Archives

- June 2025 (3)

- May 2025 (4)

- March 2025 (6)

We were just reviewing performance numbers and this caught us by surprise.

The NZX (New Zealand Stock Exchange) has failed to deliver a positive total cumulative return over the past 5 years to 31st May 2025.

This talks to the benefits of diversification and why you do not have all your wealth concentrated in one investment, even if that single investment is a country.

Things can go wrong.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

Despite President Trumps bests efforts, spending on R&D (research and development) is the real power behind American exceptionalism and it is not fading anytime soon.

American businesses continue to outspend everyone on R&D and this is the reason why EPS (earning per share) are significantly higher for American businesses compared to the rest of the World.

Important to note that the Chinese are also being smart by spending big on R&D.

The reason is simple, the more money businesses spend on researching new technologies, testing ideas and developing prototypes the more they will keep innovating and improving existing products, services, processes which creates sustained wealth.

This is also the reason why PMs (Portfolio Managers) who invest in overseas businesses have a bias to buy American businesses, they want a piece of this EPS growth.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

This is tremendously disappointing.

The Federal Labor Government is demanding to tax unrealised capital gains in superannuation for individuals with a superannuation balance exceeding $3 million.

Labor has a majority in the House of Representatives and together with the Greens they have a majority in the Senate which means that Federal Labor Government will be completely and solely to blame for this violation of public trust.

The bill to make Division 296 law has still not been presented which means that we still do not know the details of how it will work. One way it could work is as follows-

To act on speculation however is almost always a waste of time and so we will wait for the detail and the passing of the legislation.

Once law we will take the necessary steps to help our clients to minimise the impact of taxing unrealised capital gains.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

The 2025 Rich List will be published this Friday with another 6 billionaires being added.

Once again it just goes to prove that this country of ours is still a land of opportunity if you have the determination to succeed.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

The Federal Government Co-contribution was introduced from 1 July 2003 as an initiative to encourage income earners to save for their retirement within superannuation.

If you make a contribution of up to $1,000 into your superannuation account before 30 June 2025, the Federal Government will add an additional sum provided that you are earning less than $60,400 this financial year.

The table below shows you how much the Federal Government will contribute for various amounts.

|

If your total |

…and you make personal contributions of: |

…then the maximum Government co-contribution is: |

|

$45,400 or less |

$1,000 | $500 |

|

$48,400 |

$800 | $400 |

|

$51,400 |

$600 |

$300 |

| $54,400 | $400 |

$200 |

| $57,400 | $200 |

$100 |

| $60,400 or more | $0 |

$0 |

WARNING, this does not constitute Personal Advice. To discuss if this is an appropriate strategy for your given circumstances, please do not hesitate to contact us directly.

Important to remember that there are always additional eligibility conditions and if you have family, friends or colleagues that want advice please ask them to contact us.

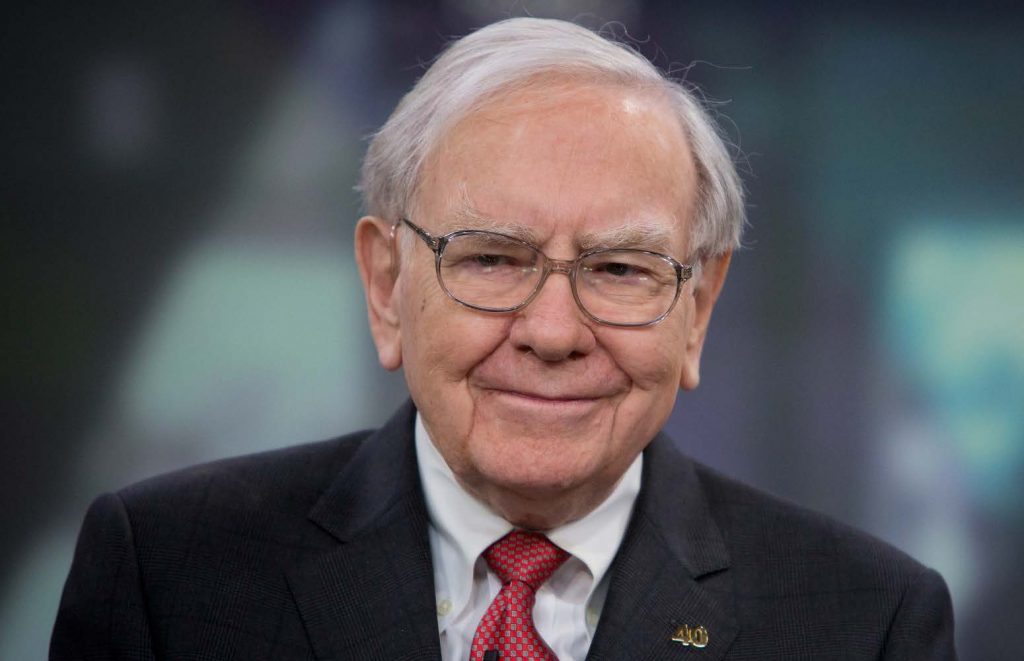

Back when Charlie Munger passed away on 28th November 2023 at the age of 99 we asked a question.

Will Warren Buffett retire?

We only had to wait 18 months to get the answer.

A few days ago, Warren Buffett age 94 announced that he will be stepping down as CEO of Berkshire Hathaway at the end of 2025.

Our thoughts are that he lost some of the joy that investing held when Charlie passed away.

Berkshire Hathaway is effectively a LIC (Listed Investment Company) which invests in both listed companies and private companies and Buffett together with his co-Portfolio Manager, The Late Charlie Munger started investing Berkshire Hathaway cash in 1965.

It is hard to image that this 60 year track record could be beaten going forward by another human but anything is possible.

This is also a reminder that having the right Portfolio Manager (what we call Talent) working for you is the key to achieving above index performance.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

A fall in the inflation rates is good news for all growth assets (property and shares).

It means that it is more likely than not that the RBA (Reserve Bank of Australia) will cut interest rates again in 2025.

The bad new is that prices have not fallen because a reduction in the rate of inflation only means that the rate of increase in the prices for goods and services has slowed.

The cost of both goods and services today is high and remains high.

The continued excessive spending by the Federal Government on welfare programmes and public service employment plus the negative impact of the US Tariff War on Australian exports has all the ingredients for slowing economic activity (meaning, recession).

Irrespective of this, our job is not to speculate.

Instead, all we need to do is follow Benjamin Graham’s Value Investing Principles and remain invested according to our appetite for volatility and look to buy more quality assets when prices fall.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

Gold is an asset because it represents as store of wealth.

This undisputed fact has been the case for millennia and Gold is also purchased heavily in times of financial fear.

For example, the price of one ounce of Gold has risen to US$3,115 today which is a 39.1% increase in 12 months.

However, the problem with investing in this asset is that Gold does not multiply.

A bar of Gold does not produce baby Gold ingots which means an investor can make no money for extended periods such as between late 1970’s and the 2008 Global Financial Crisis (some 30 plus years) during which time an investor did not make a dollar.

Worst still is the inflation adjusted price of Gold which has seen no real growth for 45 years.

Gold is a terrible asset for multiplying wealth.

The principles of Value Investing teach us to not invest in commodities, Gold might sparkle but it is just too risky.

WARNING, this does not constitute Personal Advice. To discuss if this is an appropriate strategy for your given circumstances, please do not hesitate to contact us directly.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

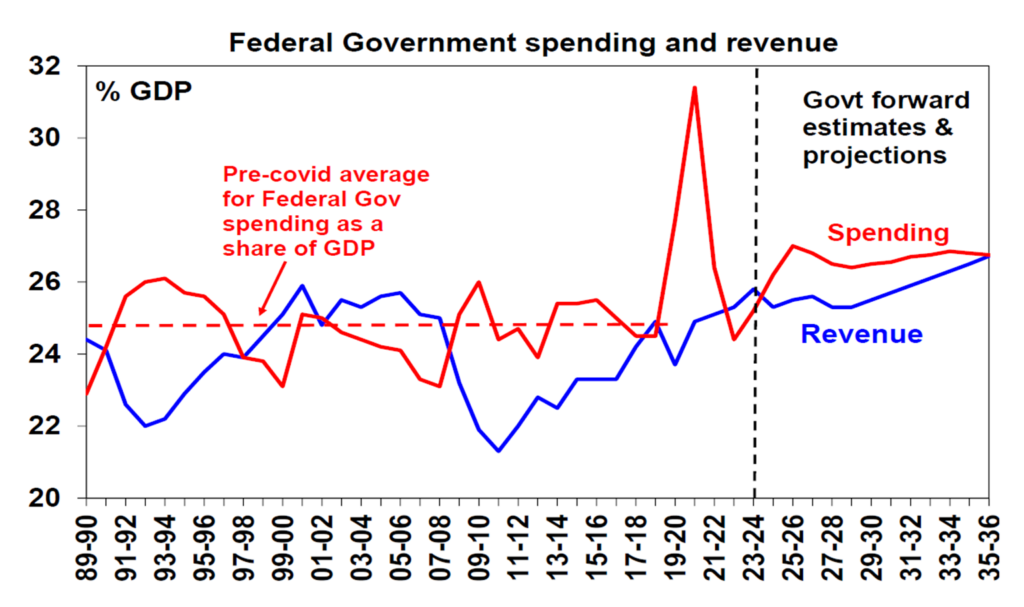

The Federal Treasurer Jim Chalmers has handed down his fourth Budget and it is all about increased spending that is projected to keep the budget in a deficit to 2036 with this year’s budget deficit projected to be AU$26.7 billion.

It is just bad news for business with small businesses missing out on an extension to the $20,000 instant asset write-off and non-compete clauses being voided for employees earning less than AU$175,000 per annum.

It is important to remember that all Budget announcements are currently proposals and will still need to be legislated.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

Clients have been asking us if Donald Trump and his Tariff War is going to cause a recession in the United States.

The actual answer is that we do not know.

The latest probability for a recession in the United States sits at 23% likely which is low and down from last year.

Similarly, Australia is at 20% likely.

Staying in cash and waiting for a recession in our experience almost always fails because the investor is not growing their assets against inflation while they wait.

Our response is to remain invested according to your appetite for risk and then react when the recession does occur because it will present an opportunity to buy more quality assets at a discounted price.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.