9 Dec 2021

Market Cycles: 2022 Outlook

- Posted by Dejan Pekic BCom DipFP CFP GAICD

‘History doesn’t repeat itself, but it does rhyme’ is a famous quote by Mark Twain.

It has been a bizarre year and a half since the COVID-19 pandemic crushed asset prices in March 2020.

Is it over?

Not quite but we are in the recovery cycle following on from a bust and it appears to be moving in a similar pattern to past recovery cycles.

The research points to a slowdown in growth asset returns in 2022 which is likely given our expectation that inflation will only edge upwards. However if inflation and interest rates do take off materially then 2022 will be an economic disaster for both growth assets and defensive assets.

Click for charts.

The future is always full of unknowns so remember what Benjamin Graham taught and that is to not speculate. Instead remain invested according to your appetite for volatility and when fear and panic take hold, only then react by buying more quality assets at discounted prices.

1 Dec 2021

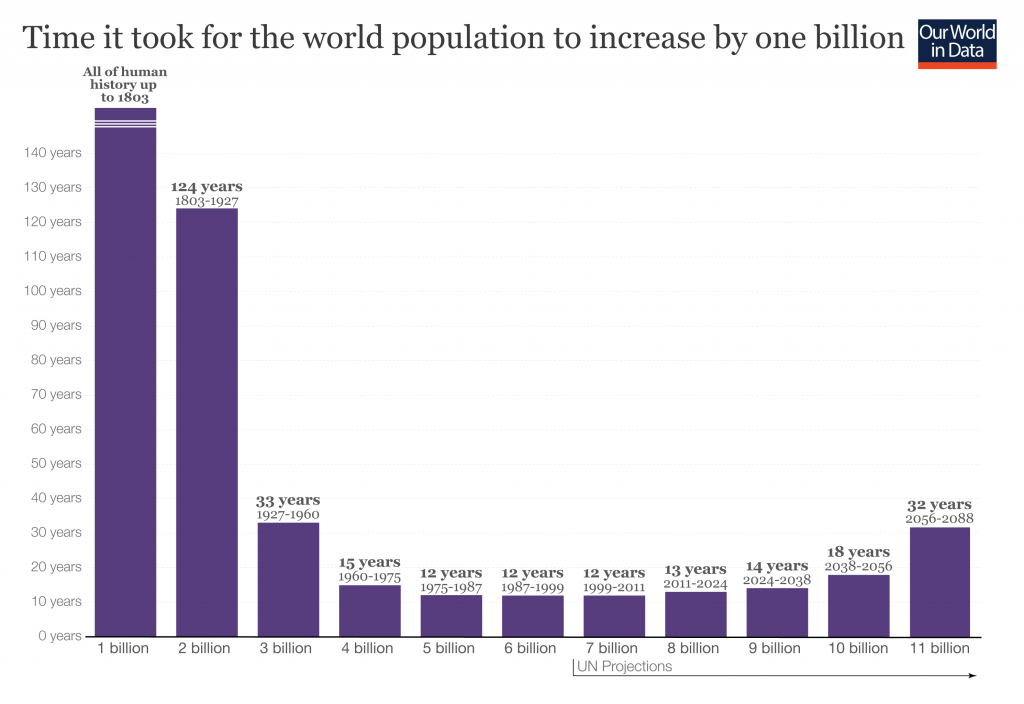

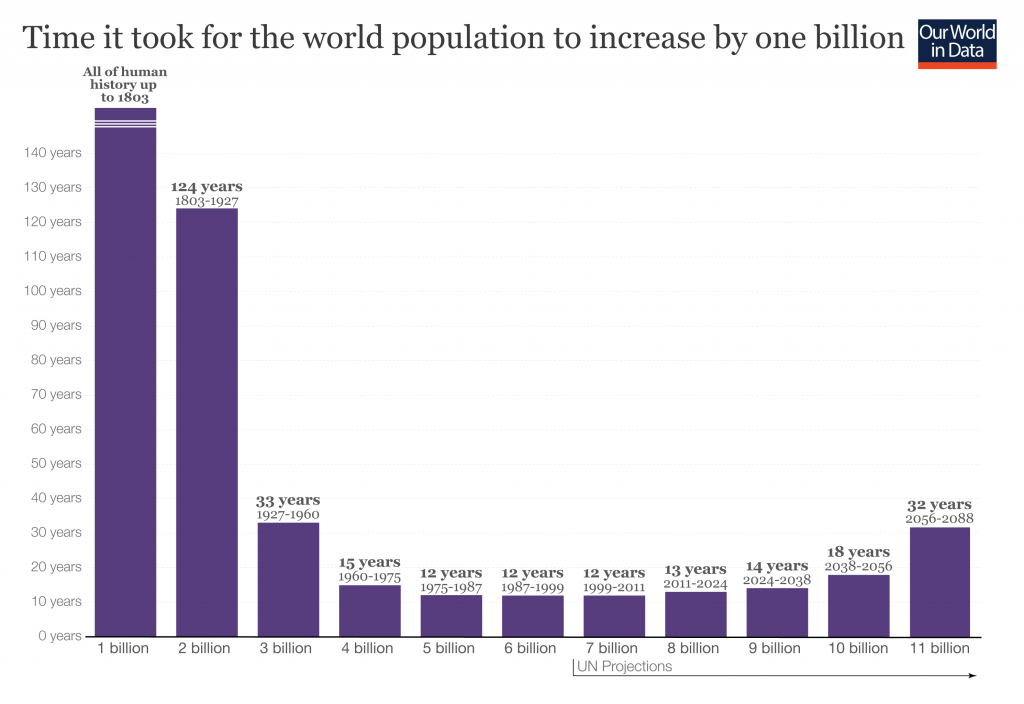

Global Population: Boom

- Posted by Dejan Pekic BCom DipFP CFP GAICD

As the global population fast approaches 8 billion humans it is interesting to note that the World has been adding 1 billion people every 12 to 14 years since the 1960’s.

This however is slowing and slowing dramatically as the fertility rate collapses because woman do not want to give birth to 8 to 12 children.

Click for chart.

Even with a collapsing fertility rate the global population is still estimated to reach 10 billion humans by 2050 which then brings into question resources.

How does the World provide food and shelter for an additional 2 billion mouths?

Some tech billionaires believe that the answer is to go off planet but the real solution should start with cleaning up the existing polluting practices of humans on this planet.

Bottom line, more humans equates to more economic activity which means more opporunity for business to sell goods and services and that is good news for investors.