29 Mar 2019

Interest Rates: Not good news

- Posted by Dejan Pekic BCom DipFP CFP GAICD

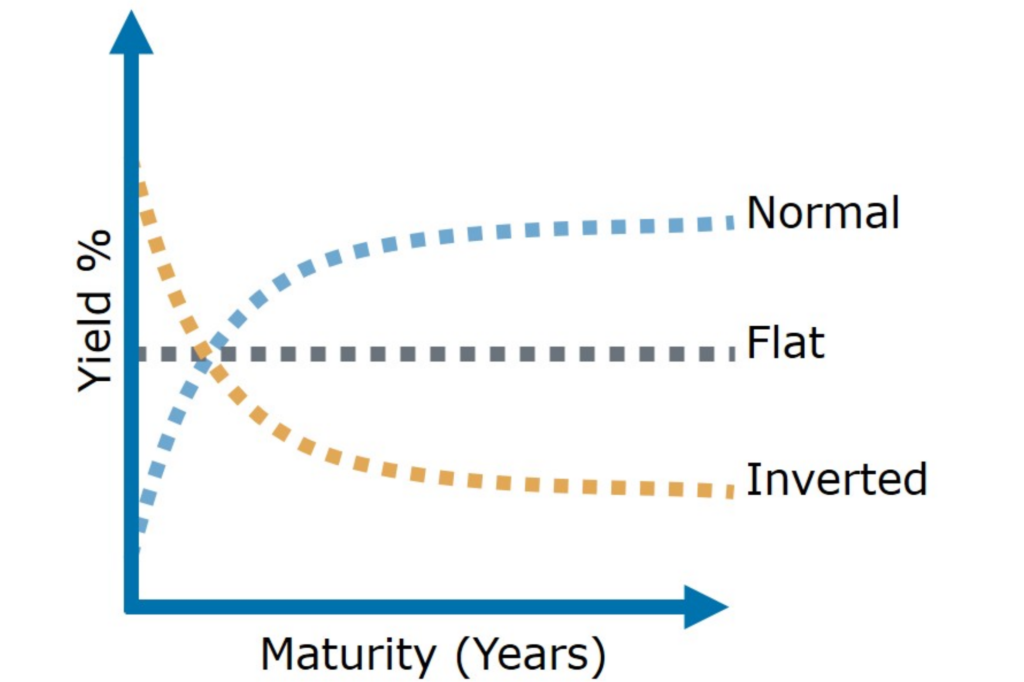

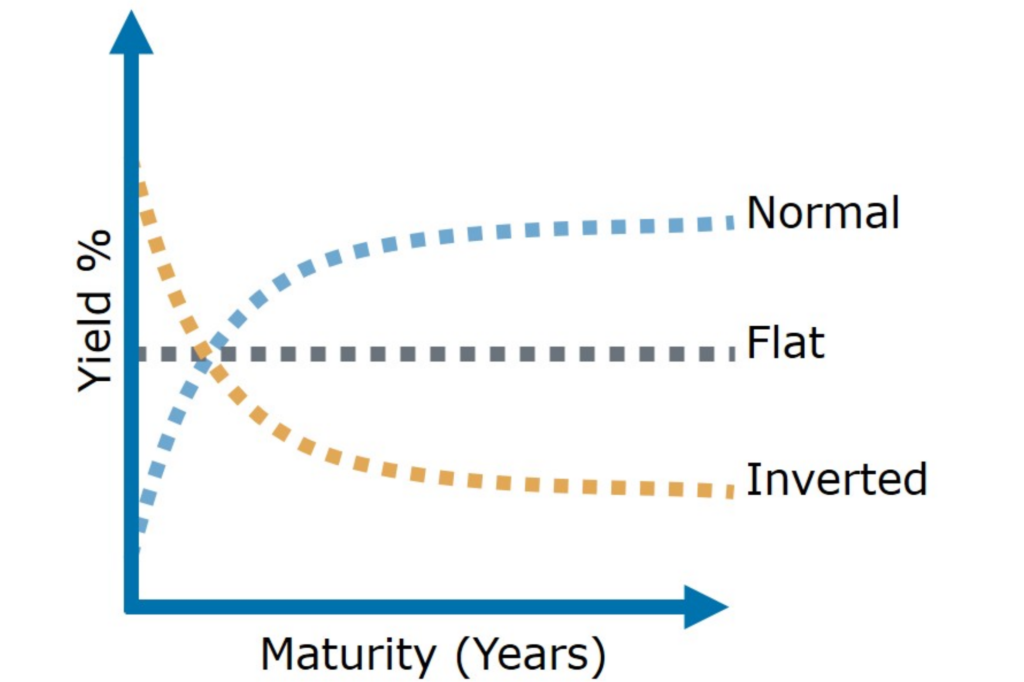

The normal is for long term interest rates to be higher than short term interest rates.

The concern is when the yield curve becomes inverted (short term interest rate are higher than long term interest rates) because in the past this has marked the beginning of an economic downturn.

Today the US 3 month Treasury Bill Rate is 2.44% and the US 10 year US Treasury Bond Rate is 2.39%.

The yield curve inverted on Friday, 22nd March 2019 and if history repeats, we are now at the start of the next US recession.

Just remember that when fear and panic take hold during the next financial catastrophe, it is then that investors will be presented with the opportunity to buy more quality assets at discounted prices.

Click for Yield Curve Basics.

27 Mar 2019

Oil Dependency: Resources

- Posted by Dejan Pekic BCom DipFP CFP GAICD

If you are curious about why Russia is deploying military personnel, plans and equipment to Venezuela then this picture says it all.

Click to view.

Venezuela is estimated to have the largest crude oil reserves in the World and even with all that wealth the country is currently in economic ruin.

This could be a strategic land grab for natural resources which has happened many times before throughout Human history.

Remember, Russia has already annexed Crimea which was part of the Ukraine and China has claimed the Spratly Islands in the South China Sea.

Russia and China are also expanding territorial claims in both the Arctic (currently only floating ice) and in the Antarctic.

22 Mar 2019

Friday Tidbit: Cool Tech

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The future is incredible and exciting.

Check out this footage of having your own autonomous AI drone that can follow you around, create a video package and upload it to social media.

Remarkable.

Watch video.

18 Mar 2019

Sydney Children’s Hospitals Foundation: Bear Cottage

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Stavros Vasiliou (client since 1997) is setting out on an adventure at the end of this month to raise $15,000 for Bear Cottage, the only children’s hospice in NSW.

His challenge is an epic 4,000km solo cycle from Perth to Sydney over 4 weeks.

We wish him every success and please feel free to support Bear Cottage.

Cycling for a Cause.

12 Mar 2019

Market Metrics: S&P 500 Index

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Using the total returns data from the S&P Composite Index (from 1872 to 1957) and the S&P 500 Index (from 1957 onwards) it is evident that there is a 31% probably of a negative return in any single year.

That is almost a 1 in 3 chance of loss based on 146 years of data.

Patience however can and does help reduce the probability of a negative return but how many investors are prepared to wait for 20 years.

Click to view.

Investing in growth assets (shares and property) requires expertise (professional management) in addition to patience. If you buy rubbish then no amount of patience will save you from poor or negative returns.

Also buying more quality assets at discounted prices when fear and panic take hold during a financial crash is another key ingredient for investing.

WARNING, past performance is no guarantee of future performance and the above does not constitute Personal Advice.

7 Mar 2019

Disruptive Technology: Amazon

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The future just does not stop coming when you see that the disruptors themselves are beginning to be disrupted.

Attached is an insight piece on how Amazon is positioning itself to win the influencer game.

Click to read.