Archives

- July 2025 (2)

- June 2025 (3)

- May 2025 (4)

- March 2025 (6)

The 2025 Rich List will be published this Friday with another 6 billionaires being added.

Once again it just goes to prove that this country of ours is still a land of opportunity if you have the determination to succeed.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

The Federal Government Co-contribution was introduced from 1 July 2003 as an initiative to encourage income earners to save for their retirement within superannuation.

If you make a contribution of up to $1,000 into your superannuation account before 30 June 2025, the Federal Government will add an additional sum provided that you are earning less than $60,400 this financial year.

The table below shows you how much the Federal Government will contribute for various amounts.

|

If your total |

…and you make personal contributions of: |

…then the maximum Government co-contribution is: |

|

$45,400 or less |

$1,000 | $500 |

|

$48,400 |

$800 | $400 |

|

$51,400 |

$600 |

$300 |

| $54,400 | $400 |

$200 |

| $57,400 | $200 |

$100 |

| $60,400 or more | $0 |

$0 |

WARNING, this does not constitute Personal Advice. To discuss if this is an appropriate strategy for your given circumstances, please do not hesitate to contact us directly.

Important to remember that there are always additional eligibility conditions and if you have family, friends or colleagues that want advice please ask them to contact us.

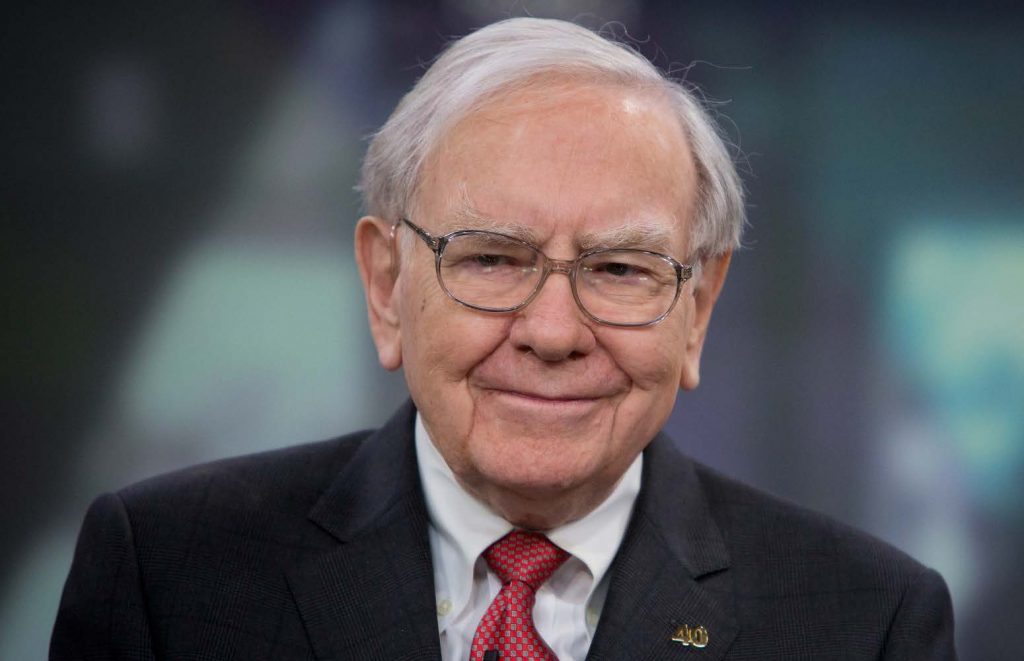

Back when Charlie Munger passed away on 28th November 2023 at the age of 99 we asked a question.

Will Warren Buffett retire?

We only had to wait 18 months to get the answer.

A few days ago, Warren Buffett age 94 announced that he will be stepping down as CEO of Berkshire Hathaway at the end of 2025.

Our thoughts are that he lost some of the joy that investing held when Charlie passed away.

Berkshire Hathaway is effectively a LIC (Listed Investment Company) which invests in both listed companies and private companies and Buffett together with his co-Portfolio Manager, The Late Charlie Munger started investing Berkshire Hathaway cash in 1965.

It is hard to image that this 60 year track record could be beaten going forward by another human but anything is possible.

This is also a reminder that having the right Portfolio Manager (what we call Talent) working for you is the key to achieving above index performance.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

A fall in the inflation rates is good news for all growth assets (property and shares).

It means that it is more likely than not that the RBA (Reserve Bank of Australia) will cut interest rates again in 2025.

The bad new is that prices have not fallen because a reduction in the rate of inflation only means that the rate of increase in the prices for goods and services has slowed.

The cost of both goods and services today is high and remains high.

The continued excessive spending by the Federal Government on welfare programmes and public service employment plus the negative impact of the US Tariff War on Australian exports has all the ingredients for slowing economic activity (meaning, recession).

Irrespective of this, our job is not to speculate.

Instead, all we need to do is follow Benjamin Graham’s Value Investing Principles and remain invested according to our appetite for volatility and look to buy more quality assets when prices fall.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.