30 Sep 2021

Billionaires: Global Wealth Distribution

- Posted by Dejan Pekic BCom DipFP CFP GAICD

This is amazing, there are almost 7.9 billion people on the planet and 10 (thats right, ten, the number of fingers on two hands) are now worth over US$100 billion.

These top 10 richest are listed above.

For capitalism to continue to work it needs to evolve because the single minded pursuit of profit at all cost will result in even more extreme inequality than exists today which can only lead to social chaos and the breakdown of society.

Everyone then loses.

If you doubt this, just consider that at present 1.1% of the global population holds 45.8% of global wealth while almost 4.4 billion people (55% of the global population) cannot even amass US$10,000.

Click for chart.

The fact is that there are vastly more poor people than wealthy and when the poor cannot feed their family then social chaos and revolution follows. Think Marie Antoinette.

Capitalism needs to evolve to survive.

28 Sep 2021

Megatrends: Air Travel

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The next one to two decades are going to be incredibly exciting as software consumes the World.

But it is not just software.

If you think about air travel it becomes clear that Asia with half the World’s population is going to double and then triple the volume of flights as income rises.

Click for chart.

So how do you take advantage of megatrends such as this- do you invest in airlines or airports or accommodation or alternate jet fuel or antipollution technology and the list goes on?

WARNING, this does not constitute Personal Advice and is general in nature. To discuss if this is appropriate for your given circumstances please do not hesitate to contact us directly.

22 Sep 2021

Australian Residential Property: Prices

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Question, which buyer segment has driven Australian residential property prices over the past 12 months?

Investors.

Click for chart.

Owner occupiers are going nowhere while first home buyers are not borrowing to purchase.

Employment uncertainty due to COVID-19 pandemic together with existing high property prices which just keep increasing are the likely factors causing First home buyers to delay buying their first property.

For Australia to grow and maintain a prosperous middle class, the Federal Government needs to find a way to ensure housing affordability for the next generation of Australians which means taxation reform.

If not changed, the current tax regime can only result in inequality and further shrinkage of the middle class which is bad news for all Australians.

20 Sep 2021

Inflation Genie

- Posted by Dejan Pekic BCom DipFP CFP GAICD

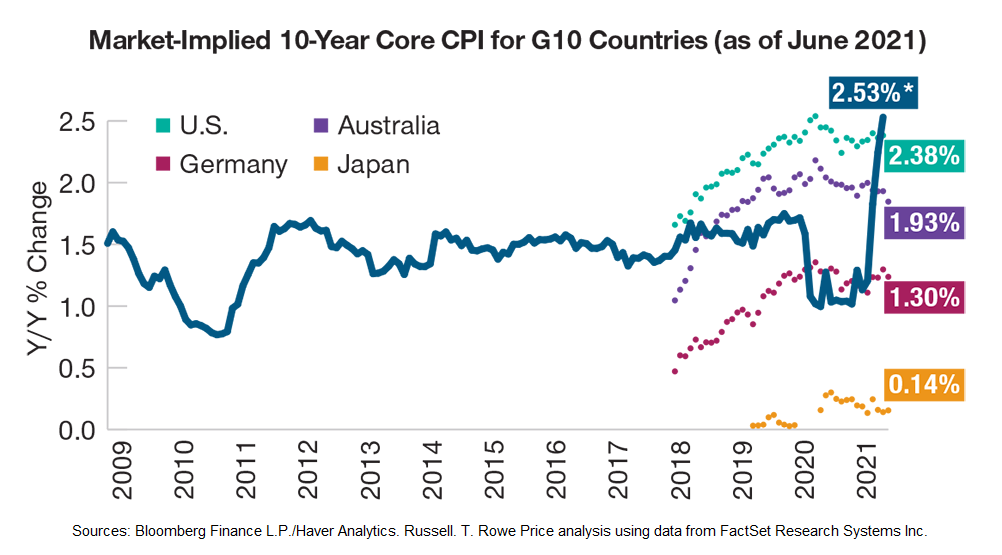

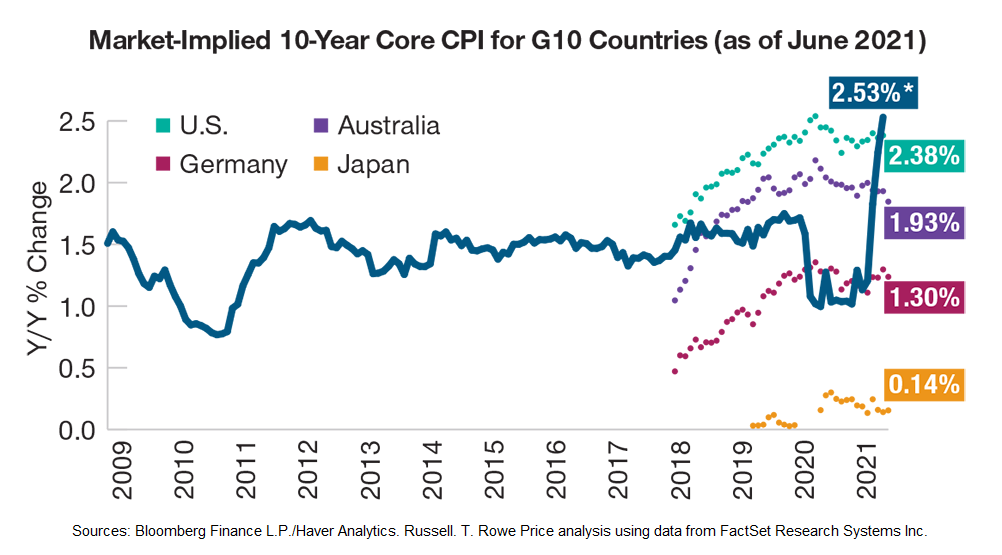

You can see from the chart above that the forecast jump in inflation has presented in the United States, Germany, Japan and Australia.

The question is whether the jump in inflation is permanent or temporary?

Our view is that it is temporary and likely to reverse as goods supply increases due to a post COVID-19 global recovery.

For example, if we take a closer look at Australia, the current jump in headline inflation has still failing to lift core inflation up into the RBA target range.

Click for chart.

Why is inflation so important because large fast moving increases in inflation destroy asset prices and that is bad news for investment portfolios.

Need help, call us to book in a conference call time.

16 Sep 2021

Market Metrics: Commodity Prices

- Posted by Dejan Pekic BCom DipFP CFP GAICD

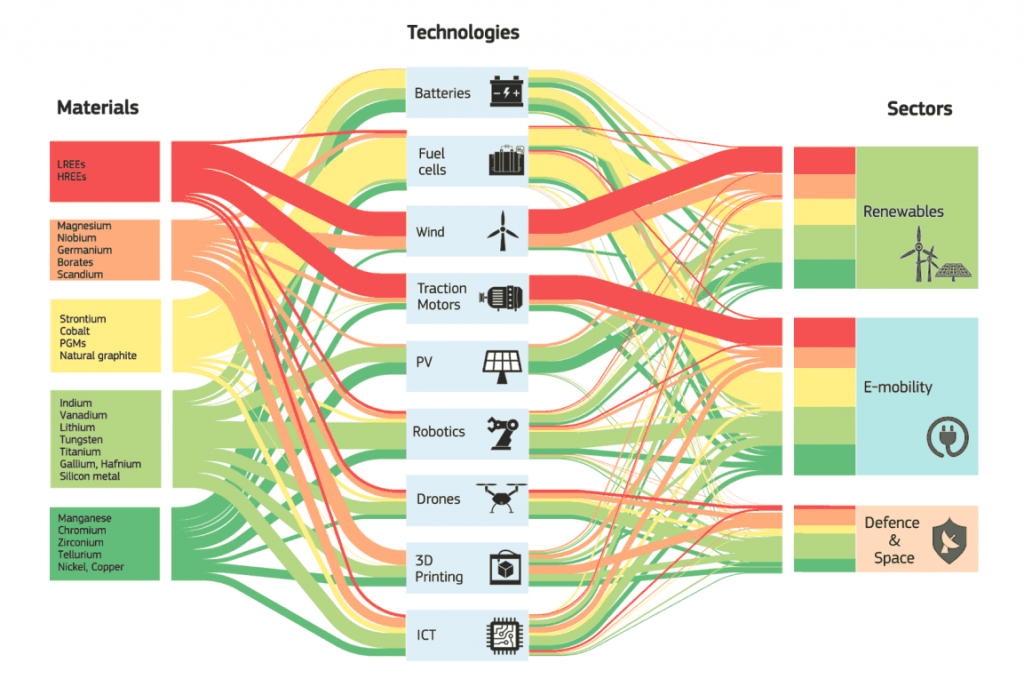

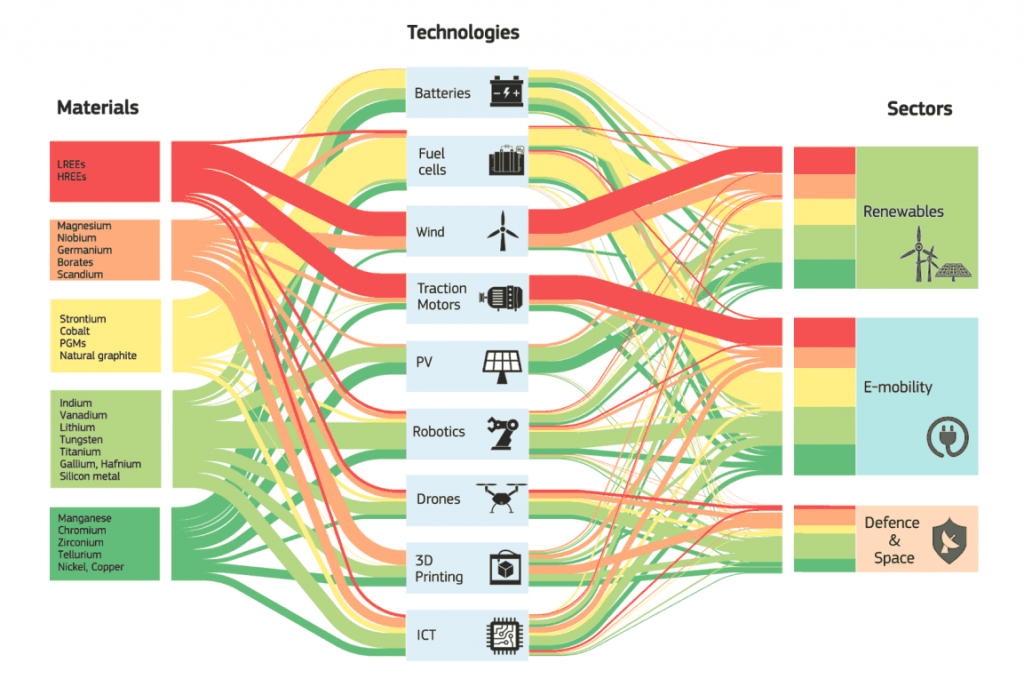

Commodities are forecast to be entering a new super cycle due to the demand for clean energy and electric vehicle technology. For example, a electric vehicle contains 4 to 10 times as much copper as a conventional car.

The Commodity Research Bureau (CRB) Index acts as a representative indicator of global commodity markets. This secular super cycle bull market in commodities is forecast to peak by 2045.

Click for chart.

The implication for the Australian dollar is that it is most likely to rise which reduces the return on internationally held investments in Australian dollar terms.

WARNING, this does not constitute Personal Advice and to discuss if this is appropriate for your given circumstances please do not hesitate to contact us directly.

As with all forecasts, they are just a hypothesis because no one can predict the future with certainty.

The real message is to remain invested according to your appetite for volatility and when fear and panic take hold, react by buying more quality assets at discounted prices.

10 Sep 2021

Friday Tidbit

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Investing is difficult because you cannot drive a car by looking in the rear view mirror.

The past does not predict the future.

Meaning that investing is and has always been a combination of both art and science.

We have attached research containing 5 future predictions on video games, pay TV, video streaming, American football and autonomous vehicles.

Will they eventuate?

We don’t actually know is the correct answer, however they do get you thinking about the future and what is coming.

Enjoy.

WARNING, this does not constitute Personal Advice and to discuss if this is appropriate for your given circumstances please do not hesitate to contact us directly.

Click to read.

6 Sep 2021

Super, Super, Super

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The ATO (Australian Tax office) has reported that 27 of the top 100 SMSF have a total balance of over AU$100m for the financial year ending 30 June 2019.

Superannuation continues to be the great tax minimisation opportunity for the super wealthy and the middle class in Australia.

At a maximum tax rate of 15% on earnings and unrestricted access to the money from age 65 nothing can touch superannuation as a tax minimisation vehicle to store wealth other than the primary residence which attracts a 0% tax rate on capital gains.

The reasoning for why this outcome was always going to eventuate was eloquently put forward by Kerry Packer in 1991 when he famously stated that all Australians should legally seek to minimise their tax…

“I’m not evading tax in any way shape or form. Of course I’m minimising my tax. If anybody in this country doesn’t minimise their tax they want their head read. As a government I can tell you you’re not spending it that well that we should be paying extra.’’

Click to read.

2 Sep 2021

Indicators: United States of America

- Posted by Dejan Pekic BCom DipFP CFP GAICD

A economic recession in Australia is officially defined as two consecutive quarters or more of GDP (Gross Domestic Product) contraction.

GDP rose 0.7% for June quarter which reflected the continued easing of COVID-19 restrictions and the recovery in the labour market. The current September quarter however is likely to be negative with both NSW and Victoria in protected COVID-19 pandemic lockdowns.

While it is bad economic news for Australia the United States of America (USA) is in the complete opposite position because they do not believe in lockdowns as evidenced by the fact that the delta strain of COVID-19 is reeking havoc but businesses are still trading.

The attached chart indicates no recession for the USA on the horizon which is good news for business and good news for investors.

Click for chart.

The economic bumps, twists and turns just keep on coming.