28 Sep 2022

Market Metrics: Dow Jones Industrial Average (DJIA)

- Posted by Dejan Pekic BCom DipFP CFP GAICD

It is official.

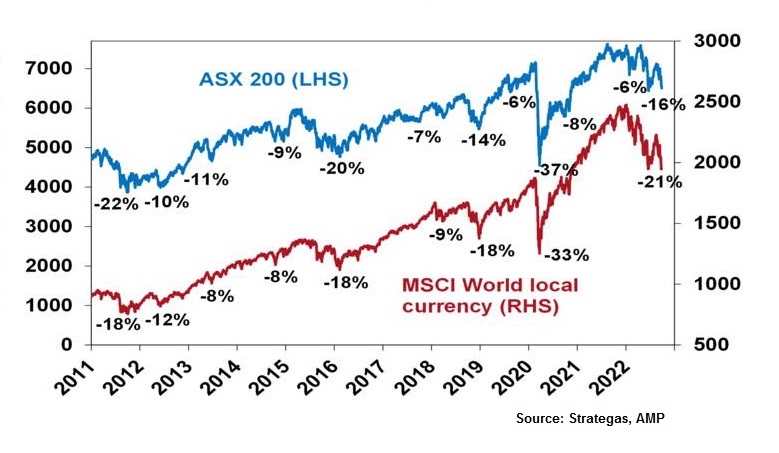

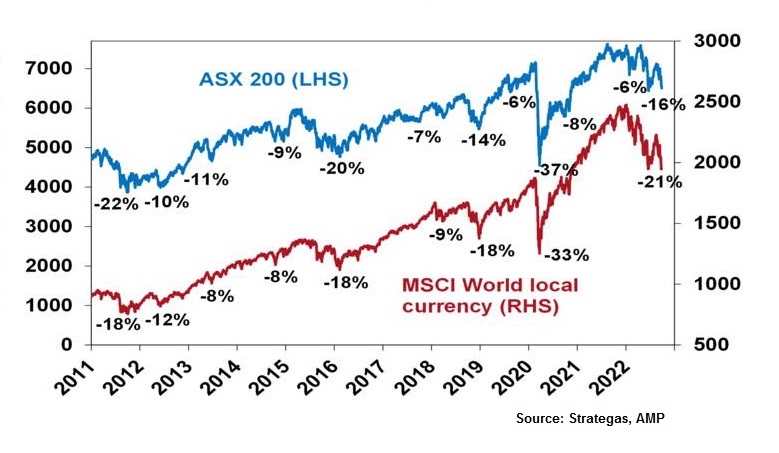

Financial asset prices have crashed and we are now in a bear market.

The DJIA fell to a new overnight close of 29,135 points which is a 20.8% fall from recent peak.

Surprisingly, our ASX200 is still at correction levels with asset prices having just fallen 14.8% from recent peak given yesterdays 6,496 point close.

The last bear market took place in March 2020 which was only 2.5 years ago when asset prices fell an average of 37%.

Could current prices fall as they did in 2020, absolutely but historically quality assets rebound quickly when prices have fallen by 20% and over.

If you want to take advantage of this asset price crash (or have family, friends, colleagues that want to take advantage) please contact us.

23 Sep 2022

Friday Tidbit

- Posted by Dejan Pekic BCom DipFP CFP GAICD

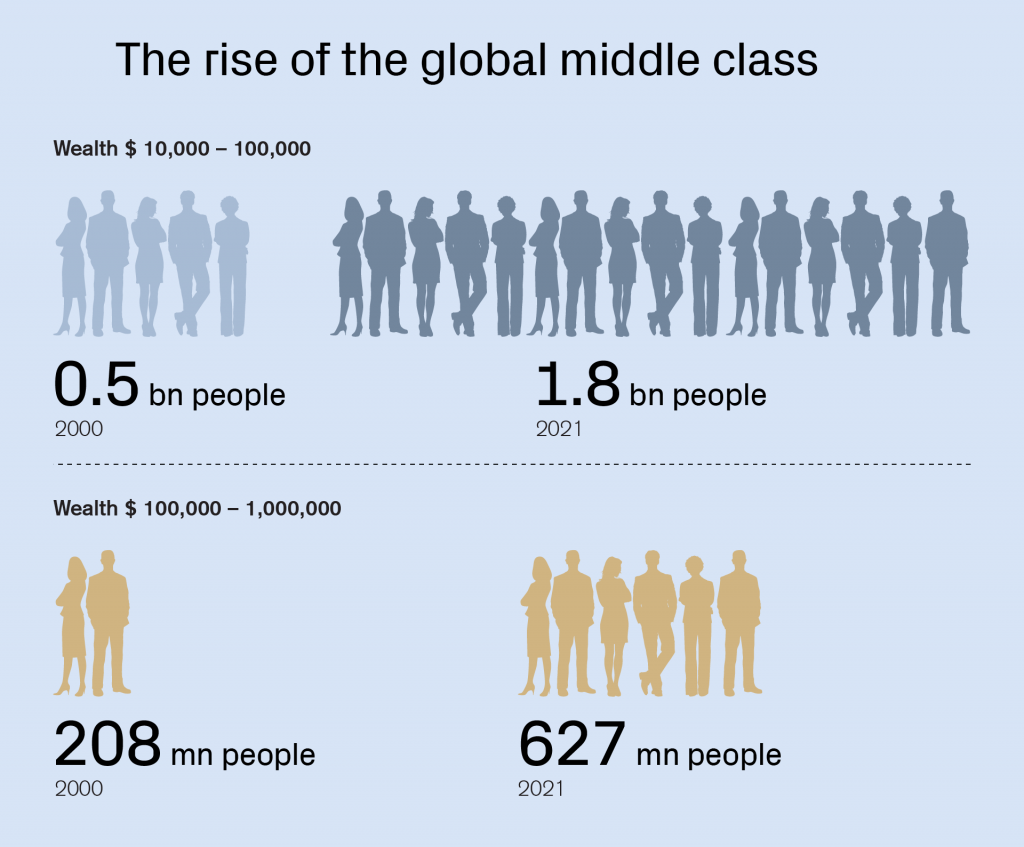

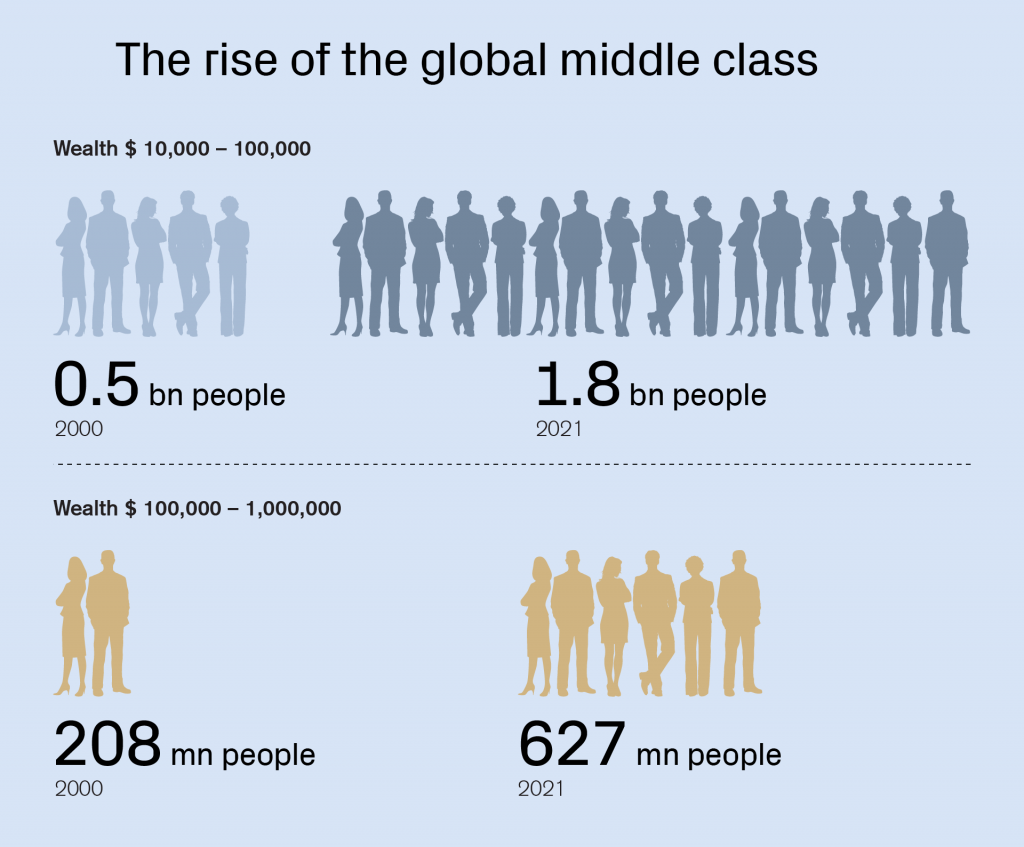

The middle class is growing and the Ultra-High Net Worth (UHNW) are growing.

You will now need over US$50m (AU$75m) in assets to meet the definition of UHNW.

The number of UHNW individuals globally is currently 264,200 and expected to rise to 385,000 by 2026 which statistically is an insignificant number given that our planet hosts 5.3 billion adults.

Click to read.

19 Sep 2022

Disinflation: Growth Scarcity

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Yes inflation is at 40 year highs due to the COVID-19 pandemic restricting supply of goods coupled with the Russian invasion of Ukraine.

This is a fact in the short term but what is the medium to long term outlook.

Population growth is collapsing, the World has over US$300 trillion in debt and technology innovation continues to fall in cost.

These are structural medium to long term deflationary forces.

Click for charts.

This means that the current asset price correction which could easily devolve into an asset price crash presents investors with an opportunity to buy more quality asset at a discounted prices.

WARNING, this does not constitute Personal Advice. To discuss if this is an appropriate strategy for your given circumstances please do not hesitate to contact us directly.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

14 Sep 2022

Recession Indicator: United States (Part 2)

- Posted by Dejan Pekic BCom DipFP CFP GAICD

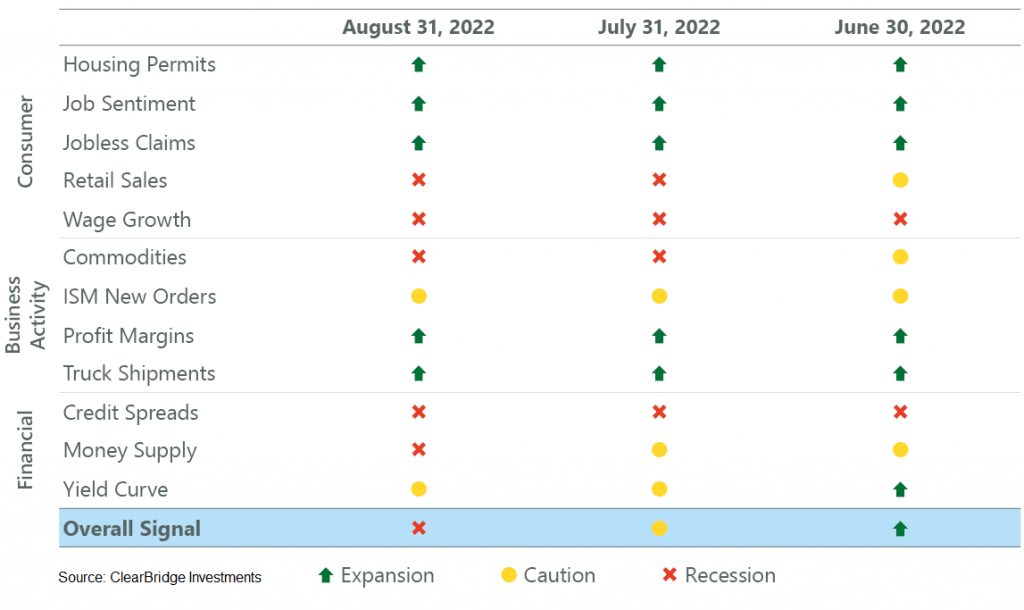

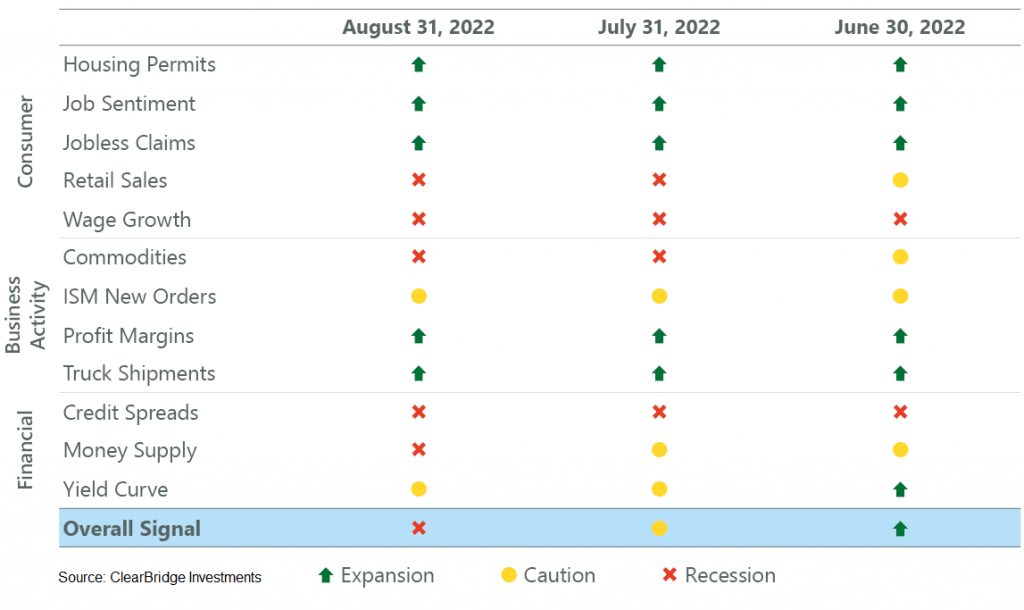

As a follow on to Monday, the reason for asking whether history is repeating or rhyming is because it is impossible to accurately predict the future.

It can be clearly seen from the attached chart that the United States does not go into a recession every time it begins increasing interest rates.

Click for chart.

Jerome Powell, the Chair of Federal Reserve of the United States is increasing interest rates to slow inflation which is being caused by strong job growth, low unemployment and increasing consumer spending.

Remember, if a recession does follow in the United States and or subsequently in Australia then it will become an even better time for investors to buy more quality asset at a discounted price.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

12 Sep 2022

Recession Indicator: United States (Part 1)

- Posted by Dejan Pekic BCom DipFP CFP GAICD

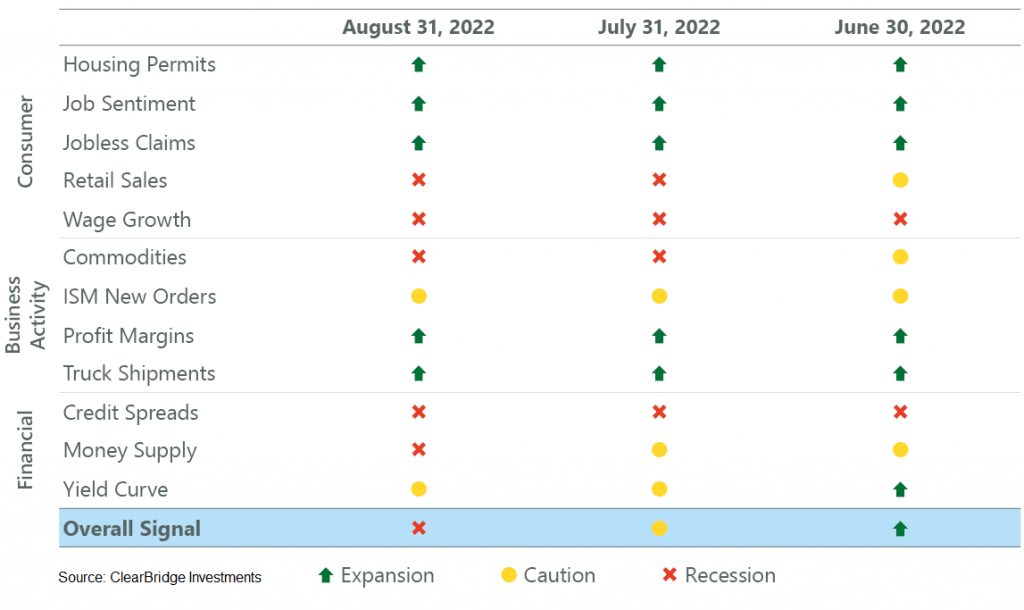

Economic history tells us that every time the United States begins increasing interest rates a recession follows afterwards more than 50% of the time.

The United States is now in its 14th interest rate increase cycle during the past 70 years and the question being asked is whether a recession will follow in the United States.

GDP (gross domestic product) in the United States has now declined for two consecutive quarters which is usually cited as the definition for a recession.

Click for chart.

However, Jerome Powell, the Chair of Federal Reserve of the United States is saying that a recession is not coming because of the consistently strong job growth, historically low unemployment and solid growth in consumer spending which is why the increase in interest rates is required, to slow down the rate of inflation.

The key to remember is that if a recession does follow in the United States and or subsequently in Australia then it will become an even better time for investors to buy more quality asset at a discounted price.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

8 Sep 2022

Australian Interest Rates: Agricultural Boom

- Posted by Dejan Pekic BCom DipFP CFP GAICD

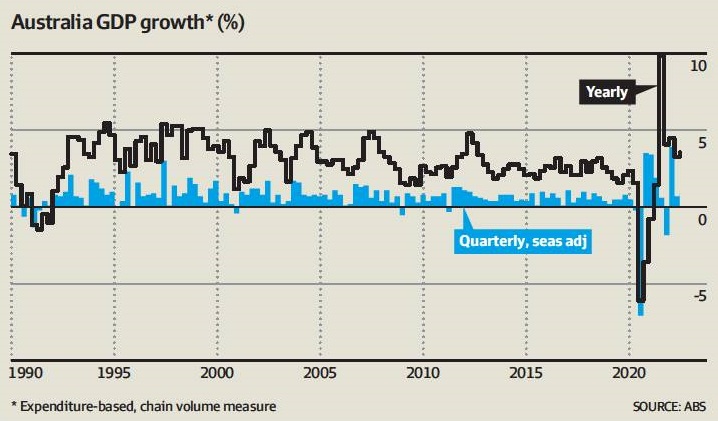

The RBA (Reserve Bank of Australia) increased interest rates.

Why do interest rates keep rising, because the Australian economy is doing well.

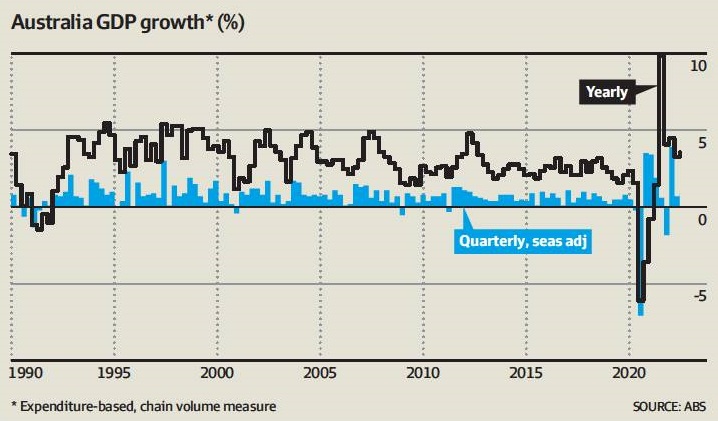

The unemployment rate has collapsed to 3.4% and the ABS (Australian Bureau of Statistics) has lifted annual real GDP (Gross Domestic Product) growth from 3.3% to 3.6%.

It is not just hard commodities such as iron ore, coal and gas that are in high demand globally but also Australian soft commodities.

In fact it is an agricultural boom.

Click for chart.

This means that the RBA will continue to increase the Cash Rate and that means that residential mortgage interest rates will continue to rise but there will be a limit because the Federal Government cannot afford to financially bankrupt the 30% of Australian households who hold residential mortgages.

Now is the time to remain invested according to your appetite for volatility and continue to buy more quality assets at discounted prices.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

2 Sep 2022

Friday Tidbit

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The Future Fund was established in 2006 to limit the taxation burden on Australians in meeting the escalating future superannuation liabilities of the Commonwealth Public Service.

The Future Fund has just released its results for last financial year and as expected it delivered a -1.2% return for the 12 months to 30 June 2022 which is better than expected given its 60% allocation to growth assets and 40% defensive assets.

This asset allocation of the Future Fund tracks that of a Balanced- Level 3 investor risk profile.

Click to read.

What you may not know about the Future Fund is that its investment methodology follows Benjamin Graham thinking in that he believed that the vast majority of people are not capable of making investment decisions.

This is why the Future Fund hires some of the very best talent (Portfolio Managers) that money can buy to manage its assets.

That’s smart.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.