30 May 2019

Interest Rates: US Yield Curve

- Posted by Dejan Pekic BCom DipFP CFP GAICD

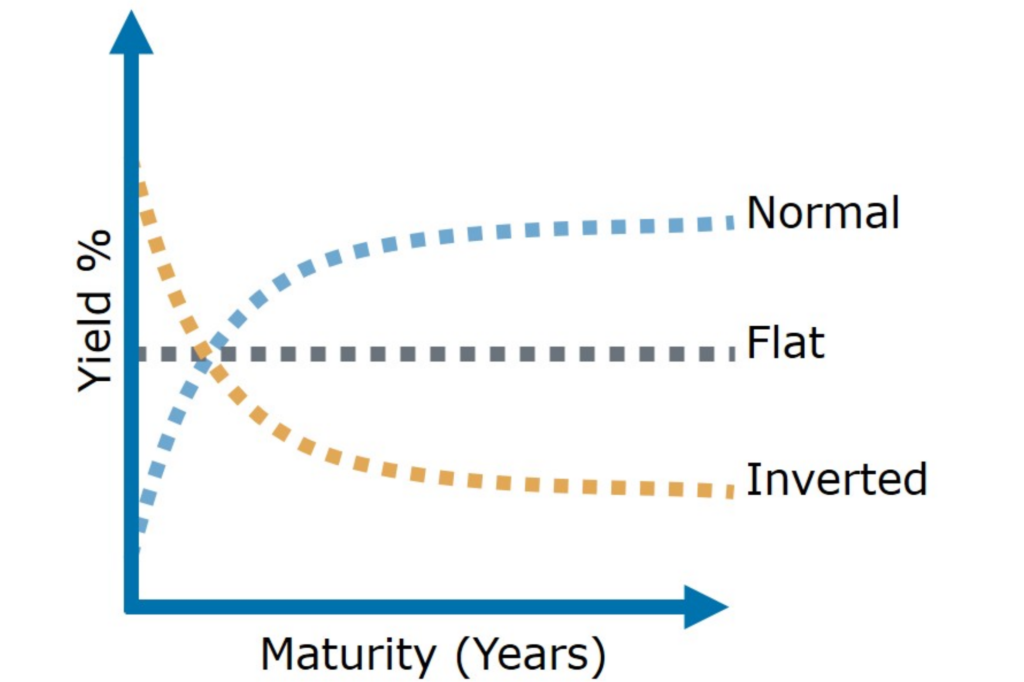

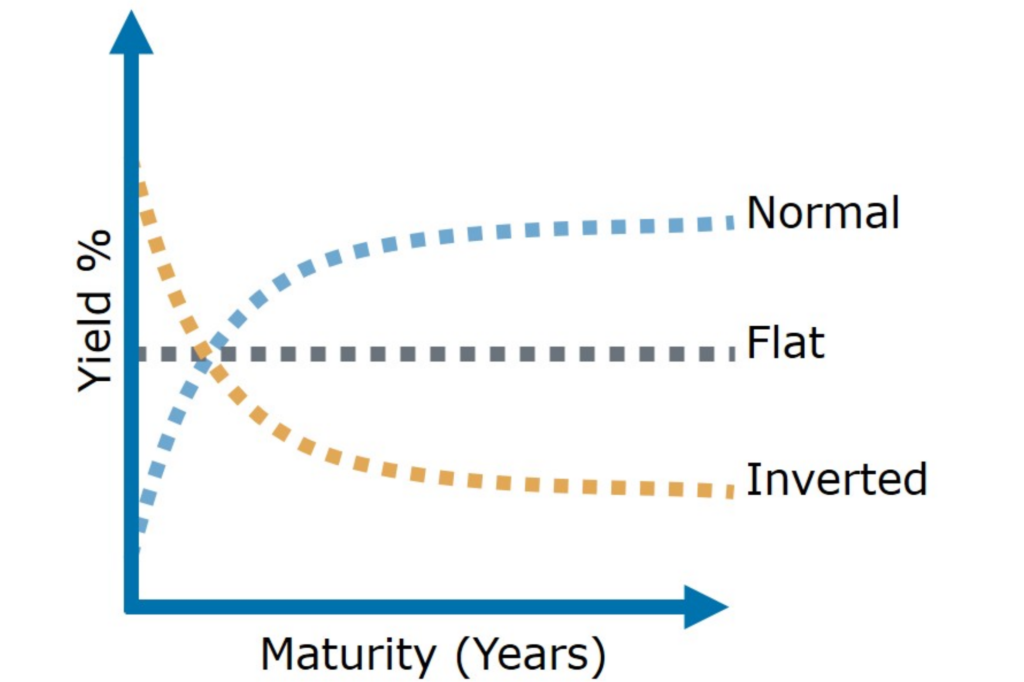

The normal is for long term interest rates to be higher than short term interest rates.

The concern is when the yield curve becomes inverted (short term interest rate are higher than long term interest rates) because in the past this has marked the beginning of an economic downturn.

Today the US 3 month Treasury Bill Rate is 2.37% and the US 10 year US Treasury Bond Rate is 2.25%.

The yield curve has been inverted since Monday, 13th May 2019 and historically the inversion has pointed to the start of the next US recession but the research shows that this is not always the case.

Click for chart.

The key for investors with all of this market noise is to remain invested according to your appetite for volatility and then, when fear and panic take hold during the next financial catastrophe, to take advantage by buying more quality assets at discounted prices.

28 May 2019

Technical Paper: Changes to insurance in Superannuation

- Posted by Dejan Pekic BCom DipFP CFP GAICD

We have been getting questions about losing insurance cover attached to a superannuation account which is classified as inactive.

Yes this will happen and will be effective from 1 July 2019.

The legislation requires superannuation members to either opt-in to hold insurance in a superannuation account classified as inactive or to make ongoing contributions/rollovers.

We have attached a technical paper detailing the change and if you have questions or need help please call or email us directly.

Click to read.

22 May 2019

Warren Buffett, The Oracle of Omaha

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Gold is a store of wealth.

This is undisputed and has been the case for millennia and is the case today.

However the problem with investing in gold is that it does not multiply. A bar of gold does not produce gold ingots, in fact it literally makes nothing and costs the investor money to securely store the gold against theft.

This latest video on gold is all about how billionaires are investing in gold as a defense asset for the next financial catastrophe.

Click to watch.

Now before everyone suffers a bout of gold fever we pulled this out of the archive from Warren Buffett’s playbook as a reminder about why business enterprise has been and will continue to be the best performing asset class over the long term.

It is just so simple when you focus on buying quality assets at reasonable or better still discounted prices.

Click to read.

20 May 2019

European Union: Divorce

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The euro was officially launched on 1st January 1999 and then after three years of working with the euro as ‘book money’ alongside member national currencies, euro coins and euro banknotes were launched on 1st January 2002.

Originally, the 12 member countries comprising the European Union are Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain.

Today, the European Union comprises 19 nation economies and the question being asked is will the European Union fall apart?

The European Union is a currency union but not a fiscal union. Not having a European Union government with tax and spending authority has resulted in large sovereign debts and a big divergence between the northern member countries and the southern member countries.

Attached is a chart with some of the World’s best and worst performers in terms of Gross Domestic Product (GDP) and shows that Greece has fallen behind Sudan and Ukraine in terms of GDP growth. Italy and Cyprus have been outgrown by Iran and Brazil while Spain and Portugal have been outgrown by the United Kingdom.

Click for chart.

The European Union has shackled together 19 national economies but what is the benefit for the losing members who cannot devalue their currency to become more globally competitive?

A fiscal union must become a reality for the European Union or there will be divorce.

The key for investors with all of this is to remain invested according to your appetite for volatility and when fear and panic take hold during the next financial catastrophe, to take advantage by buying more quality assets at discounted prices.

16 May 2019

Up to a 50% guaranteed return: Superannuation Co-contribution for 30 June 2019

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The Federal Government Co-contribution was introduced from 1 July 2003 as an initiative to encourage low to middle income earners to save for their retirement within superannuation.

If you make a contribution of up to $1,000 into your superannuation account before 30 June 2019, the Federal Government will add an additional sum provided that you are earning less than $52,697 this financial year. Conditions apply.

The table below shows you how much the Federal Government will contribute for various amounts.

|

If your total

annual

income is:

|

…and you make

personal contributions of:

|

…then the maximum Government

co-contribution is:

|

|

$37,697 or less

|

$1,000

|

$500

|

|

$40,697

|

$800

|

$400

|

|

$43,697

|

$600

|

$300

|

|

$46,697

|

$400

|

$200

|

|

$49,697

|

$200

|

$100

|

|

$52,697 or more

|

$0

|

$0

|

WARNING, this does not constitute Personal Advice. To discuss if this is an appropriate strategy for your given circumstances please do not hesitate to contact us directly.

9 May 2019

Market Metrics: Forecast

- Posted by Dejan Pekic BCom DipFP CFP GAICD

If we go back to basics, the number one factor in determining your future return is price.

No matter the quality of the asset, if you overpay on the purchase you will make little or no profit.

That is an absolute fact.

We have attached a portfolio managers (PM) view on the forward 3 year forecast for a number of financial assets.

Interestingly the PM see good returns on Australian listed companies and very poor returns from purchasing Australian listed property (A-REITs) at current prices.

The PM is also forecasting that US listed companies and Australian Government bonds are not going to make any money over the next 3 years.

Click for charts.

The problem with individual investors acting on such information is that we are talking about the future which is impossible to predict with absolute certainty.

This is why the key for investors is simply to remain invested according to your appetite for volatility, allow the professional PM’s to do their job and when fear and panic take hold during the next financial catastrophe, to take advantage by buying more quality assets at discounted prices.

WARNING, this does not constitute Personal Advice. To discuss if this is an appropriate strategy for your given circumstances please do not hesitate to contact us directly.

3 May 2019

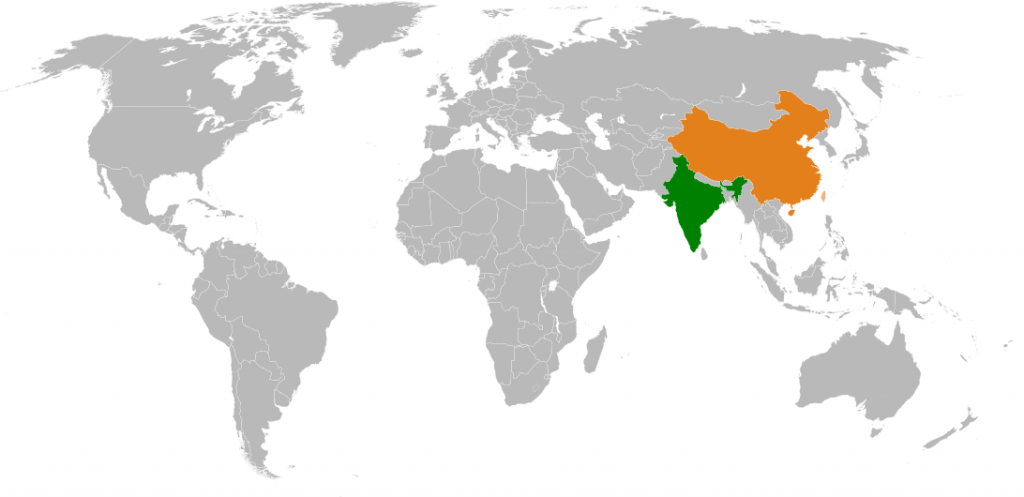

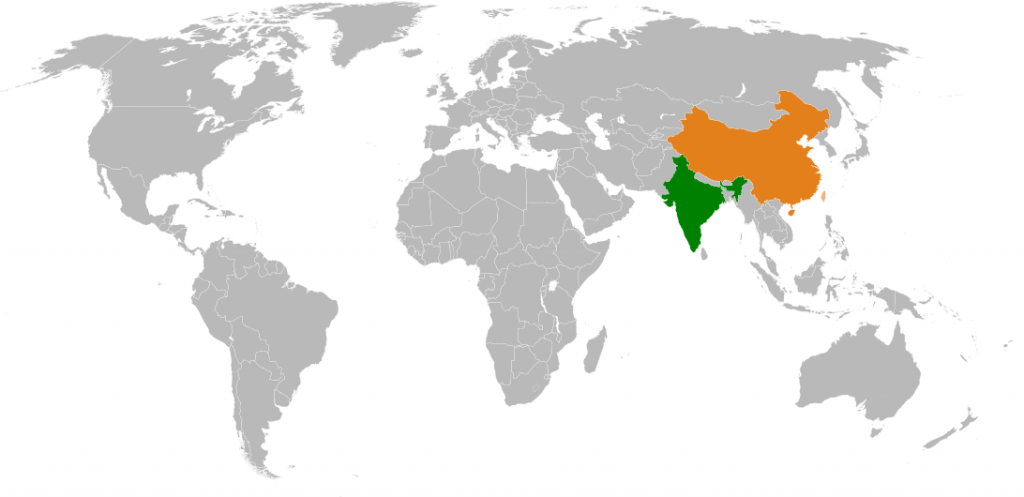

Friday Tidbit: Asian Century

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The Gross Domestic Product (GDP) forecast by the International Monetary Fund (IMF) for the next four years to 2023 does not show any change in the ranking of the top 10 economies.

The United States is projected to still rank 1st at US$24.7 trillion, China 2nd at $14.2 trillion and India 5th at US$4.3 trillion by 2023.

However what maybe missed is that the IMF is forecasting GDP to increase 38.2% for China and 46.4% for India while United States is expected to rise by only 14.8% or less than half by comparision.

Asia is closing the gap and rapidly.

Interestingly Australia continues to be a good news story and is forecast to increase its ranking from 14th to 13th with US$1.8 trillion GDP by 2023.

Click for table.