29 Apr 2022

Friday Tidbit

- Posted by Dejan Pekic BCom DipFP CFP GAICD

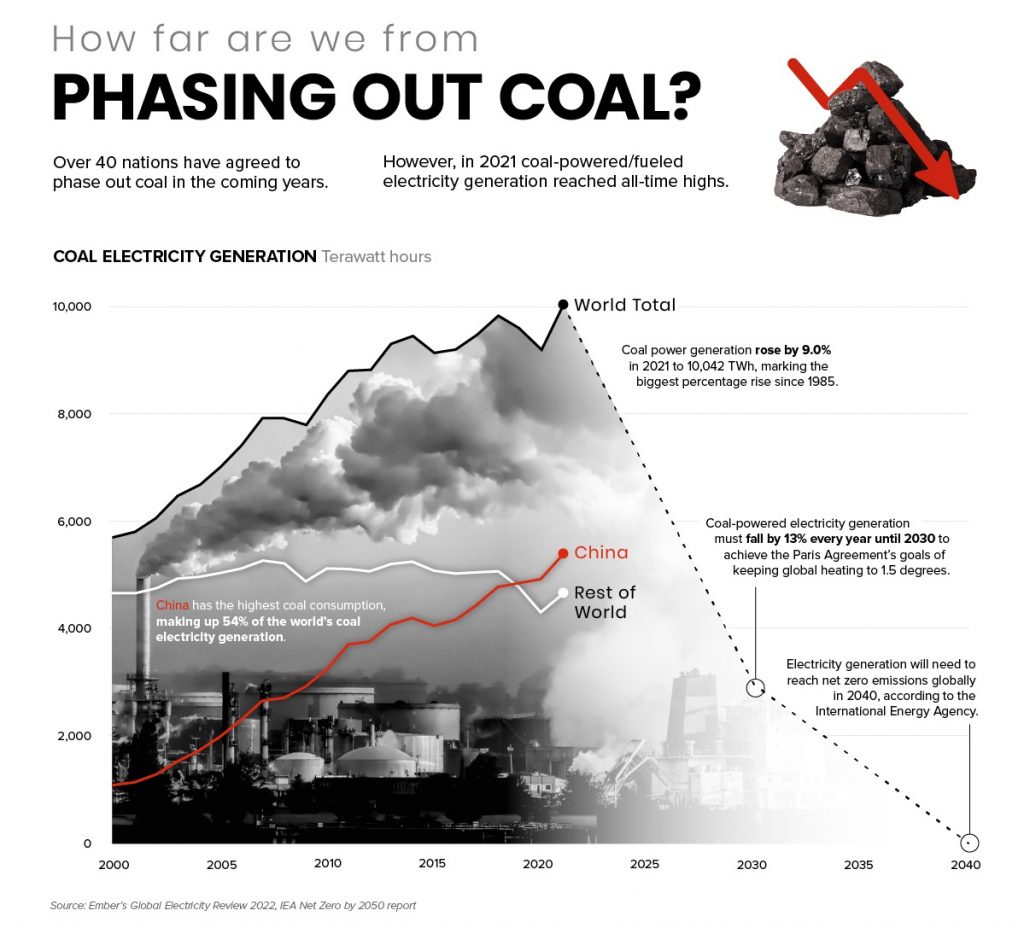

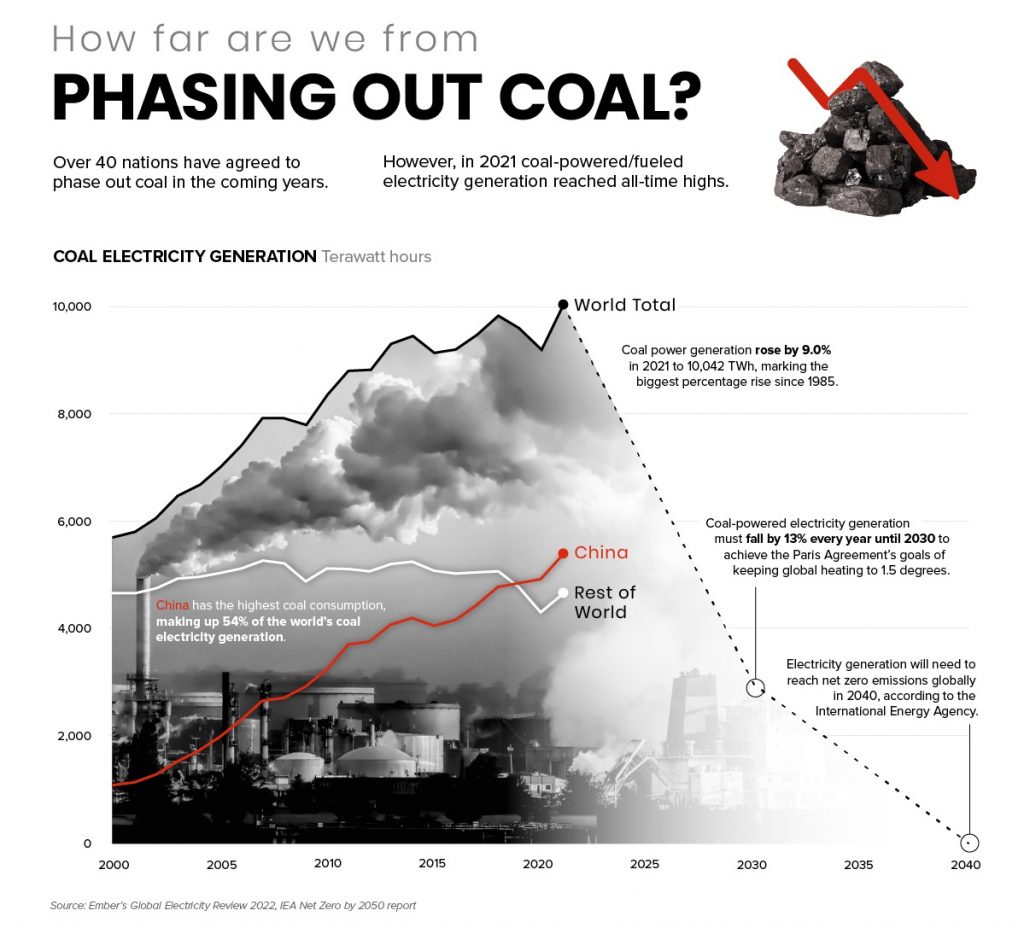

Given the current rate of coal consumption pictured above, the required spend to achieve net-zero by 2050 is going to be in the tens of trillions of dollars which presents investors with an investment opportunity over the coming decades.

WARNING, this does not constitute Personal Advice and is general in nature. To discuss if this is appropriate for your given circumstances please do not hesitate to contact us directly.

28 Apr 2022

China: Supply, supply, supply

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The past 5 months have been bad for financial asset prices.

The Dow Jones Industrial Average and the S&P500 have both corrected (meaning a 10% plus fall from recent peak) while the NASDAQ index has crashed with a fall beyond 20% from recent peak.

Why had this happened? Because the United States Federal Reserve has started increasing short term interest rates.

Why? Because inflation in the United States has jumped to 40 year highs.

Why? Because even if demand remained the same, the supply of goods has reduced which causes prices to increase due to scarcity.

Why? Because China’s manufacturing output has reduced.

Why? Because China has decided to pursue a zero COVID-19 infection policy which has completely failed and continues to fail.

This is the challenge because with large segments of the Chinese workforce quarantined for COVID-19, supply of manufactured goods has dropped which is very bad economic news for China and bad news for the rest of the World.

China needs to get producing and moving goods otherwise inflation will remain high.

Click to read.

Please remember that as this economic violence continues, investors need to remain invested according to your appetite for volatility and when fear and panic take hold, react by buying more quality assets at discounted prices.

22 Apr 2022

Australian Residential Property: Housing Affordability

- Posted by Dejan Pekic BCom DipFP CFP GAICD

According to the just released Demographia International Housing Affordability 2022 Edditon, Sydney and Melbourne residential property markets are ranked in the top 5 most unaffordable cities in the World.

Sydney came in second after Hong Kong and Melbourne came in fifth (refer table on page 15).

Click to read.

How is this good news for our children and grandchildren?

The recession in 2020 was expected to deflate residential property prices by a forecast 20% or more but it failed to deliver.

Just like an elastic band, if you continue to stretch and stretch, the elastic band will eventually break and that also applies to asset prices.

Please remember to remain invested according to your appetite for volatility and when fear and panic take hold, react by buying more quality assets at discounted prices.

21 Apr 2022

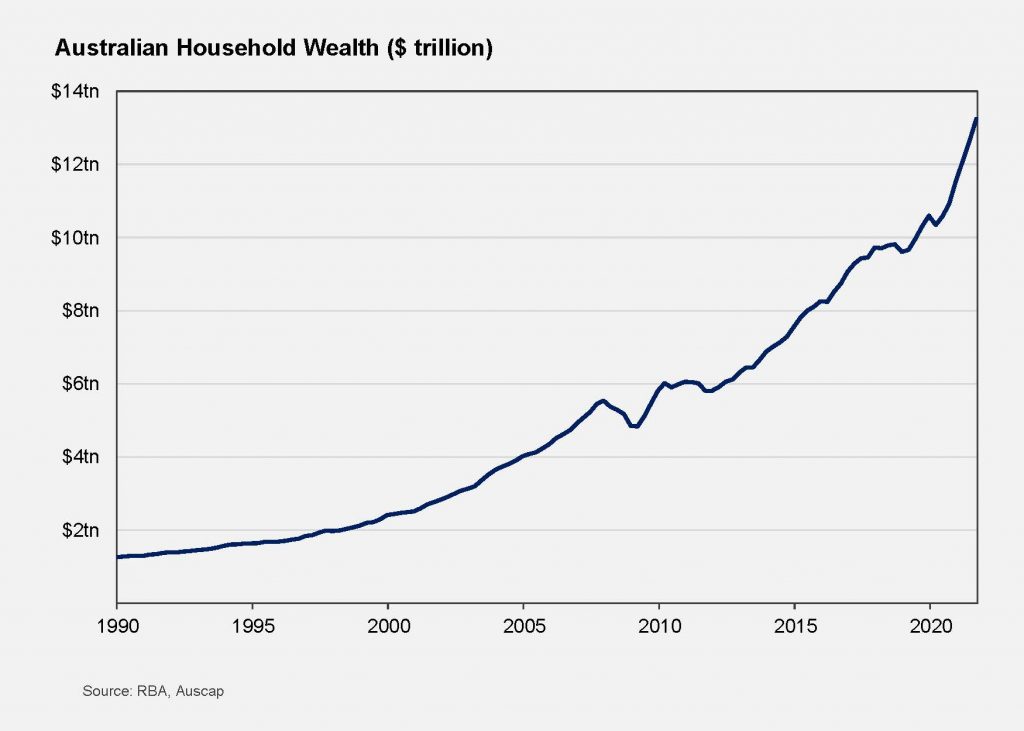

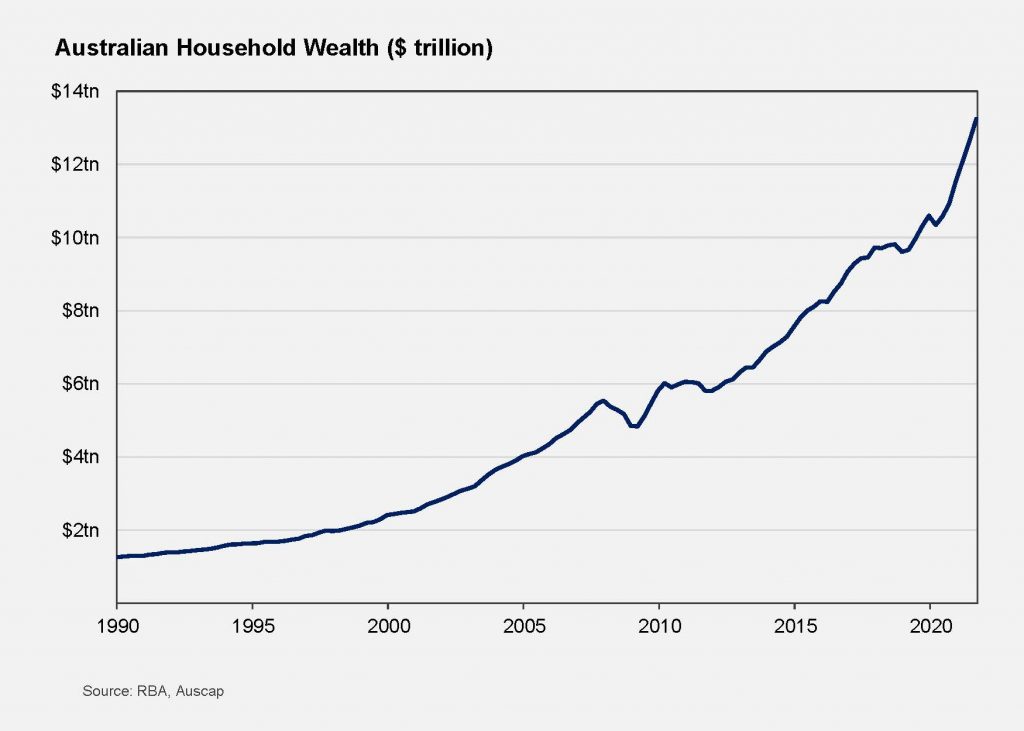

Update- Australian Household Wealth: AU$14,000,000,000,000 (that is AU$14 trillion)

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Australian households have amassed AU$14 trillion in wealth which is 25% higher than pre COVID-19 Pandemic levels (see chart above).

Most of the wealth is made up of residential property with the primary residence being the foundation over the past 3 decades and likely to continue while the taxation benefits make it so advantageous.

Further research has segmented Australians into four distinct wealth groups-

- Emerging Affluent

- Established Affluent

- Emerging Mass Market

- Established Mass Market

This type of profiling is always interesting however the challenge with using averages is that you almost always find yourself meeting the criteria for more than profile.

Click for charts.

Just remember, if you have family, friends and or colleagues that need financial advice please ask then to contact us and we will know how to best help them.

14 Apr 2022

Collectables: Masterworks

- Posted by Dejan Pekic BCom DipFP CFP GAICD

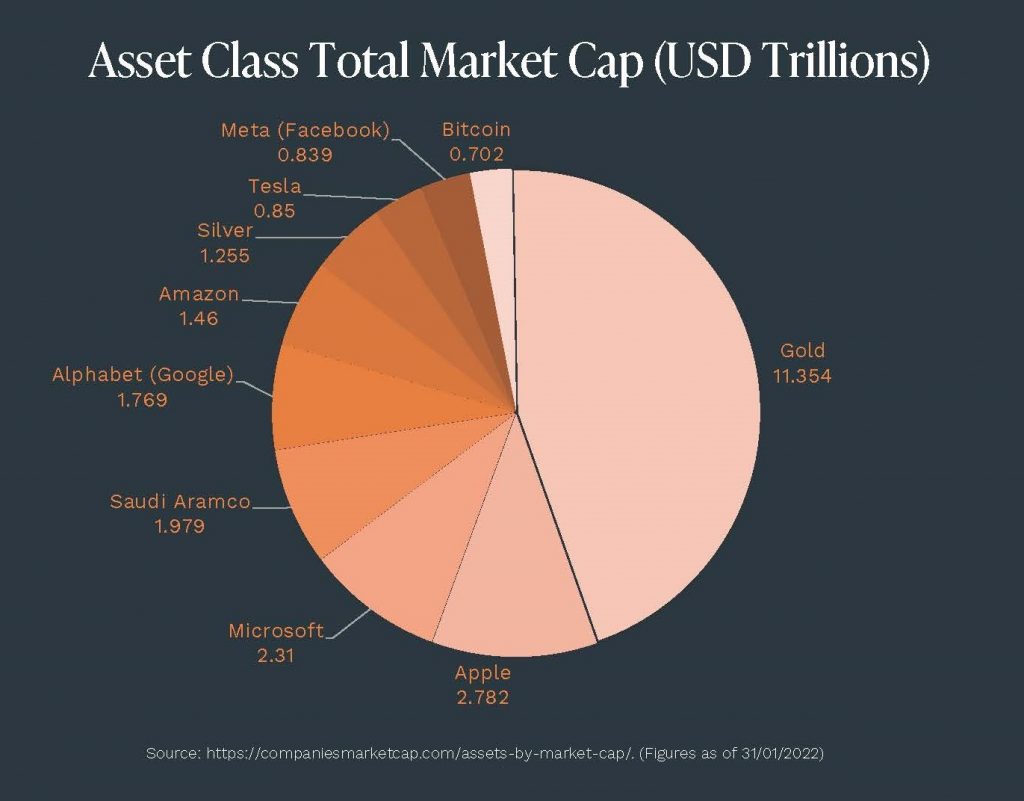

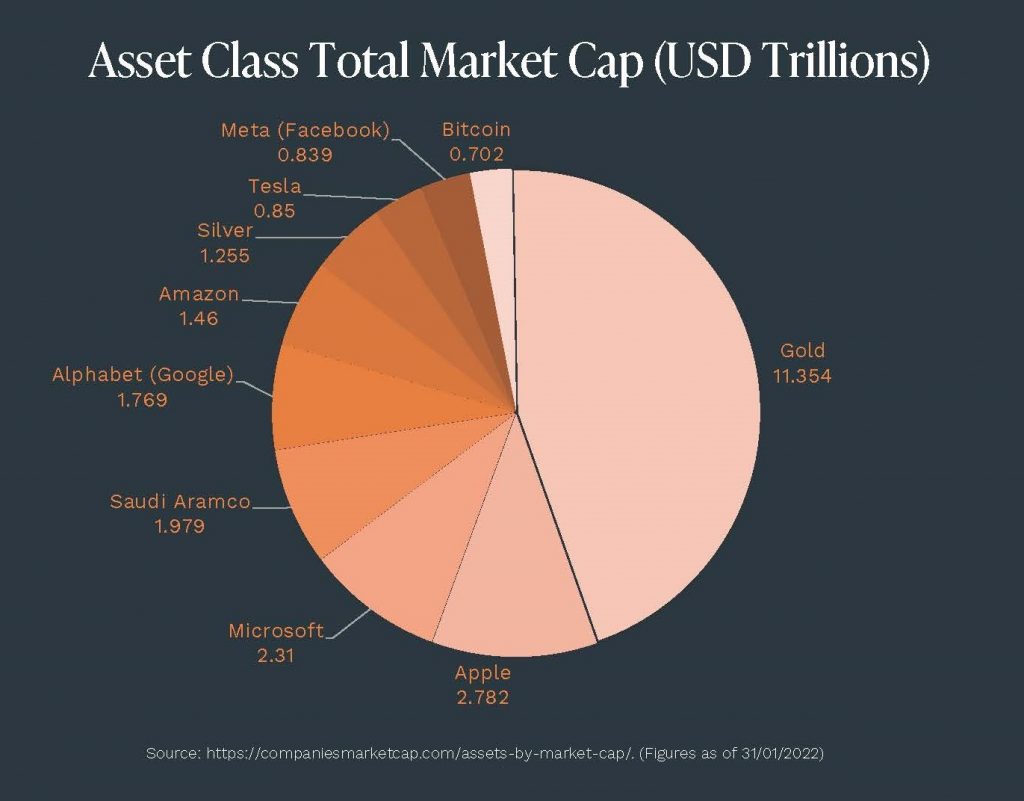

Bitcoin has become the 10 most valuable asset globally.

The cryptocurrency market is valued at US$1.9 trillion and Bitcoins makes up about 41% of the cryptocurrency market.

If you are a student of Benjamin Graham and his Value Investing principles then you will quickly come to understand that Bitcoin is in fact a collectable and thanks to technology, this collectable has been able to be divided into tiny units which can be bought and sold for a price.

The concept of Bitcoin has now also helped traditional collectables such as paintings to be unitised into a market just like cryptocurrency trading.

Click for art.

The thing to remember about buying collectables is that they rely on scarcity and as long as there is a group who want to trade in this limited item there will be a price.

Once there is no longer a group that wants to trade in this collectable the price will evaporate.

12 Apr 2022

Disruptive Technology: Innovation Platforms

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The current asset price correct has changed nothing.

‘Software is consuming the World’ and this decade is when everything is going to change.

If this statement is correct then the current investment in artificial intelligence, battery technology, blockchain, robotics, gene sequencing in 2020 will increase 15 fold during this decade which presents a unique investment opportunity.

The compound annual growth rates would be beyond anything previously experienced during the past three decades and will only be possible if the technological breakthroughs continue to arrive which is more likely than not given the amount of money being invested.

Click for charts.

Importantly, during this decade asset prices will continue to boom/bust which is why we recommend against speculating, instead investors should remain invested according to their appetite for volatility and when fear and panic take hold, only then react by buying more quality assets at discounted prices.

7 Apr 2022

Demographics: From pyramid to beehive

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The number of people on this planet is increasing and the population demographic is changing which presents investment opportunity.

By 2030 the world population will be 8.5 billion of which over 5 billion will be middle class who account for 33% of global economic spending.

The Asia Pacific region will be the biggest contributor to populaiton and economic growth given that it is currently comprises half the global population.

More people means more demand for resources which means Government and business will need to find more food, more water and more energy.

Bottom line, increasing population and changing demographics results in economic growth which is good news for business and investors.

Click for charts.

1 Apr 2022

Environmental, Social and Governance (ESG)

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Environmental, social and governance (ESG) is an approach to evaluating the extent to which a company works on behalf of social goals that go beyond the role of a company to maximize profits for shareholders.

Environmental considers how a company performs as a steward of nature. Social examines how it manages relationships with employees, suppliers, customers and the communities where it operates. Governance deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights.

Does adopting ESG criteria benefit?

Consider using the same ESG criteria to evaluate countries and a clear pattern emerges.

- Countries with better Environmental protections are linked to better economic outcomes

- Countries with better Social (educated workforce) are linked to better economic outcomes

- Countries with stronger Governance are linked to better economic outcomes

If it holds true at a country level then the expectation is that ESG will also produce better economic outcomes at a company level.

Click for charts.