27 Jul 2017

Road Transport: Car Elevator

- Posted by Dejan Pekic BCom DipFP CFP GAICD

What a novel idea!

Click to watch.

25 Jul 2017

Credit Reporting Bureaus: Tax Debt

- Posted by Dejan Pekic BCom DipFP CFP GAICD

This is new.

The Federal Government has proposed legislation to allow the ATO to disclose tax debt information of small businesses with annual turnover of $2 million or less to credit reporting bureaus if they are not paying their outstanding tax.

Currently, there is $19 billion in overdue tax of which $12.7 billion or 66.8% is owed by small business.

Once the banks get this information, good luck with trying to get credit if the owners have not engaged with the ATO to manage their outstanding tax debt.

21 Jul 2017

Friday Tidbit: Savings versus investing

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The attached model was created by the Director of Research at Pension Parnters LLC and we have adapted it for Australian income.

The model ignores inflation, ignores tax on returns and assumes a 30 year average lifetime income of $49,300 after tax which is equivalent to gross income of $63,000 per annum in Australia.

The question it asks is what is more important- the rate of return or the rate of savings?

The outcome of saving 1% per annum of your after tax income and earning 10% per annum on your saving is $81,096 after 30 years.

However if you save 5.5% per annum of your after tax income and earn just 1% per annum on your savings the outcome is $94,319 after 30 years.

The answer to the question is that both are important but the rate of savings is more important that the rate of return.

It all gets really exciting if you can both save 5.5% per annum of your after tax income and earn 10% per annum on your savings which would deliver $446,026 after 30 years.

We want to share this simple message and reminder because it is a fundamental fact that all the wealth that you accumulate had to begin by first saving with the only exceptions being inheritances, gifts and or winnings.

Sometimes you can get lucky but saving is always reliable.

18 Jul 2017

Market Metrics: Tech

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Analysts are reporting that the technology sector has the highest forecast earnings growth in 2017 outside energy and materials.

The price index has just about reached the peak level last seen in the 2000 tech wreck but this time corporate profits are improved.

Still, tech sector valuations are stratospheric (think Amazon P/E 847, Salesforce.com P/E 465, Netflix P/E 282) with the most likely explanation being that the adoption of new technologies is changing the business model for every industry from retail to energy production.

Tech companies are effectively being priced for a larger slice of the same pie.

When will prices come back to some form of normality? Who knows!

14 Jul 2017

Friday Tidbit: Net medical expense tax offset

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Its tax time again and remember to keep a log of your medical expenses because it could help you qualify for a tax deduction.

Click for net medical expense tax offset thresholds.

12 Jul 2017

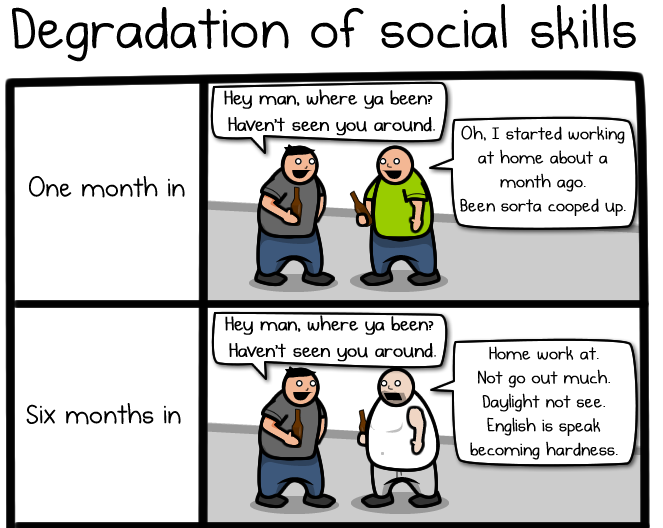

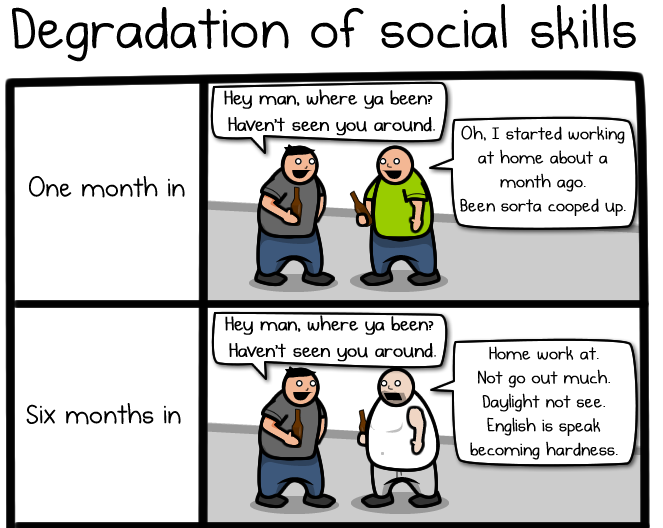

Employee Engagement: Working from home

- Posted by Dejan Pekic BCom DipFP CFP GAICD

This is a hard one because you really have to balance what is good for staff development and what is good for business growth.

In sport it is always about the team and the only way to achieve performance excellence is with the full participation of all individuals.

Click to read.

5 Jul 2017

Newealth FSG & CG (July 2017)

- Posted by Dejan Pekic BCom DipFP CFP GAICD

We have updated our Financial Services Guide and Credit Guide with the only change being the introduction of a licensee fee from the 1st July 2017 to cover part of the increasing compliance costs for ongoing administration, record keeping and file management.

For more details, click ‘Newealth FSG & CG’ or alternatively go to the FINANCIAL SERVICES GUIDE & CREDIT GUIDE link at bottom of the page.