profits decrease, lowering asset prices. We may see businesses cut jobs, which slows markets further. This can result in lower-than-anticipated returns and increased volatility.

There are specific terms to describe market phases. When a market is surging ahead, it’s a bull market (like the stampeding animal). When you have declines of less than 10%, it’s called a market dip. A loss of between 10% and 20% is a correction. Drops of 20% or more are called a bear market (picture the market hibernating). If that decline happens very quickly, it’s a crash. When economic growth declines for at least two consecutive quarters, you have a recession.

A downturn, then, is just one stage of market movement, and every market stage is just that: a stage. So, after every market downturn comes recovery.

With a cyclical economy, downturns, like peaks, are guaranteed. To see this, we just need to look at history.

Unsurprisingly, we know the biggest market crashes best: the Wall Street crash of 1929, Black Monday in 1987, the dot-com bubble crash of 2000 and the Global Financial Crisis, to name a few. As mentioned, crashes are just one type of market activity. According to the S&P 500, there have been 13 crashes since the mid-20th century and 24 corrections. Investopedia lists 22 bear markets since 1929. Market dips are even more common.

In his 35 years as a financial planner, Dejan Pekic has seen plenty of ups and downs.

“When I started in 1991, we were in a recession. This was quickly followed by the bond crash of ’94. Then you had the Asian financial crisis of ’97, the tech wreck of 2000, closely follow by September 11. Just two years later was the second Iraq war. Jump to 2008 and everything was booming. Since then, we’ve had COVID, Ukraine and Trump, all influencing global markets.”

We can’t predict when downturns will arrive, or end. We do know that the best way to face a downturn is with patience, not panic.

Acting on fear during a market plunge is common. Dejan sees many clients instinctively rush to sell as soon as a downturn happens. That’s risky in a few ways.

The way investors react to market uncertainty can determine what happens next. It’s common for investors to panic, leading to mass sell-offs, which worsen a downturn. With plunging prices, acquiring a fair selling price can be hard.

Emotional reactions can also derail long-term goals. The best decisions come with perspective, patience and discipline. Diversified investments are key to compounding returns. Stay the course and you will see asset recovery.

Another consequence of emotional selling? Lost opportunity. The Newealth team are often busiest during major market dislocations – because this can be a great buying opportunity. Purchase when assets have plunged and you may be able to add to your portfolio at a bargain.

Downturns are a natural part of the economy, not something to be feared. Understanding that is the first step. Once you know that downturns and recovery go hand in hand, there’s more incentive to stay calm and stay the course.

Preparation is also key. We work with every client to create a tailored financial plan that best suits their personal goals. And we use value investing principles to focus on long-term financial security with a disciplined margin of safety.

Thinking into the future is another strategy to help you stay in control during a financial downturn. If you picture your long-term goals, there’s motivation to take a breath, refocus and move forward with confidence.

At Newealth, we’ve guided clients through every market cycle since 1991 – with clarity, transparency and discipline. Our approach isn’t about predicting the next move. Instead, we prepare for every outcome.

We use decades of experience and proven research strategies to steer you through market downturns and out the other side.

If you’re looking for perspective and a plan that stays steady through market noise, we’re here to help you stay the course with confidence.

General Advice Warning:

The information in this blog is general in nature and does not take into account your personal objectives, financial situation or needs. You should consider whether the information is appropriate for you and seek professional advice before making any financial decisions.

Newealth Pty Ltd ABN 61 091 100 275 | AFSL 231297

Australians’ confidence in financial security is eroding due to a combination of cost-of-living pressures, the associated mental health impact, and a lack of professional financial advice. This is a key takeaway of the State of Australia’s Safety Net 2025 Report, released by the Council of Australian Life Insurers (CALI).

The CALI 2025 Report, which paints a picture of working Australians struggling with rising living costs, details the mental health strain associated with financial and work pressures and a lack of financial clarity. This is impacting all generations, with mental health claims now the leading cause of TPD claims in Australia.

According to the report, just 8% of working Australians received personal financial advice on life insurance in the past year. Simultaneously, it found most Australians lack confidence in their understanding of insurance products.

While the report indicates close to half of the population trust online sources for financial information, a lack of tailored professional advice is placing people at risk of having inadequate coverage or unsuitable coverage for personal needs.

Interestingly, a large proportion of Australians are interested in accessing life insurance through superannuation, reflecting the important of holistic professional financial advice across savings, superannuation and insurance.

According to The State of Australia’s Safety Net 2025 report:

The CALI 2025 Report reveals that while Australians understand the value of life insurance, many remain underinsured due to cost pressures, confusion and limited access to advice. At Newealth, we help you close that gap – with clear, comprehensive and tailored financial advice. We ensure you and your family are protected no matter what life brings.

General Advice Warning:

The information in this blog is general in nature and does not take into account your personal objectives, financial situation or needs. You should consider whether the information is appropriate for you and seek professional advice before making any financial decisions.

Newealth Pty Ltd ABN 61 091 100 275 | AFSL 231297

Warren Buffett’s final annual letter marks the close of an extraordinary chapter in investing – a small reminder of what truly matters in wealth creation. His teacher, Benjamin Graham gave him the principle foundations of investing which Buffet perfected. Through patience and discipline, Buffet was able to prove time and time again that those principles worked.

At Newealth we are guided by those same principles. We have been reading Buffets annual letters for decades – to remind him of those principles. That the market will have its highs and lows, but our job as advisers is to stay calm and focus on the long term. There’s no secret formula — just wisdom, discipline and consistency. The same qualities that built Berkshire Hathaway are the ones that guide how we look after our clients today.

While Buffet may be stepping back, it’s the lessons he and Graham have taught us that will continue to endure. Invest with reason, act with integrity and don’t let the markets moods dictate our decisions.

General Advice Warning:

The information in this blog is general in nature and does not take into account your personal objectives, financial situation or needs. You should consider whether the information is appropriate for you and seek professional advice before making any financial decisions.

Newealth Pty Ltd ABN 61 091 100 275 | AFSL 231297

Many people think financial advisers just pick investments, but investment advice is just one part of a much larger role.

A financial adviser’s role spans tailored and comprehensive financial counsel across investments, superannuation, retirement, cash flow and estate planning. A skilled financial adviser will expertly guide you through market volatility. And a trusted financial adviser will stay with you for years, ensuring you have the clarity and confidence to make sound financial choices at every life stage.

At Newealth, we’re a long-term financial partner. Yes, we focus on returns, but we also guide you through key milestones, changing priorities and complex decisions. Our expertise and support give you peace of mind to feel comfortable with your finances.

Guidance beyond the portfolio

Providing recommendations on savings or investments is one strand of a financial adviser’s role, but an expert adviser has a broader focus. At Newealth, we help you refine financial goals, formulate investment strategies and stay with you for years.

We provide comprehensive investment advice for life, from savings and investments to retirement and estate planning, superannuation and insurance recommendations. Our clients span families, business owners and professionals, including Catherine Parry, a retired solicitor who has been with Newealth since 2014.

“When I started with Dejan, it’s safe to say my financial position was less than ideal. It was pretty bad, to be honest. And with no judgement at all, Dejan just shone a spotlight on all the dark recesses of my balance sheet. He made me feel that it was something that could be tackled with a plan. And we drew up a plan, and we tackled it, and I’ve never looked back.”

Comprehensive and tailored financial planning, with ongoing support, gives you the best shot at financial success. Whether you’re looking to start a family, buy a home, pivot your career or step into retirement, strategic planning and guidance will help you stay in control of your finances.

Navigation through market volatility

Volatility is part of financial markets. It’s always been there and always will be. It’s also natural for market crashes to trigger panic. The good news? You can always navigate market swings and even find opportunity in volatility.

A financial adviser’s role is to help you calmly navigate the unforeseen and manage your finances in every situation. As wealth management specialists, the Newealth team know the best way to handle market volatility is with considered, diversified investment strategies and a disciplined margin of safety. We also take advantage of market downturns to recommend quality assets at lower prices, and we only invest with the level of risk that every client is comfortable with.

“[Dejan’s] depth of knowledge of financial markets and how to manage one’s appetite for risk or not, as the case may be, is excellent. You really feel you’re being safely guarded,” adds Catherine.

Market crashes are guaranteed to happen, and preparation is key. Our careful and holistic financial planning helps you replace uncertainty with confidence.

Support for financial confidence

At Newealth, we focus on relationships, not transactions. We provide expert, objective and transparent financial planning services – and we empower you to make informed financial choices.

Steve Camillo, a retired architect, has been with Newealth since 2016.

“In my career, I was responsible for projects worth hundreds of millions of dollars. I was comfortable with that because I knew what I was doing. What I hadn’t been trained to do was do my finances, and that’s where Newealth and Dejan stepped in,” explains Steve.

“I know I can ring Dejan at any point in time and say, ‘What’s going on here?’, ‘I don’t understand this particular thing’ or ‘Should I be doing this?’. He gives me my sanity back and calms me down, and that service is invaluable.”

Expert financial planning is more than crunching numbers. Robust support and trusting relationships are a crucial part of a financial adviser’s role.

Strategic partnerships for financial security

A certified financial planner with over 35 years in the industry, Dejan Pekic knows that great financial advice changes lives.

We work with professionals, families, retirees and small business owners. We help you create a personal financial plan, formulate investment strategies and support you to help you reach your goals.

At Newealth, we see a financial adviser’s role as much more than numbers – it’s about partnerships. We guide you through every life stage with transparent, disciplined advice and a focus on what truly matters.

If you want a financial relationship built on trust, clarity and long-term perspective, we’re here to help you plan with purpose.

General Advice Warning:

The information in this blog is general in nature and does not take into account your personal objectives, financial situation or needs. You should consider whether the information is appropriate for you and seek professional advice before making any financial decisions.

Newealth Pty Ltd ABN 61 091 100 275 | AFSL 231297

Tariffs are bad news because they increase the cost of goods however it appears that the US Tariff War is proving to be a one-time jump in prices.

The impact of the tariffs is being described as an inflation ‘camel hump’ and if inflation does subsequently reduce then it will be good news for all growth assets (property and shares).

Lower inflation supports all asset prices for longer, it certainly does not mean that we will not have a asset price correction/crash instead it implies that the next correction/crash is further away.

Fortunately, we do not need to concern ourselves with the timing of the next correction/crash because Benjamin Graham’s Value Investing Principles teach us that all we need to do is remain invested according to our appetite for risk and buy more quality assets when asset prices fall.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

Over three decades in financial planning, Newealth has seen booms, busts, bubbles and recoveries. The biggest lesson? Patience pays off.

Market cycles can trigger a rollercoaster of emotions for investors: from optimism to euphoria, panic and despondency. As emotions move in waves, so does the market – and with every downturn comes opportunity.

Since 1991, Newealth Founder Dejan Pekic has seen markets hit rock bottom and bounce back, many times. A Certified Financial Planner, Dejan understands market cycles are best managed with careful planning, strategic investments, and patience.

Financial markets are in consistent flux, even when not visibly apparent. There are four phases of market activity: expansion, peak, contraction and trough (which is also the first stage of recovery).

With expansion comes accelerating economic growth. A peak indicates the highest level of economic activity. Contraction is when the market slows, and this is when you will see corporate profits fall, increased unemployment and decreases in consumer spending. During a trough, prices hit their lowest point before economic indicators begin to stabilise. This precedes recovery, when the market begins to move – and the cycle resumes.

Major global events directly impact market cycles, while economic indicators, government policies and investor sentiment contribute to the duration of market cycles. Dejan explains that full financial cycles can sometimes occur in as little as a few years.

“As Benjamin Graham taught us, the busts are continual. When I started in 1991, we were in a recession. This was quickly followed by the bond crash of ’94. Then you had the Asian financial crisis of ’97, the tech wreck of 2000, closely followed by September 11. Just two years later was the second Iraq war. And then the Global Financial Crisis hit in 2008. Jump to 2009 and everything was booming. Since then, we’ve had COVID, Ukraine and Trump, all influencing global markets.”

“As Graham explained, the busts are the big drops, with market falls of 20 percent. And these drops, even though they’re harrowing for everybody, they’re the big opportunities to buy.”

The movement of asset prices has a strong sway on emotions. The anxiety and panic that accompanies market plunges leads many investors to sell and run. According to Dejan however, this is a prime opportunity to refocus your investments.

“As soon as asset prices crash, everybody runs away, not towards the market. When prices are very high, that’s actually the most dangerous time to invest but when these big dislocations occur, when these big asset prices fall, that’s your buying opportunity. So that’s where we’re always operating. We’re very, very active during those exciting periods when everything seems to be going to ruin.”

Market crashes are guaranteed to happen. As a specialist in financial planning and generational wealth management, Newealth knows the market. We help individuals and families stay on track with disciplined and tailored investment strategies, holistic financial services, and long-term support, particularly through volatile market stages. We guide you through financial downturns head on, with clarity and proven investing strategies.

At Newealth, our approach is grounded in Benjamin Graham’s value investing principles. We help clients plan for long-term financial security and capital preservation with a disciplined margin of safety.

Risk management is a key part of every financial plan. We help you build and protect investments with diversified strategies and acceptable levels of risk.

A diversified strategy incorporates growth assets and defensive assets. Growth assets include shares and property, which can be volatile, but which can generate higher returns over the long term, as well as providing income streams. Defensive assets include fixed interest investments, such as bank term deposits, which generate lower profits than growth assets but are more stable. Defensive assets in isolation may not help you reach long-term financial goals, but they play a key role, especially during market downturns.

“If you’re running a diversified strategy, which is in line with Graham’s thinking, it never pays to sell and run,” explains Dejan. “The market constantly moves up and down, and our job is to help manage that for clients. So, when prices are really high, clients take some of the profit and move it to defensive assets. And we move with the amount of volatility that a client likes.”

With strategic planning and personalised support through the four market stages, we can help you stay on track as you work towards your financial goals, with clarity, and peace of mind.

At Newealth, our team take a holistic approach to financial planning, delivering tailored recommendations across superannuation, investment, retirement planning and wealth protection. “And one of the biggest things we’ve done over 35 years is just keep clients out of trouble,” adds Dejan.

As a boutique Sydney financial planner, we provide independent financial advice based on robust research, established investment strategies and 35 years of expertise. We value client relationships, we plan long-term, and we stay with you through market cycles, calmly guiding you through even the toughest periods.

We’ve helped clients stay the course through every market cycle since 1991 — with clarity, discipline and patience. Ready to plan your financial future with confidence? Please feel free to email or call.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

General Advice Warning:

The information in this blog is general in nature and does not take into account your personal objectives, financial situation or needs. You should consider whether the information is appropriate for you and seek professional advice before making any financial decisions.

Newealth Pty Ltd ABN 61 091 100 275 | AFSL 231297