25 Jun 2020

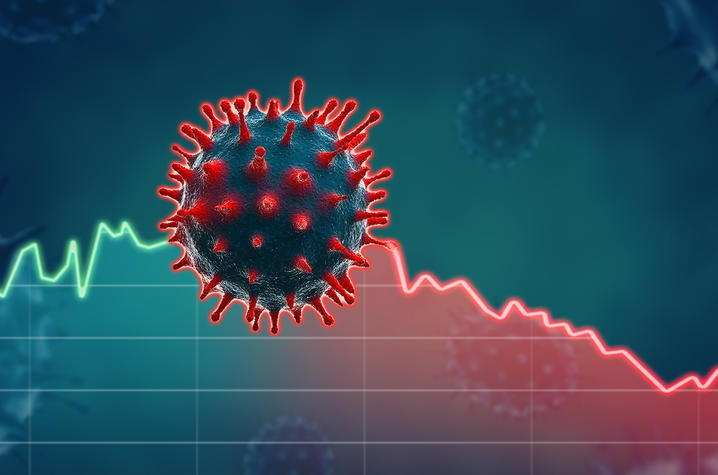

IMF: Economic Impact COVID-19

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Now for some good news.

The International Monetary Fund (IMF) economic growth rate forecast for Australia has improved from -6.7% in April 2020 to -4.5% in June 2020.

Better still, Australia is expected to improve to positive 4.0% for 2021.

Click for chart.

The IMF is estimating that 300 million full-time jobs have been lost globally in the June 2020 quarter alone.

Remember, this is still not over, be patient, keep investing in line with your appetite for risk/volatility and look to react as new opportunities present.

22 Jun 2020

Electric Vehicles: Tesla

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Morning and after today there will only be 6 more business days remaining in the 2020 financial year.

By Wednesday next week, 30 June 2020 will be consigned to the annals of history and never come again. Irrespective of whether it was a good or bad year, it will be over as we begin financial year 2021.

Separately and without much fanfare, Tesla last week became the World’s most valuable automaker by market capitalisation which is calculated by multiplying the total number of shares on issue by the current share price.

The future is most definitely electric.

Click for graphic.

19 Jun 2020

Bull vs Bear: Market Cycles

- Posted by Dejan Pekic BCom DipFP CFP GAICD

We trust that you are not overly anxious about the current bear market that we are all experiencing.

History confirms that although bear markets occur at irregular intervals, they do in fact occur routinely and are shorter in duration than bull markets.

They also ALWAYS present an huge opportunity to buy more quality assets at discounted prices. For example, parts of the retail sales industry have almost collapsed with revenue drops exceeding 50%.

WARNING, this does not constitute Personal Advice and to discuss if this is appropriate for your given circumstances please do not hesitate to contact us directly.

The good news is that bear markets are always followed by significant bull markets and positive returns.

Click for charts.

17 Jun 2020

Company Directors: DIN

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Must say that it is about time.

New anti-phoenixing legislation has finally been passed by the Federal Government requiring all current and new Company Directors to get a Director Identify Number (DIN) for life.

To be a Company Director is to be in a high position of public trust.

Many Company Directors are responsible for hundreds of millions of dollar of assets and they should be able to be track throughout their professional career to see how successful or how destructive they have been at managing assets on behalf of shareholders.

This is one positive compliance measure that is long overdue given the number of criminal and incompetent Company Directors that have destroyed shareholder wealth over the past 30 years.

Click to read.

10 Jun 2020

Australian Institute of Company Directors (AICD): 7 Lessons

- Posted by Dejan Pekic BCom DipFP CFP GAICD

As of this morning there are 6.93 million confirmed COVID-19 cases Worldwide and 401,000 deaths.

Australia’s current number of deaths stands at 102 which is relatively a huge success expect for those people who have passed.

Here are 7 lessons learned from the COVID-19 pandemic lockdown with more to come.

- Federation gets its act together

- The public service won’t look the same

- Digitisation delivers

- New ways of working

- Climate change risk awareness

- Change patterns of trust

- Global concerns

Click to read.

4 Jun 2020

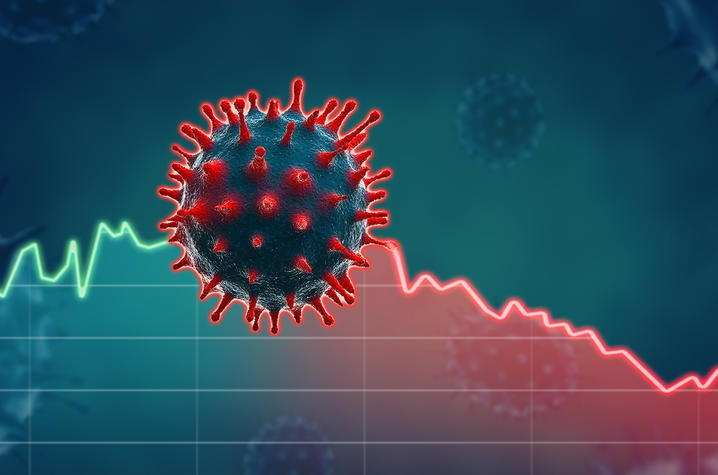

Australian Economy: Recession

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The GDP (Gross Domestic Product) number is out for the first quarter which is January to March 2020 and it is negative zero point three percent or -0.3%.

This is not unexpected and the likelihood of the second quarter which is the current April to June 2020 to also be a negative number is extremely high.

Two consecutive quarters of negative GDP will mean that the Australian economy will official be in a recession, the first in 29 years.

Click for chart.

While this recession is playing out, financial markets and asset prices have bounced since the 23rd March 2020 low with the Dow Jones Industrial Average (DJI) closing at 26,269 points overnight which represents a 26.0% increase and the Australian All Ordinaries Index (AORD) closing at 6,064 points which represents a 32.8% increase.

Congratulations to all those clients who have taken advantage of this market crash and if you are an Active client that has questions, please call me on 02 9267 2322.