29 Oct 2020

Electric Vehicles: Ready or not

- Posted by Dejan Pekic BCom DipFP CFP GAICD

This question is constantly being asked.

What are the critical challenges to mainstream electric vehicle adoption?

- Price

- Charge Time

- Range

- Charging Infrastructure

- Vehicle Choice

You should expect that these 5 critical challenges will be solved in the next decade because ready or not, the future is most definitely electric.

Click for infographic.

Click for report.

27 Oct 2020

Disruptive Technology

- Posted by Dejan Pekic BCom DipFP CFP GAICD

A Bad Ideas White Paper has been published which identifies 5 industries and sectors that are expected to be significantly disrupted by technological innovation and should be avoided for investment.

The industries and sectors listed in the White Paper include-

- Physical Bank Branches

- Brick and Mortar Retail

- Linear TV

- Freight Rail

- Traditional Transportation

Are our recommended PMs (Portfolio Managers) across these issues, absolutely but the challenge is to not overpay for hype.

Overpay, even for quality assets and it could be decades before you make a profit and that is why the price you pay for an asset is key when investing.

Click to read.

22 Oct 2020

Market Metrics: Yield

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Yield represents the income earned from an investment in the form of either interest income, rental income or dividend income.

If we go back four decades to 1980 we see that both income from growth assets (rent from property and dividend from shares) has dropped and income from defensive assets (interest from bonds) has dropped.

The biggest collapse in yield has been in defensive assets, example the Commonwealth Government 10 Year Bond yield has fallen from over 16% to 0.9% current.

The most reliable yield has been divided income from Australian listed companies which are currently running at an estimated 3% to 4% excluding the franking credit.

Click for chart.

So what does all this mean going forward?

Being fixated on purchasing assets for just yield alone to meet your living expenses in retirement is like walking around with one eye closed. You can still see but you have increased the likelihood of having an accident.

Investors should always have one eye focused on income and the other eye focused on growth when investing and be comfortable with part selling capital to meet living expenses in retirement if an when income is insufficient.

The myth that it is a complete disaster to part sell assets to meet living expense in retirement is simply false.

If you are using the right investment tax structure there is no difference between receiving income or part selling capital to meet your living expenses in retirement which then shifts the investment focus to the real challenge – maximising total return for a given risk profile.

WARNING, this does not constitute Personal Advice and is general in nature. To discuss if this is appropriate for your given circumstances please do not hesitate to contact us directly.

20 Oct 2020

US Unemployment- Jobs???

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The numbers have improved in the United States.

However, the COVID-19 Pandemic has impacted more negatively on the portion of the workforce earning below $38,000 per annum (US$27,000) than above $85,000 per annum (US$60,000).

By forcing us to play by new rules, the COVID-19 economic recession is defining new winners (technology, healthcare) and new losers (travel, restaurants, apparel) and if you are employed in an industry on the losing side then increasing your income becomes more difficult.

The same thinking applies for investing.

Click for chart.

14 Oct 2020

10 Investment Themes for the next 10 years

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Digital disruption is here and it is fascinating to see its impact on the global workforce and how it will help drive economic prosperity.

The attached research details the following 10 investment themes that are expected to drive the next 10 years.

- The big keep getting bigger

- Cloud demand is sky-high

- Innovative leader may emerge in emerging markets

- The prognosis looks good for a cancer cure

- House calls are coming to health care

- Content is king, but streaming is the kingdom

- Artificial intelligence could spark the next tech revolution

- Self-driving card may rule the roads

- ESG could be a pillar of portfolios

- The US China rivalry may define geopolitics

Click for insight.

12 Oct 2020

Interest Rates: Defensive Asset Fails

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Following on from Friday’s fixed term deposit rate update, the situation is just as bad in the United States.

Over the past 200 years, interest rates in the United States peaked at 15.8% in September 1981 and have now fallen to an all-time low of 0.5% in August 2020.

Click for chart.

The US Federal Reserve does not anticipate an interest rate increase until 2023.

Using cash and or fixed term deposit as a defensive asset solution no longer makes any sense.

Need help, find us.

9 Oct 2020

Friday Tidbit

- Posted by Dejan Pekic BCom DipFP CFP GAICD

It has taken 30 years for fixed term deposit rates to utterly collapse.

Click for chart.

My mother just received her 8 month fixed term deposit renewal notice from Commonwealth Bank of Australia which has offered 0.05% per annum to renew.

That is not half a percent but 0.05% or $33 of interest income per $100,000 deposited for 8 months.

Seriously, what does $33 buy?

Using cash or fixed term deposit as a defensive asset solution no longer makes any sense.

Need help, find us.

7 Oct 2020

2020 Australian Federal Budget

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The Federal Treasurer Josh Frydenberg has handed down his second Budget which was deferred from the original date of 12 May 2020 as a result of the COVID-19 Pandemic.

Some of the key measures include-

- Bringing forward Stage Two of the Personal Income Tax Plan to 1 July 2020

- Allowing businesses to expense capital investment and carry back losses to offset against previous year’s profits

- A new JobMaker tax credit to support businesses hiring new staff

It is important to remember that these Budget announcements are still only proposals and still need to be legislated.

Click to read.

2 Oct 2020

Australian Bureau of Statistics (ABS)

- Posted by Dejan Pekic BCom DipFP CFP GAICD

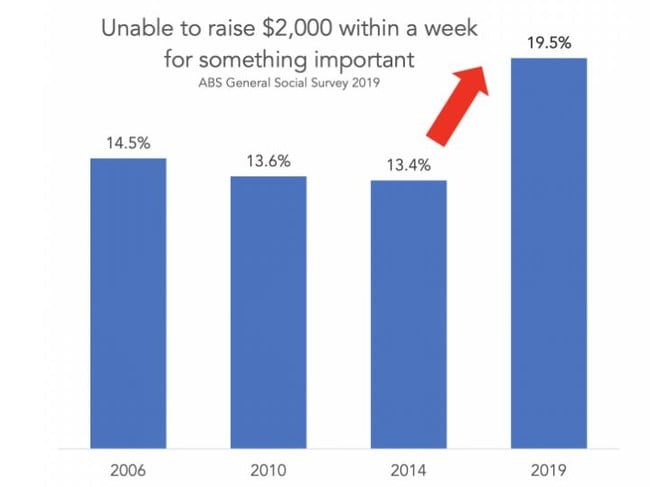

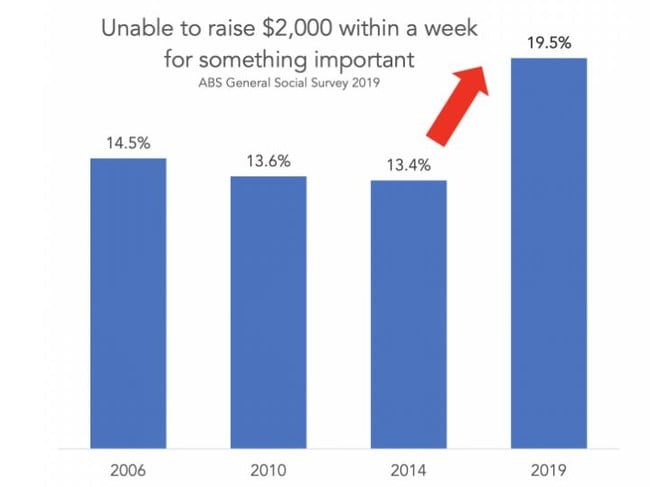

The ABS has just released the ‘General Social Survey: Summary Results, Australia’ for 2019 which states that 19.5% of households in Australia do not have the means to raise $2,000.

That means that 1.6 million households of the estimated 8.3 million households in Australia or 4 million people cannot raise $2,000 within a week for something important.

Do not understand. How is the case?

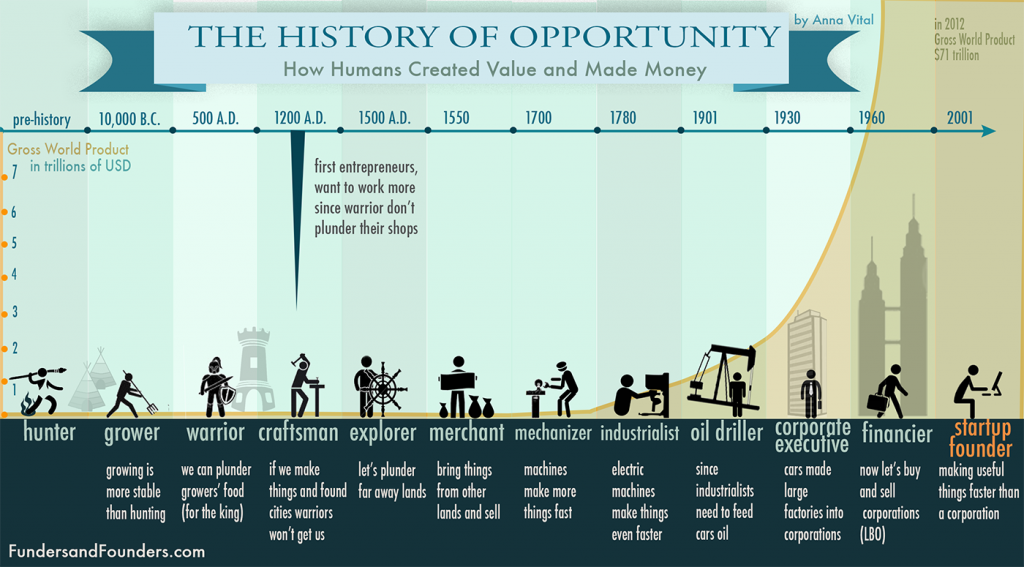

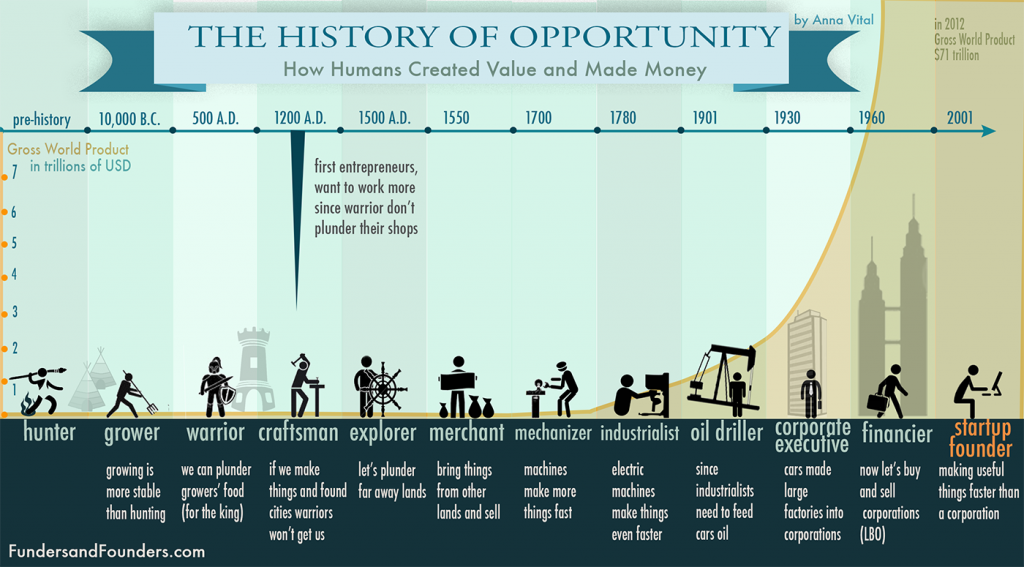

Australia is such a wealthy country and full of opportunity.

Click for General Social Survey.

Note, this was the case before the impact of the COVID-19 Pandemic.