22 Feb 2022

Market Metrics: Equity Market Corrections VS Crashes

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Asset price corrections, defined as a 10% fall or more from recent peak are common while asset price crashes, defined as a 20% fall or more from recent peak are less common.

Both corrections and crashes are actually routine financial markets phenomena but they occur at irregular intervals which is why they can never accurately be predicted. In hindsight, the reason for the asset price fall is always obvious but in hindsight, we are all Trillionaires. Our point is that hindsight investing is meaningless fantasy.

Click for charts.

The learning from the charts is to accept that corrections and crashes are something that cannot be avoided when investing but once they do hit, Mr Market presents you with an opportunity to buy more quality assets at discounted prices.

In the words of Benjamin Graham…“Mr Market’s job is to provide you with prices; your job is to decide whether it is to your advantage to act on them. You do not have to trade with him just because he constantly begs you to.”

18 Feb 2022

Value Investing Principles: Income is key

- Posted by Dejan Pekic BCom DipFP CFP GAICD

For three decades we have been asked… ‘why invest in listed businesses?’

The answer is simple answer, as investors we want to own an increasing income stream.

Peter Thornhill who first presented me with this chart in 1991 or 1992 has sent us an updated version to remind us of the relentless growing dividend income stream that is created from being invested in boring publically listed industrial companies.

Click for chart.

Yes the dividend income can fall such as during COVID-19 crash in 2020 but so too did rental income and interest income.

The bonus of investing in businesses that sell goods and services is that the price (capital value) increases for quality businesses and every time prices fall due to fear and panic, investors are presented with an opportunity to buy more quality listed businesses at discounted prices.

WARNING, this does not constitute Personal Advice and is general in nature. To discuss if this is appropriate for your given circumstances please do not hesitate to contact us directly.

16 Feb 2022

US Interest Rates: How high can rates go?

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The US 10 year bond yield has moved up from 0.54% in March 2020 to the current 1.98% which is a big percentage change.

However it remains difficult to see US 10 year bond yield rising back up to 4.00% quickly given that US debt passed US$30 trillion in January 2022 and World debt is fast approaching US$300 trillion.

Click for chart.

Put simply, the World is awash with debt, that is the elephant in the room and to take the US 10 year bond yield back up to 4.00% quickly would collapse prices for both growth assets and defensive assets.

As Benjamin Graham taught, remain invested according to your appetite for volatility and if bond yields do explode upwards causing fear and panic to take hold, then react by buying more quality assets at discounted prices.

10 Feb 2022

The Future of Retirement: A journey, not a destination

- Posted by Dejan Pekic BCom DipFP CFP GAICD

It now appears that Australians no longer want to retire from full-time work.

Instead, they intend on working longer, past age 67 because work makes them happy, helps them maintain a sense of purpose and it allays boredom.

How things have changed over the past 3 decades.

This does not come as a surprise for us because requirement just like continual holidaying is very much overrated if there is no sense of purpose.

The purpose can be paid or unpaid voluntary work but without this sense of purpose, human life becomes hollow and unfulfilling.

That is why it is so important to get excited about something.

Click for report.

8 Feb 2022

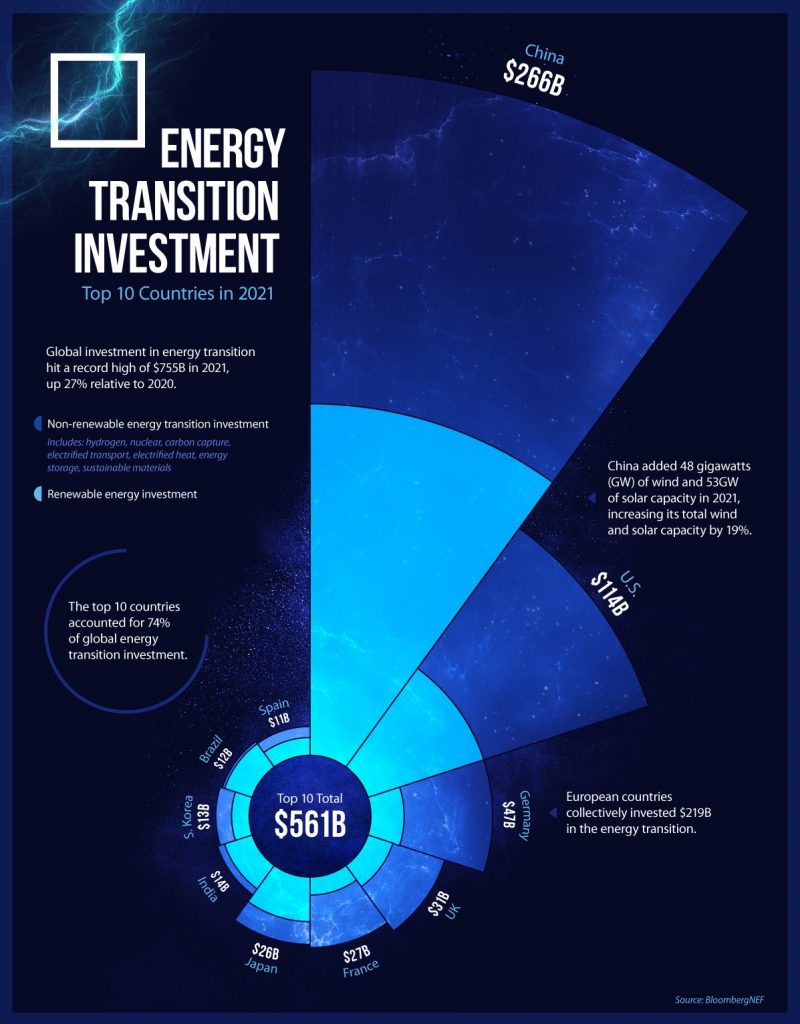

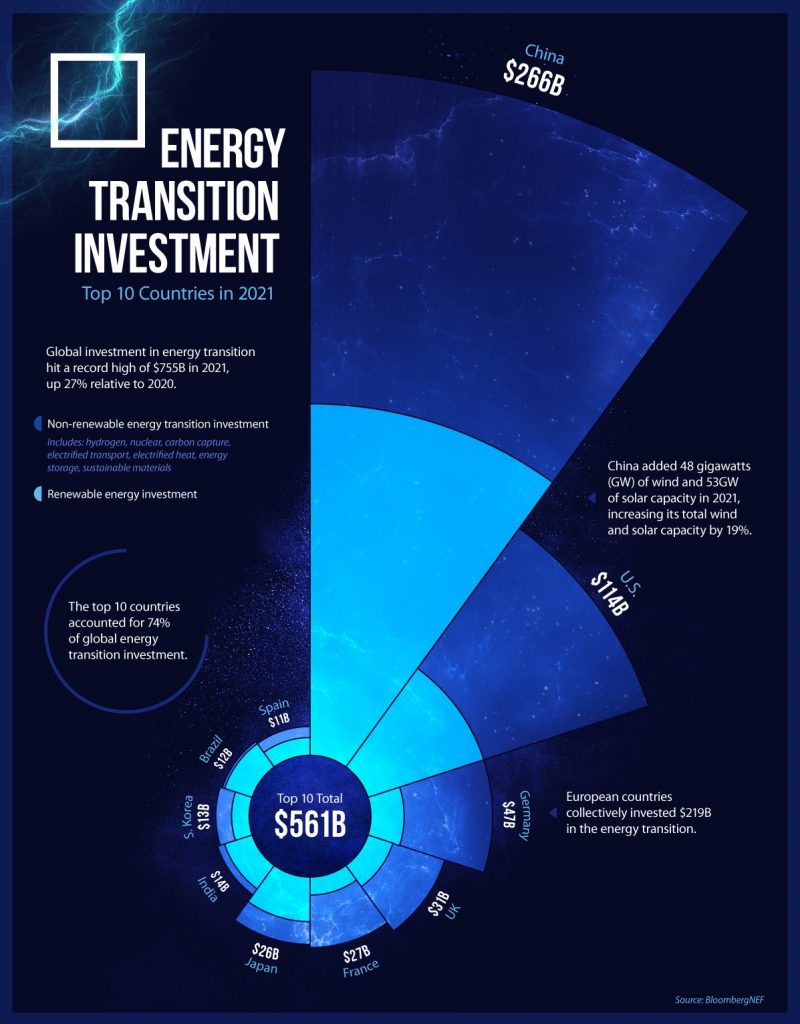

Decarbonisation: Energy Transition Investment

- Posted by Dejan Pekic BCom DipFP CFP GAICD

More than 130 countries are on a path to decarbonisation which is to move to net-zero emissions by 2050.

The United Nations Framework Convention on Climate Change (UNFCCC) estimates that US$125 trillion will need to be spent on investment to achieve net-zero on a global scale by 2050.

China is currently leading the way having invested US$266 billion of the total US$755 billion invested in global energy transition in 2021.

Click for report.

The required spend is going to be enormous to achieve net-zero by 2050 which presents a megatrend investment opportunity.

WARNING, this does not constitute Personal Advice and is general in nature. To discuss if this is appropriate for your given circumstances please do not hesitate to contact us directly.

4 Feb 2022

Business Cycles: From Tailwinds to Headwinds

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Economists, forecasters and analysts kept telling us throughout last year that the economics for 2022 where going to be good.

The COVID-19 pandemic was going to be brought under control, supply chain was going to be restored and interest rates were going to remain low.

The reality however is that the headwinds have arrived much quicker than expected.

The pandemic is not under control, it is rampant across the World and there are not enough supply of raw materials, not enough workers, not enough containers, not enough products, not enough truckers and that has resulted in shortages and higher prices.

Will these supply shortfalls be fixed, absolutely yes but how long is the question.

The headwinds listed in the attached chart were always coming so remember what Benjamin Graham taught. Don’t speculate, instead remain invested according to your appetite for volatility and when fear and panic take hold, only then react by buying more quality assets at discounted prices.

Click for chart.