25 Jul 2018

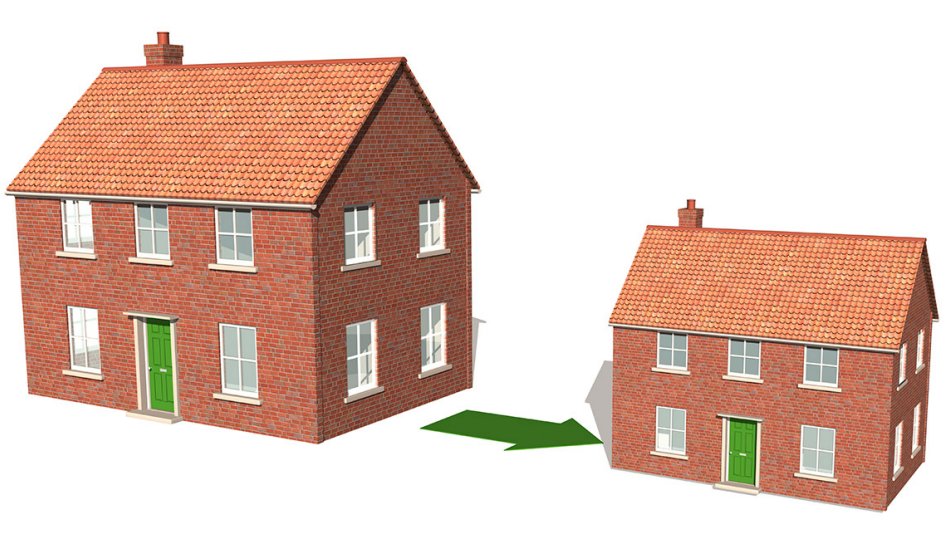

Superannuation Reform: Downsizing

- Posted by Dejan Pekic BCom DipFP CFP GAICD, Senior Financial Planner

Downsizer superannuation contribution has arrived which means that if you are 65 years or older you can choose to make a downsizer contribution into your superannuation of up to $300,000 each from the proceeds of selling the primary residence (your home) without having to satisfy the work test.

This is an opportunity for clients who do not qualify for the Age Pension because it does not count towards the individual total super balance cap $1.6 million but it will still count towards the $1.6m transfer balance cap which means you will still not be able to make more than the maximum initial contribution of $1.6 million into the pension phase of superannuation.

The numbers are less attractive for clients who qualify for a part Age Pension because the primary residence is an exempt asset for Centrelink purposes whereas superannuation is counted under the Asset Test.

Click for technical paper.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.