29 Oct 2018

Aged Care: Family Home Assessment

- Posted by Dejan Pekic BCom DipFP CFP GAICD

This is a complex area and we are getting increasing numbers of questions about Aged Care and the impact on the principal family residence.

The fact is that once we enter Age Care we almost never come back home because we need help with the daily activities of living.

It is sobering when you consider that there are only two paths to death.

Either we are healthy and pass away through a sudden event such as an accident, heart attack or we become disabled and then pass away.

We have attached a technical paper on the topic to give you an idea of how complex this area becomes and why advice is needed.

Click to read.

25 Oct 2018

Interest Rates: Yield Curve

- Posted by Dejan Pekic BCom DipFP CFP GAICD

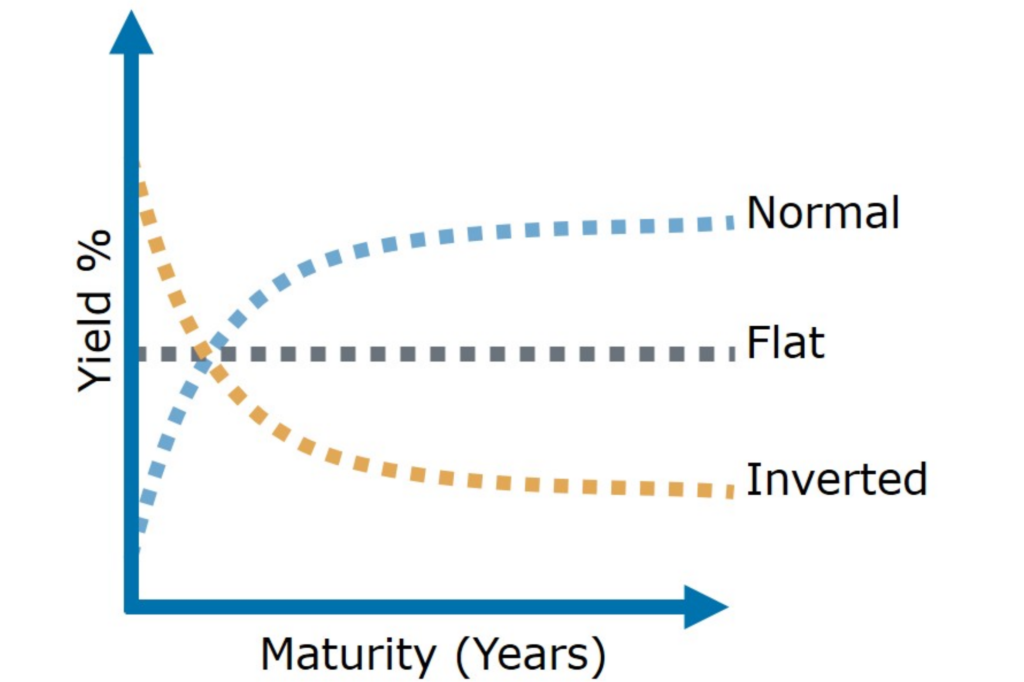

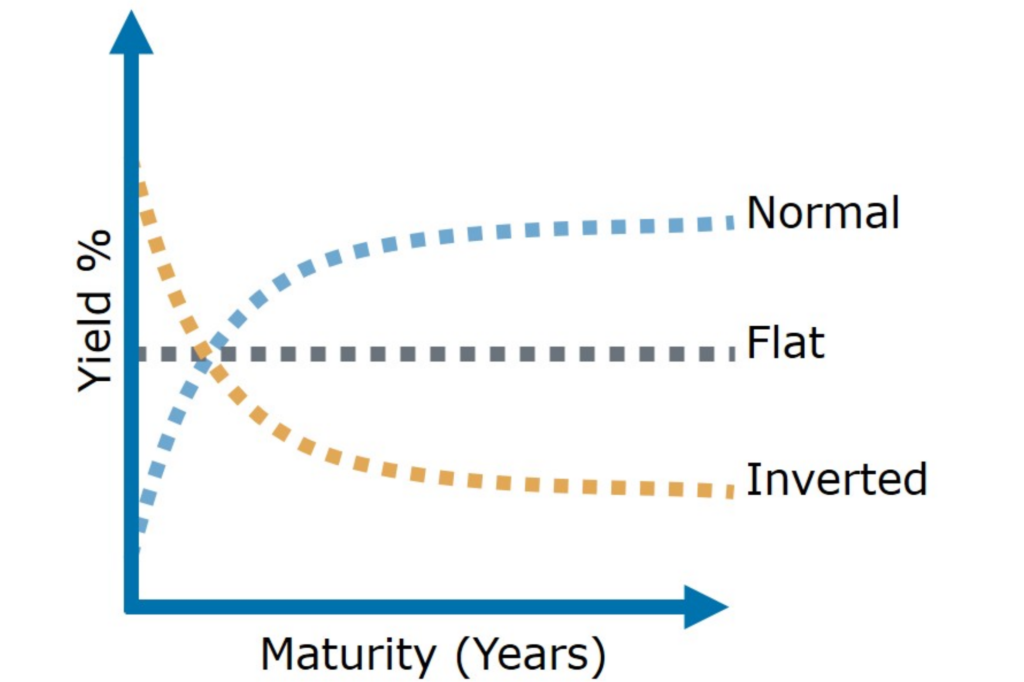

The normal is for long term interest rates to be higher than short term interest rates.

However short term interest rates are rising which is flattening the yield curve.

The concern is when the yield curve becomes inverted (short term interest rate are higher than long term interest rates) because in the past this has marked the beginning of an economic downturn.

Currently the US 3 month Treasury Bill Rate is 2.34% (was 1.09% 12 months ago) and the US 10 year US Treasury Bond Rate is 3.10% (was 2.39% 12 months ago).

The gap has narrowed from 1.3% to 0.76% which is why we are seeing the yield curve flatten.

Click for Yield Curve Basics.

19 Oct 2018

Market Metrics: S&P 500 Index

- Posted by Dejan Pekic BCom DipFP CFP GAICD

FAANG stocks (Facebook, Amazon, Apple, Netflix, Google) are part of the S&P 500 Information Technology Index which is one of 11 sectors that make up the S&P 500 Index.

To understand why the S&P 500 Index reached record levels this year you need to go no further than to look at the performance of the S&P 500 Information Technology Index which is up 600% since the 2008 Global Financial Crisis.

The current price to earnings ratio for the FAANG stocks are stretched but not at hallucinating levels apart from Amazon and Netflix.

Now it is very possible that these lofty valuations could persist for some time further before this second longest bull market in US history comes to an end.

Click to view.

16 Oct 2018

Australian Residential Property: Loan Capping

- Posted by Dejan Pekic BCom DipFP CFP GAICD

This is the other side of The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry.

Debt serviceability.

The amount of debt that you can borrow to purchase any property type has already been reduced by lenders as a result of The Royal Commission.

In addition to The Royal Commission the Federal Government made Comprehensive Credit Reporting compulsory from 1 July 2018 which requires lenders to share 50% of borrowers data increasing to 100% by 1 July 2019.

These measures have and will continue to put downward pressure on residential property prices.

It is like the perfect financial storm- property prices down, share prices down, bond prices down- it is literally coming from all directions.

Remember, when fear and panic take hold during the next financial catastrophe, investors will be presented with the opportunity to buy more quality assets at discounted prices.

Click to read.

10 Oct 2018

Future of the Global Economy: Economic Forces

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The future is accelerating and the challenge is to work out how to take advantage of the forces that are changing the global economy.

None are new and we have attached a link that graphically illustrates these major forces-

- Software replacing manufacturing with automation and artificial intelligence.

- Excessive amount of world debt which currently stands as US$247 trillion when government and private are combined.

- Accelerating wealth divide between ultra-wealthy and rest.

- Rise of Chinese prosperity.

- Technology and technological adoption approaching exponential rate of change.

- Rise of green industries to combat climate warming.

- Demographic change advancing developing countries.

- Tariffs and trade wars impacts.

Ready or not they are already here and already shaping the global economy.

Click to view.

3 Oct 2018

Warren Buffett, The Oracle of Omaha

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Warren Edward Buffett is 88 years of age, still working and one of the best Portfolio Managers that has ever been.

There are many messages that you would expect to hear from Buffett in reference to investing but love caught us by surprise.

To quote, ‘…when you get to my age, you’ll really measure your success in life by how many of the people you want to have love you actually do love you… That’s the ultimate test of how you have lived your life...’

An opportunity pause, reflect and share the love.

Click to read.