31 Oct 2023

The Wisdom of Great Investors: What you need to know

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The insight from these Great Investors is remarkable yet deceptively simple.

What you need to know to invest-

- Avoid self destructive behavior– Benjamin Graham

- Don’t attempt to time the market– Peter Lynch

- Be patient– Jesse Livermore

- Don’t let emotions guide your investment decisions– Warren Buffett

- Recognise that short-term underperformance is inevitable– John Maynard Keynes

- Disregard short-term forecasts and predictions– John Kenneth Galbraith

Click to read.

The underlying message is that investing is boring.

It is about compounding over time and not about sexy.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

9 Oct 2023

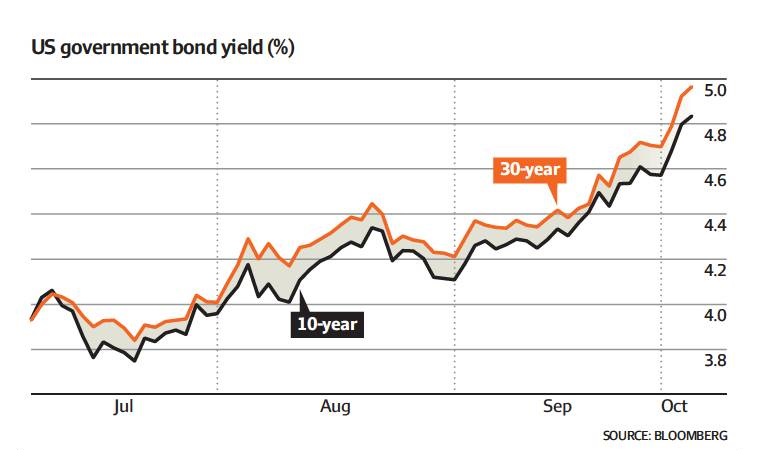

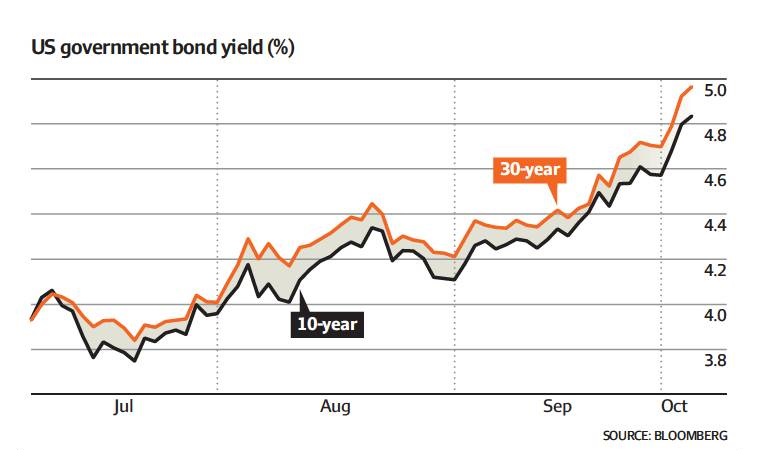

Market Metrics: Bond Yields

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The US 10 year bond yield has jumped higher over the past few months to reach a new high of 4.81% as at 3rd October 2023.

Rising bond yields are almost always bad news for growth assets prices (property and shares) and also bad news for defensive assets prices (bonds).

This is the key reason for the Dow Jones Industrial Index falling 7% to 8% since the end of July 2023 (see above chart).

Click for multi-decade chart.

The only positive outcome from rising bond yields is for interest earned on cash deposits.

When asked if bond yields will go higher, it is difficult to see because the elephant in the room remains global debt which currently stands at over US$300 trillion and will act as a break on rising bond yields.

However, if what currently tracking as an economic slowdown changes into a recession with mass unemployment then fear and panic will take hold and as Benjamin Graham taught, that is the best time to buy more quality assets.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.