31 May 2018

Taxation: Reward for effort

- Posted by Dejan Pekic BCom DipFP CFP GAICD

This is one of those very special pearls of wisdom and was sent by one of our clients.

Not only is it a must read but we also ask that you forward it to every political leader in Australia.

Business which is represented by 12,505,200 workers (ABS, April 2018) is the one driver of economic prosperity and any Government or opposition that believes otherwise is living in an economic delusion.

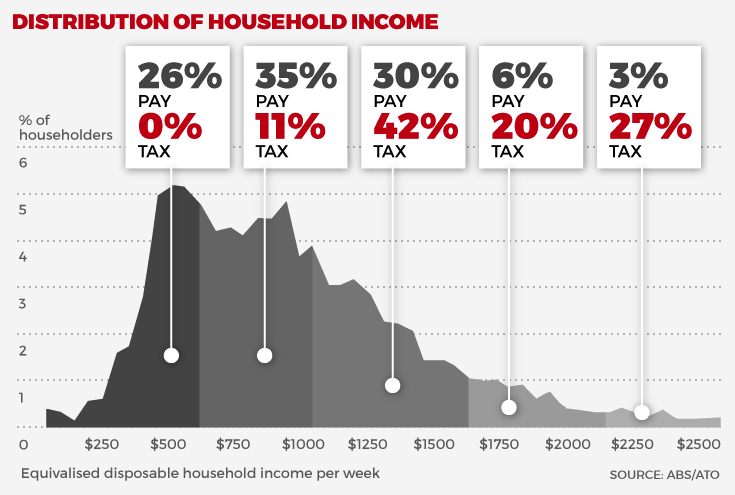

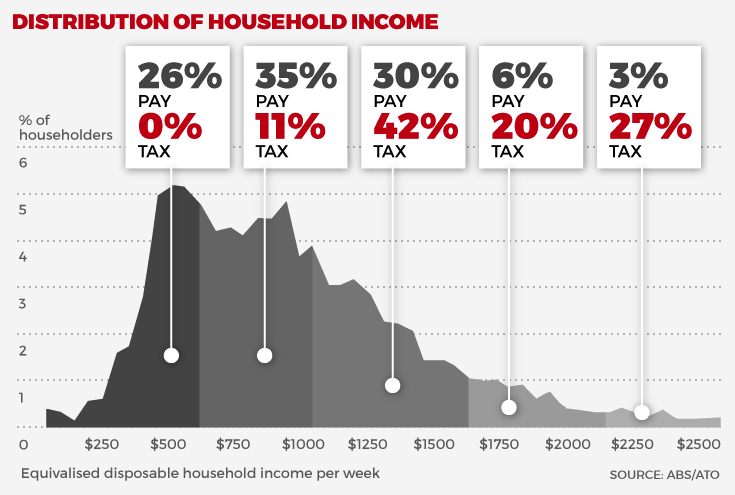

Income tax in Australia is all wrong when the top 40% of households by income per week collectively pay 89% of the tax take (above chart ABS/ATO).

How is this a fair reward for effort?

Click to read.

25 May 2018

Friday Tidbit: Top 10 Australian Billionaires

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The 2018 Rich List is out and who would have thought that you can make so much money out of cardboard.

Just goes to prove that this country of ours is a land of opportunity if you have the determination to succeed.

Click to view.

24 May 2018

Screenagers: Technology & Children

- Posted by Dejan Pekic BCom DipFP CFP GAICD

This paper was sent out by Epping Boys High School and is insightful on how parents today do need to help their children manage the all consuming technology and social media onslaught which will just not go away.

Click to read.

21 May 2018

Up to a 50% guaranteed return: Superannuation Co-contribution for 30 June 2018

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The Federal Government Co-contribution was introduced from 1 July 2003 as an initiative to encourage low to middle income earners to save for their retirement within superannuation.

If you make a contribution of up to $1,000 into your superannuation account before 30 June 2018, the Federal Government will add an additional sum provided that you are earning less than $51,813 this financial year.

The table below shows you how much the Federal Government will contribute for various amounts.

|

If your total

annual

income is:

|

…and you make

personal contributions of: |

…then the maximum Government

co-contribution is: |

|

$36,813 or less

|

$1,000 |

$500 |

|

$39,813

|

$800 |

$400 |

|

$42,813

|

$600 |

$300

|

| $45,813 |

$400 |

$200

|

| $48,813 |

$200 |

$100

|

| $51,813 or more |

$0 |

$0

|

Click for super co-contribution calculator.

17 May 2018

Self Managed Super Funds (SMSF): Civil Penalties

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The SMSF administration vehicle for superannuation is problematic because it give members (who are both the trustee and the client) the illusion of control while materially increasing the members exposure to liability.

In essence, a SMSF administration vehicle moves all responsibility from an unrelated trustee of a Public Offer superannuation vehicle to the members.

Breaching the Superannuation Industry (Supervision)(SIS) Act 1993 for a SMSF trustee is as simple as not documenting investment decisions, not keeping adequate financial records of transactions, using funds to invest in a holiday house for members and or lending money to members.

If SMSF trustee is found to have contravened the SIS Act, the ATO can now seek a maximum civil penalty of $420,000.

In addition to civil penalties, a members can also be charged with a criminal offence and if found guilty of dishonesty and deception can be imprisoned for up to 5 years.

This fact should be very concerning.

Fortunately Public Offer superannuation vehicles such as a master trust and wrap platforms exist and are often the best and least expensive structure for crafting a diversified investment strategy UNLESS the investment strategy in superannuation requires the purchase of real property and or purchase of shares in an unlisted private company where there are no related parties.

Key should be to use the right vehicle (SMSF or Public Offer) for the purpose required.

Click to read.

9 May 2018

2018 Australian Federal Budget

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The Federal Treasurer Scott Morrision has handed down his third Budget which included the following key measures.

- Income tax cuts through a combination of tax rate threshold changes and tax offsets.

- Extension of the provision allowing small business to instantly write-off asset purchases under $20,000.

- Cash payments to businesses will be restricted to $10,000 or less.

- Work test exemption for those age 64 to 74 with total superannuation balance of less than $300,000.

It is important to remember that these Budget announcements are still only proposals and still need to be legislated.

Click to read.

7 May 2018

Life Insurance: Cancer

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The bad news is that more young Australians are being diagnosed with cancer.

The good news is that survival prospects have improved.

Survival from all cancers combined for young Australians rose from 80% in 1985-1989 to a 89% chance of surviving for 5 years in 2010-2014.

That is great news.

Trauma type life insurance will not stop cancer or some other unexpected health tragedy but it will greatly help reduce the financial burden during the recovery period.

Click for chart.

Click for report.

1 May 2018

Disruptive Technology: Tech Trends

- Posted by Dejan Pekic BCom DipFP CFP GAICD

As you read through the 2018 Tech Trend Report expect to be amazed over the advancements in artificial intelligence, biotech, autonomous robots, green energy, smart farms and space travel which will fundamentally change our way of life.

We are all truly ‘GEN-T’.

The Transition Generation where machines capable of learning, deciding and creating will co-exist with humans.

Click to download report.