31 May 2021

Market Metrics: S&P/ASX200

- Posted by Dejan Pekic BCom DipFP CFP GAICD

It is official, the S&P/ASX200 index has finally moved above the 7,162 point high it reached on the 20th February 2020 and just before the 37% crash in financial asset prices in March 2020.

It has only taken 14 months but Friday, 28th May 2021 close at 7,179 set a new record all time high.

Click for chart.

Now we wait to see how high we go before we walk into the next financial catastrophe which will be either months or years away.

As Benjamin Graham taught, remain invested according to your appetite for volatility when fear and panic take hold, then react by buying more quality assets at discounted prices.

28 May 2021

Friday Tidbit: Top 10 Australian Billionaires

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The 2021 Rich List is out and mining is on top with technology coming up fast.

Amazingly, 111 of the top 200 are billionaires (that is worth over AU$1,000,000,000).

Lets see how long it takes before you have to be worth a billionaire dollars just to qualify to get on the Top 200 Rich List.

The 18 new entrants on the Rich List prove that Australia is truly a land of opportunity if you have the determination to succeed.

Click for Top 10.

25 May 2021

Warren Buffett, The Oracle of Omaha

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Berkshire Hathaway Inc. (Berkshire) held its shareholder Annual General Meeting (AGM) as a virtual event on the 1st May this year.

You may be asking, what is Berkshire?

It is a publically listed American multinational conglomerate holding company headquartered in Omaha, Nebraska and run by Warren Buffett and Charlie Munger.

However its business is simply the business of investing in other businesses.

Berkshire is effectively a LIC (Listed Investment Company), a listed professionally managed fund with Warren Buffett and Charlie Munger as its PMs (Portfolio Managers).

In saying that, Berkshire has been the ultimate professionally managed fund given that for every US$10,000 invested in Berkshire in 1965, investors would have US$281.06 million by the end of 2020 compared to US$2.36 million if invested in the S&P 500 index.

Talent, specifically having the right PM talent working for you is the key to achieving above index performance over the medium to long term.

A couple of thoughts and insights that Warren Buffett shared during the AGM was that Berkshire is seeing ‘substantial inflation’ and he is still negative on Bitcoin.

Has Warren Buffett been wrong in the past?

Yes, but he is more often right than wrong and we concur that inflation is rising which as a causal effect increases interest rates but how high can interest rates actually go given the lack of wage growth?

Not much in our professional opinion because a rampant rise in interest rates would financially destroy Western economies.

20 May 2021

Inflation: Wage Growth

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Inflation is definitely spiking upwards, examples include material prices for building and construction which have already risen due to lack of supply.

This prospect of an inflation genie jumping out of the bottle is causing tremors in financial markets which are currently down since their April 2021 highs.

But how high can inflation actually rise given that its largest input is salary and wage growth which has not moved upwards for the past two decades.

Click for chart.

We can see a pattern, yes the number of people returning to employment has increased but something keeps impacting to subvert the rate of increase in the total number of people in the workforce and in turn continues to suppress wage growth.

Our best guess is that it is technology which through artificial intelligence (AI) advances continues to work quietly towards reducing the total number of people needed to do a job.

Will AI continue to impact and suppress wage growth and in turn keep a lid on inflation?

Don’t know but it is more likely than not.

Remember never to panic and as Benjamin Graham taught, to remain invested according to your appetite for volatility. If the inflation genie does jump out of the bottle, causing fear and panic to take hold, then you will be presented with an opportunity to react and buy more quality assets at discounted prices.

18 May 2021

Electric Vehicles: BEV+PHEV

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The acronym BEV stands for a Battery Electric Vehicle (a pure all-electric vehicle) while a PHEV is used to describe a Plug-in Hybrid Electric Vehicle which has both a battery and a petrol or diesel engine.

Global annual sales of BEVs plus PHEVs went over 3 million units in 2020 for the first time and Germany has now become the second largest consumer market of plug-in vehicles after China.

Interestingly and during the COVID-19 pandemic, the number of plug-in vehicles sold in Europe jumped from 589,000 to 1,395,000 in just 12 months. Surprisingly however, sales of plug-in vehicles in Japan fell by 28% during this same period.

Click for charts.

What do large global EV sales volumes imply, that the future is most definitely electric.

12 May 2021

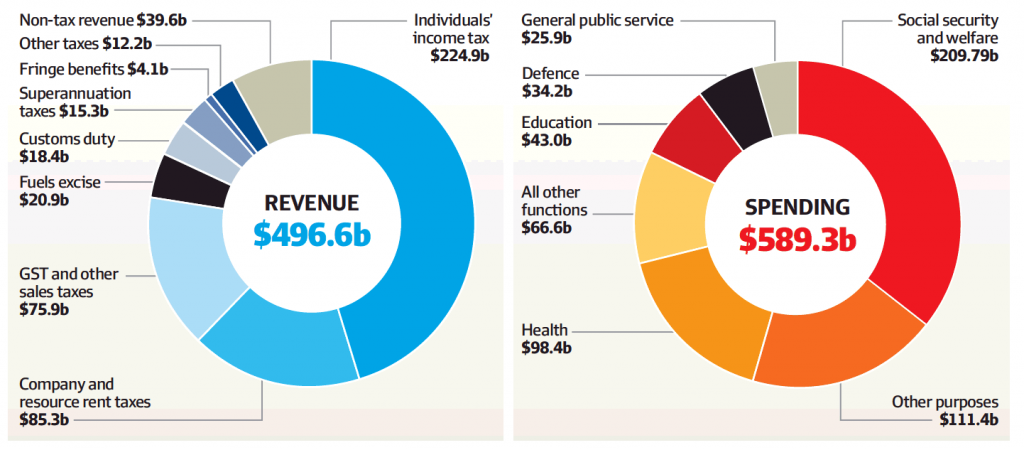

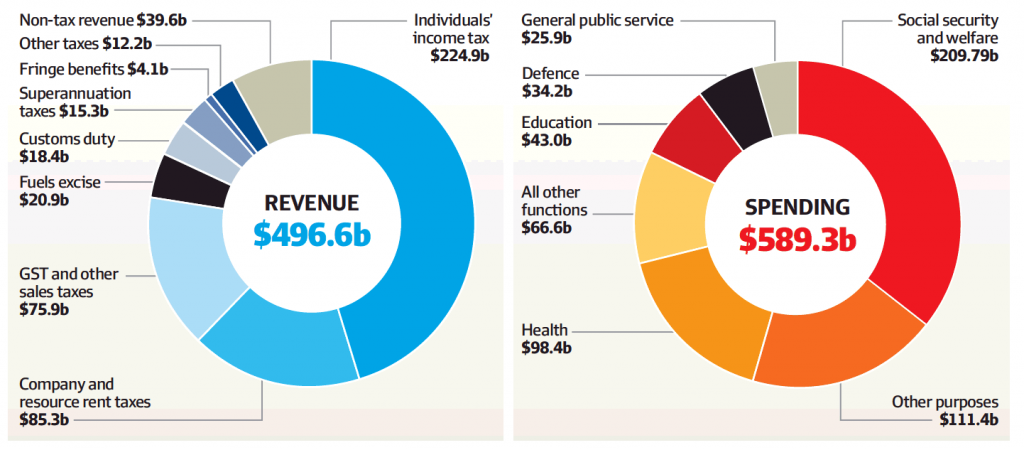

2021 Australian Federal Budget

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The Federal Treasurer Josh Frydenberg has handed down his third Budget with big spending for women, single parents, families, first home buyers, disabled Australians, retirees, worker, aged care and airlines plus airports.

A couple of key opportunities include-

- Removal of the Work Test from 1 July 2022– Individuals up to the age of 74 years will be allowed to make or receive non-concessional or salary sacrifice super contributions without meeting the Work Test.

- Downsizer contribution from 1 July 2022– The minimum age requirement for the downsizer contribution will reduce from 65 to 60.

Have a question, given all this spending in excess of revenue, who exactly is going to repay this ever increasing Federal Government debt?

It is important to remember that these Budget announcements are still only proposals and will still need to be legislated.

Click to read.

6 May 2021

US Interest Rates: How high can rates go?

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The market for fixed interest securities is currently pricing in the 5 year breakeven US inflation rate at 2.6% which has not been seen since the 2008 Global Financial Crisis (GFC).

The US 10 year bond yield has also moved up from the 2020 low but at the current 1.59% it is still materially below the 4.00% level in 2008.

Click for charts.

It is difficult to see US 10 year bond yield continuing any form of large increase with US debt at just over US$28 trillion and World debt over US$277 trillion or 365% of World GDP.

Put simply, the World is awash with debt, that is the elephant in the room and to take the US 10 year bond yield back up to even 4.00% would collapse prices for both growth assets and defensive assets.

As Benjamin Graham taught, remain invested according to your appetite for volatility and if bond yields do explode upwards causing fear and panic to take hold, then react by buying more quality assets at discounted prices.

4 May 2021

Up to a 50% guaranteed return: Superannuation Co-contribution for 30 June 2021

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The Federal Government Co-contribution was introduced from 1 July 2003 as an initiative to encourage low to middle income earners to save for their retirement within superannuation.

If you make a contribution of up to $1,000 into your superannuation account before 30 June 2021, the Federal Government will add an additional sum provided that you are earning less than $54,837 this financial year.

The table below shows you how much the Federal Government will contribute for various amounts.

|

If your total

annual

income is:

|

…and you make

personal contributions of:

|

…then the maximum Government

co-contribution is:

|

|

$39,837 or less

|

$1,000

|

$500 |

|

$42,837

|

$800

|

$400 |

|

$45,837

|

$600

|

$300 |

| $48,837 |

$400

|

$200

|

| $51,837 |

$200 |

$100

|

|

$54,837 or more

|

$0

|

$0

|

Yes, there are always additional eligibility conditions but that is why we are here, to help you.

WARNING, this does not constitute Personal Advice. To discuss if this is an appropriate strategy for your given circumstances please do not hesitate to contact us directly.