27 Mar 2020

Federal Government Stimulus Package

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Royal Assent was granted on Tuesday, 24 March 2020 which means that the Federal Government stimulus package has come into force as law.

Supporting and helping individuals and business in great crisis is most definitely the role of Government however it is also important to understand that the Government does not produce anything and so must borrow this money.

For the Government to give money it must take from taxpayers on which the future debt burden falls.

Click to read.

During this asset price crash it is most important for investors to never ever panic and instead look for buying opportunities.

Keep your head and if you are an Active client wanting to discuss how you can take advantage, please call me on 02 9267 2322.

24 Mar 2020

Australian Agricultural Supply: Food

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The panic buying is just ridiculous when you consider that Australia produces enough food each year to feed 75 million people.

There are only an estimated 26 million Australians.

Click to read.

The key for investors during this financial catastrophe is never to panic and to look for buying opportunities.

Keep your head and if you are an Active client wanting to discuss how you can take advantage, please call me on 02 9267 2322.

17 Mar 2020

Coronavirus outbreak: History of Pandemics

- Posted by Dejan Pekic BCom DipFP CFP GAICD

We have attached a chart to give you a perspective on the current COVID-19 death toll (currently estimated under 7,000) versus previous pandemics.

Click for chart.

Irrespective of this low relative death toll, fear and panic have most definitely gripped financial markets.

The Australian All Ordinaries Index (AORD) closed at 7,255 on 20th February 2020 and has since fallen to a low of 5,058 yesterday which represents a 30.5% movement.

The Dow Jones Industrial Average (DJI) closed at 29,551 on 12th February 2020 and has since fallen to a low of 20,189 overnight which represents a 31.7% movement.

The key for investors is never to panic and to look for buying opportunities.

Keep your head and if you are an Active client wanting to discuss how you can take advantage of what is now a crash, please call me on 02 9267 2322.

5 Mar 2020

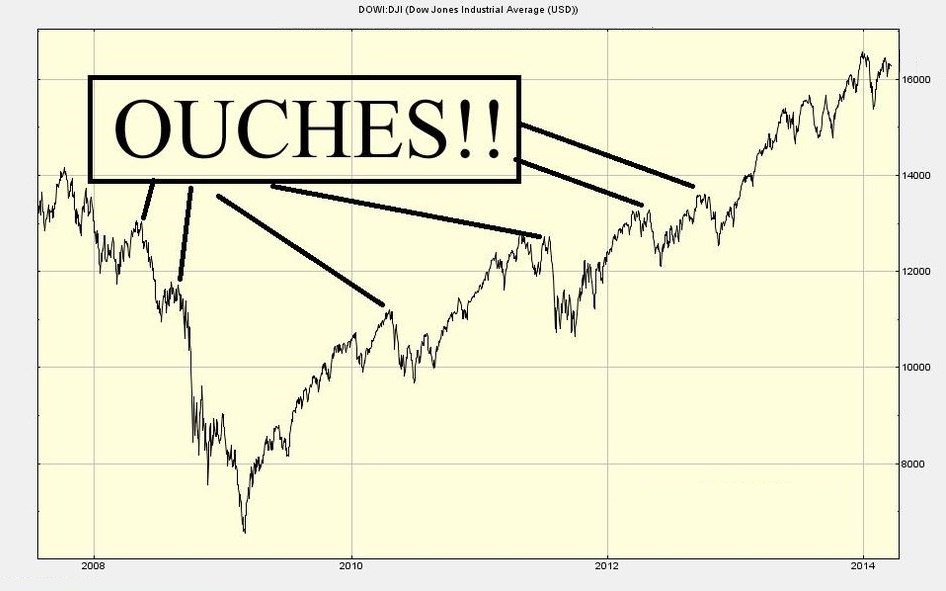

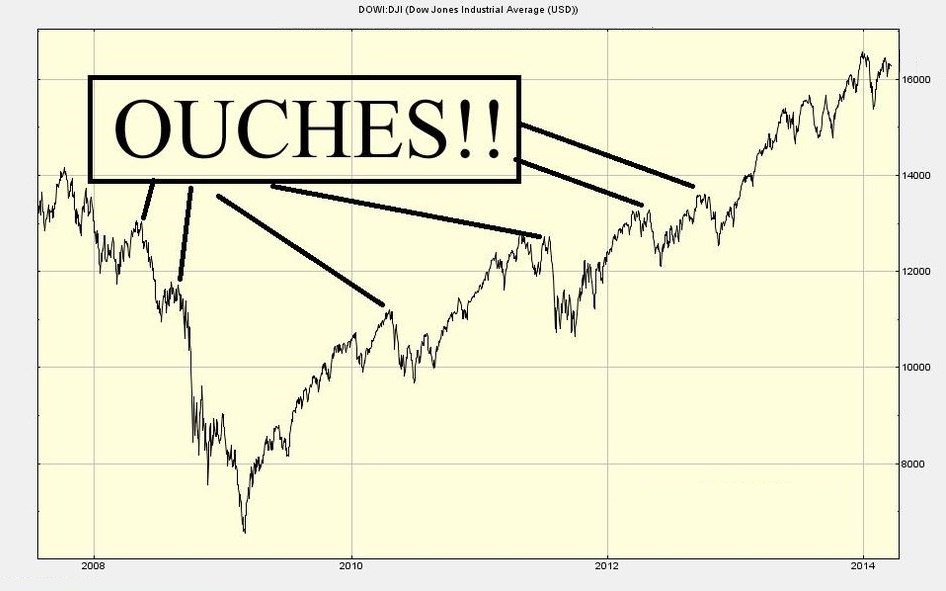

Market Metrics: Correction verses Crash

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Interestingly there have been three major corrections defined as a 10% fall or more from recent peak since the Global Financial Markets (GFC) crash in 2008.

There was 2011 when US lost its AAA credit rating, 2016 when the purchasing managers index (PMI) in China dropped below 50 and 2018 when Trump launched his tariff war on China and then the rest of the World.

All three corrections did not devolve enough to become a financial markets crash which is defined as a 20% fall or more from recent peak.

The current COVID-19 event is most definitely a correction as confirmed by the Down Jones Industrial Average having fallen 14.1% but it has already rebounded from that low.

Click for charts.

Will this fourth attempt win out and crash financial markets? Don’t know.

However what we do know is that when Mr Market is offering a 10% discount that is an opportunity to add to your investment portfolio even if the fall were to continue into a financial markets crash.

WARNING, this does not constitute Personal Advice and to discuss if this is appropriate for your given circumstances please do not hesitate to contact us directly.

3 Mar 2020

Business Demographics: Boss Insights

- Posted by Dejan Pekic BCom DipFP CFP GAICD

We have attached a paper on the role of business ownership in shaping Australia over the past three decades.

The insights are many, including the big shift into professional services and the increased number of sole traders and businesses employing up to 4 staff which points to a culture of relentless entrepreneurship.

In fact the number of owner-managers since 1991 has increased from 1.5 million to around 2.3 million today and although these owner-managers now employ more staff their share of the total workforce has actually reduced to 17%.

So, where do we go from here?

Click to read.