30 Sep 2019

Inside Bill’s Brain: Safe Nuclear

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Just watched a three part series on Bill Gates, a billionaire philanthropist and one of the founders of Microsoft.

In part 3 he presents a clean energy solution using the current stockpiles of nuclear waste.

This is brilliant and a huge win win solution because we do have a nuclear waste problem.

A safe nuclear solution using up the stockpiles of nuclear waste would dramatically reduce fossil fuel consumption and has the potential to reduce the negative impact of climate change being caused by humanity.

If we do not change how we produce our electricity, the story of Easter Island will replay on a planet wide scale.

The challenge, getting politicians to start down this road of safe nuclear and decommissioning all the old generation nuclear power plants that are lethal.

Click to watch.

26 Sep 2019

Environmental Pollution: War on plastic

- Posted by Dejan Pekic BCom DipFP CFP GAICD

More good news.

The Ellen MacArthur Foundation estimates that by 2025 there will be one tonne of plastic for every three tonnes of fish which makes plastic the biggest threat to the World’s oceans.

Andrew Forest, an Australian Billionaire is spearheading a business case to put a price on plastic and will commit US$300m to end the US$2.2 trillion of plastic waste pollution in our oceans.

The project is called ‘Sea the Future’.

This is exciting and very much what is needed to ensure a future.

Click to read.

20 Sep 2019

Friday Tidbit: Australian Federal Budget

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Now for some good news.

The Federal Budget is only $690 million away from delivering a budget surplus which is when the government spends less on an annual basis than the income it collects.

It has taken 12 years to get to this point and the next question is what does the government do with the cash assuming the Federal Budget does finally go back into surplus?

Should the surplus be used to reduce tax, increase infrastructure investment, increase welfare payments and or begin repaying the $648 billion (US$445 billion) in foreign debt that Australia owes?

We will leave this with you to make your own judgement.

Click for chart.

17 Sep 2019

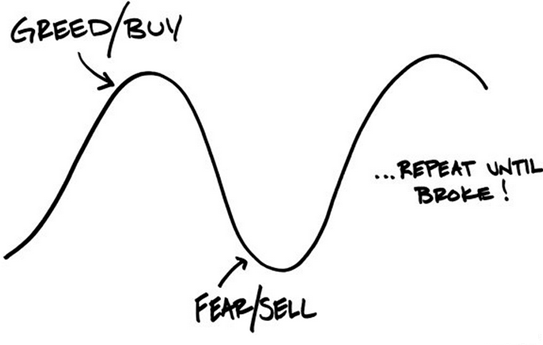

Behavioral Finance: Time in the market

- Posted by Dejan Pekic BCom DipFP CFP GAICD

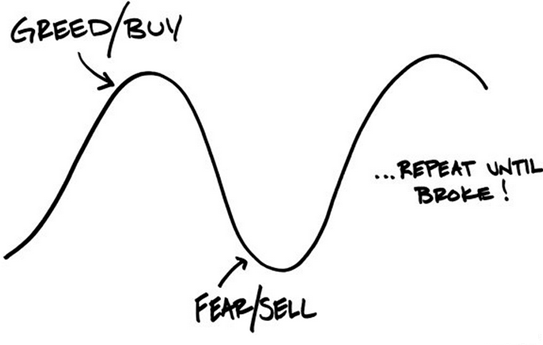

Investors are consistently bad at dealing with uncertainty, underestimating some risks and overestimating others.

This often results in attempts to time the market such as selling in the expectation of an imminent financial market crash.

Attached is research on the impact on total return if an investor investing in indices missed the 5 best performing days and the 30 best performing days versus just staying invested for the past 27 year period to 30 June 2019.

It is not surprising to see that the investor was better off staying fully invested versus missing out on being invested during both the 5 best days and the 30 best days.

Emotions are not our friend when investing.

In fact the times when an investor is feeling panic, capitulation, despondency, fear and or skepticism towards their investments is almost always the point of maximum financial opportunity.

Click for chart.

11 Sep 2019

Disruptive Technology: Tech Trends

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The 2019 Tech Trend Report has been published which identifies 315 emerging trends across 26 industries that are expected to enter the mainstream and disrupt business.

Key takeaways include-

- Privacy is dead

- VSO (voice search optimization) is the new SEO

- The Big Nine- US G-MAFIA (Google, Microsoft, Amazon, Facebook, IBM, Apple) and China BAT (Baidu, Alibaba, Tencent)

- PDRs (Personal Data Records) are coming

- China continues to ascend and not just in artificial intelligence

- Lawmakers around the world are not prepared to deal with new challenges that arise from emerging science and technology

- Consolidation continues as a key theme for 2019

We are all truly ‘GEN-T’, the first human Transition Generation where machines capable of learning, deciding and creating will co-exist with humans.

Click to download report.

5 Sep 2019

$5.8 billion Current Account Surplus

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The Current Account is essentially a measure of a country’s trade, the value of the goods and services it exports (income) versus the value of goods and services it imports (expenses).

A Current Account Surplus is good because income (exports) are higher than expenses (imports) while a Current Account Deficit is bad because expenses (imports) are higher than income (exports).

The exciting news is that Australia’s Current Account has for the first time since June 1975 changed from a deficit to posting a $5.8 billion surplus in the June 2019 quarter thanks to the huge exports of iron ore and coal followed by international education.

It took 44 years and 13 Federal Treasures to bring the Current Account Deficit back into a Current Account Surplus and let’s see how long it persists.

By comparison the United States Current Account has only been in deficit since the early 1990’s and is currently running at over US$500 billion (that is half a trillion dollars) which is bad because it is not possible to run expenses (imports) higher than income (exports) indefinitely.

Eventually, spending more than you earn must come to an end but it could still take decades or even a 100 years for this situation to be resolve provided that the United States can keep paying the interest on the trillions of dollars in debt that it is accumulating (current US Government debt US$21.4 trillion).

Click for chart.

Importantly, the key to remember is that when fear and panic take hold, that is when an investor is presented with the best opportunity to buy more quality assets at reasonable or better still discounted prices.

3 Sep 2019

Main Residence (your home)

- Posted by Dejan Pekic BCom DipFP CFP GAICD

We have attached a gentle reminder that that under the current taxation system, renting your main residence will result in a part loss of the capital gains tax free exception on your home for the period rented.

If you want to rent your main residence then you need detailed tax advice and we recommend you talk to your tax professional (Accountant) before using services such as Airbnb which shares its data with the Australian Taxation Office.

The cautionary message is that earning a rental income today (especially if only a small amount) could cost you much more in capital gains tax when you sell your main residence.

For investment properties and holidays homes it does not matter because they are always 100% liable for capital gains tax because they are not your main residence.

Key point is to talk to your tax professional (Accountant) first.

Click to read.