31 Aug 2017

GFC: Asset Bubbles

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The Global Financial Crisis (GFC) hit the World in 2008 with a devastating impact on growth assets (defined as property and shares) but it has also created an opportunity for investment.

The financial catastrophe bottomed out in March 2009 leaving Australia, the United States, Japan, United Kingdom, Germany and France all with exceptional buying opportunities.

Presently, we are on the eve of the 10 year anniversary of the GFC which was when the Australian All Ordinaries Index peaked at 6,853 on 1st November 2007 after which it all collapsed except for Australian residential property.

We have attached a chart to remind investors that booms and busts in financial markets are not new, they repeat with constant regularity but the path is always different which is why speculating is a recipe for failure.

As Warren Buffet has repeatedly stated, the key to accumulating wealth is to buy quality assets at reasonable or better still discounted prices.

25 Aug 2017

Friday Tidbit: Executive Salary, Incentives & Tenure

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Is it theft or value for shareholders to pay a Chief Executive Officer (CEO) a $26m annual salary?

Is it the business or the CEO that earns the return for shareholders?

These are tough questions because there are examples where the CEO has completely changed the fortunes of the business such as Steve Jobs at Apple Inc.

We have been grappling with this question of how much is too much since 1991 and we are still no closer to an answer.

Click to read ACSI report on CEO Pay.

22 Aug 2017

Self Managed Super Funds (SMSF): 17%

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The SMSF is a problematic administration vehicle for superannuation because it gives a client the illusion of control while at the same time materially increasing the client’s exposure to liability.

Essentially, a SMSF administration vehicle moves all responsibility from an unrelated third party trustee to the client which is a member of the fund.

Breaching the Superannuation (Industry Supervision) Regulations 1994 is as simple as not documenting investment decisions, not keeping adequate financial records of transactions, using funds to invest in a holiday house for members and or lending money to members.

The direct responsibility for any such breaches lies with the trustees which include each and every member in the SMSF.

If found negligent, the SMSF can be deemed non-complying which carries a 50% penalty on the value of the assets or the ATO can choose to charge Penalty Units which have just increased from $180 to $210 or 17% from the 1 July 2017.

That is why a Public Offer administration vehicle for superannuation such as a master trust or wrap is often the best and least expensive structure to use UNLESS the investment strategy in superannuation is to buy direct real property and or to buy shares in an unlisted company where there are no related parties.

Fortunately, our primary concern is for the capital invested to beat the respective benchmark after fees irrespective of whether the administration vehicle being used is a SMSF or a Public Offer super fund.

18 Aug 2017

Friday Tidbit: World Happiness Report 2017

- Posted by Dejan Pekic BCom DipFP CFP GAICD

We are not number 1 but Australia does make the top 10.

Surprisingly New Zealand is ahead of us, again.

Click to watch.

Click to read.

16 Aug 2017

Behavioral Finance: Rollercoaster of investment emotions

- Posted by Dejan Pekic BCom DipFP CFP GAICD

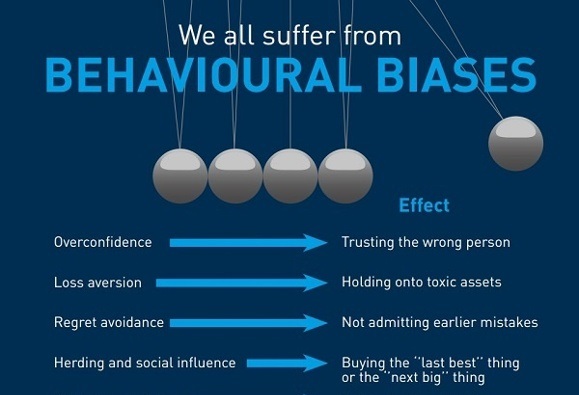

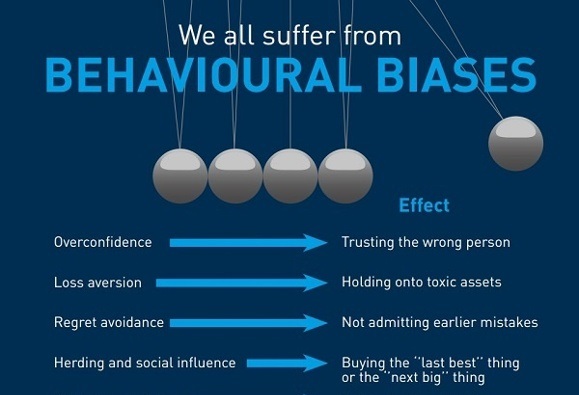

For investing, the facts are that the vast majority of individuals are consistently bad at dealing with uncertainty, underestimating some risks and overestimating others.

This led Daniel Kahneman a psychologist into researching the psychology of judgment and decision-making as well as behavioral economics for which he was awarded the 2002 Nobel Memorial Prize in Economic Sciences.

The field of behavioral finance and behavioral economics concludes that the roots of our poor decision making are far from being random, in fact these mistakes are systematic and predicable which implies that they can be greatly reduced.

Below is a series of short and entertaining videos on the behavioral biases that we face as investors and the skill is to take them into account before making a poor decision.

Please enjoy.

10 Aug 2017

Billionaires: Losing money

- Posted by Dejan Pekic BCom DipFP CFP GAICD

This is not a good result for James Packer, although it would still be amazing to have him as a client.

The learning from this piece is to use it as an example of how even billionaires can lose money when investing.

Consider, James Packer estimated wealth has fallen from $7.19 billion to $4.75 billion over the past 3 years which represents 33.9% decline in his balance sheet.

For anyone of us to lose one third of our balance sheet would be a catastrophe but this billionaire even with all his expert advisers that are paid in the millions of dollars still managed to destroy $2,440,000,000 over the last three years. That takes some doing.

The lesson, diversify to manage and limit your risk.

Click to read.

7 Aug 2017

China: The big picture

- Posted by Dejan Pekic BCom DipFP CFP GAICD

It is difficult to see a scenario for this NOT BEING the Asian century.

China just keeps punching out the sales and investment numbers for vehicles, white goods, fixed asset investment, outbound tourism and so on, and so on, and so on.

It has been four decades since China began introducing economic reforms and it is still delivering because it has an enormous population (consumer base) and a very low income per capita relative to developed nations such as Australia, United States, Singapore, Hong Kong, Japan, South Korea and Taiwan. (Chart)

Essentially, China (and also Philippines, Vietnam and India) are all mean reverting, playing economic catch-up just like the United States did with the United Kingdom.

The hard part will be to know what to do when the economic stumble occurs during this Asian century.

The United States had its biggest stumble in 1929, it ended up being an economic depression and took the rest of the World with it into financial chaos.

The China Purchasing Managers Index chart pointed to a potential downturn/recession at the end of 2015 start of 2016 but nothing eventuate.

The learning is to be patient, keep investing in line with your appetite for risk and look to take advantage when the catastrophe presents.