22 Sep 2017

Market Metrics: Dow Jones Industrial Average

- Posted by Dejan Pekic BCom DipFP CFP GAICD

This may come as a surprise but we are presently living in the second longest US bull market since World War II.

The Dow Jones Industrial Average bottomed out at 6,547 in 2009 after having reached an all-time high close of 14,164 on the 9th October 2007.

On the 20th September 2017 the Dow Jones Industrial Average closed at an all-time high 22,412 points.

By comparison the Australian All Ordinaries closed at 3,111 on the 6th March 2009 which was a 54.6% drop from its 6,853 all-time high close on the 1st November 2007.

We did achieve a mini peak at 5,976 on the 1st May 2017 but we are still nowhere near passing the 6,800 mark after almost 10 years.

The question now is how much longer can the US bull market run before it busts?

12 Sep 2017

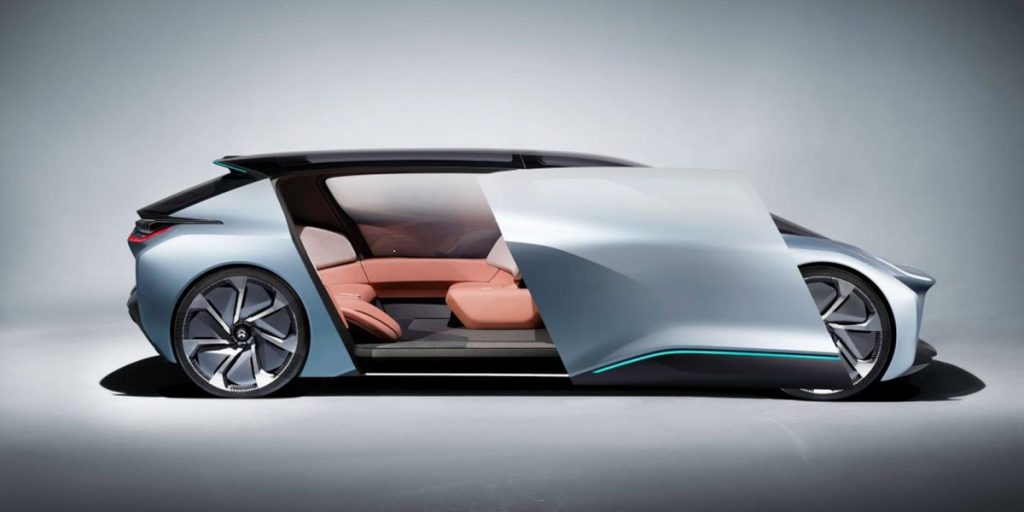

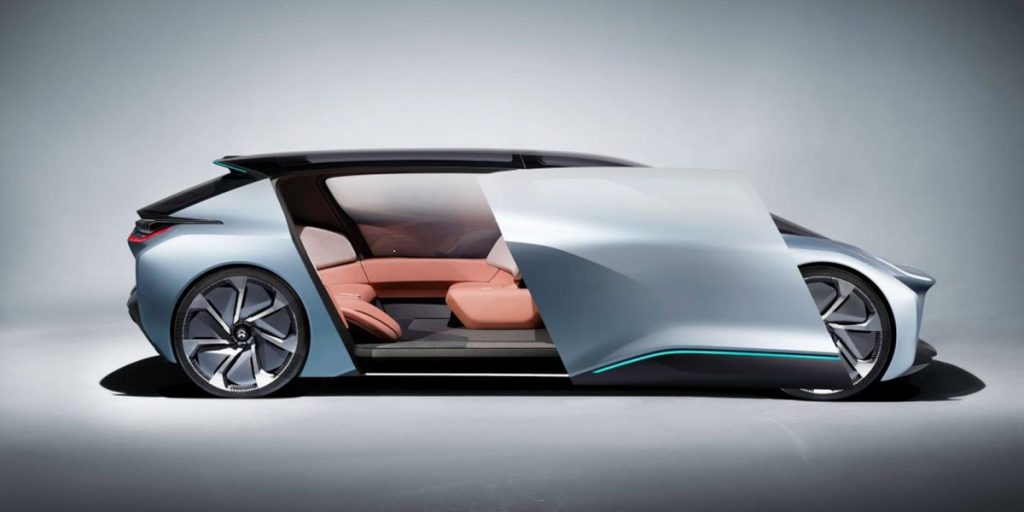

Disruptive Technology: e-car

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Back in November 2006 we sent out our first story on electric vehicles.

Specifically it was about California’s booming electric car subculture which was pushing to remake the US auto industry.

The revolutionary vision was to drive for free by having battery kits and solar-powered car ports so that electric car owners could charge up at home.

Sounds familiar and the link below will take you to seven futuristic e-car concepts to see what the design engineers are thinking.

Please note that we have been here before, the electric motor has been around since 1835 and in 1899 an electric car broke the 100 km/h speed barrier before being eclipsed by the internal combustion engine.

This time however you can expect the story to end differently.

Click to view.

8 Sep 2017

Friday Tidbit: Bankruptcy

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The entity vehicle that we call superannuation has many advantages.

These include disciplined savings towards retirement, low tax rate on investment earning (maximum 15%), the ability to contribute before tax income (maximum $25,000 per financial year) and the opportunity to rollover into a pension and pay nil tax on investment earnings and withdrawals (maximum $1.6 million).

These are tremendous benefits and an often forgotten advantage of superannuation is that it is also bankruptcy proof.

Creditors will take every cent that you own when things go horribly wrong financially except for your superannuation which is the only exception.

5 Sep 2017

Bonds: Asset Bubbles

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Last week we presented a chart to remind investors that booms and busts in financial markets are not new, they repeat with constant regularity but the path is always different which is why speculation is a recipe for failure.

Have a look at these Government Bond Yields.

You can go back to ancient Babylonian times and you will still not find negative interest rates before now.

These negative interest rates have pushed up bond prices to all time highs and the danger is that interest rates will mean revert (eventually). The impact for example of just a 1% rise in interest rates on a 30 year bond paying a 3% coupon would be a 20% drop in price.

As Warren Buffet has repeatedly stated, be fearful when everyone is greedy and greedy when everyone is fearful.

Now is not the time to be greedy.