27 Mar 2021

The Wealth Report 2020: Insight 6 of 6

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Prime Property is defined as the top 5% of the most desirable and most expensive property in a given location.

According to The Wealth Report, London globally has the highest number of prime properties at 68,189 followed by Dubai at 42,356 and Sydney in third place with 27,436 residential prime properties.

The Prime Property threshold for London is £2m (AU$3.6m) plus while it is Dh3.6m (AU$1.29m) plus for Dubai and AU$3m plus for Sydney.

Interestingly however, London comes in third when you consider the number of square metres of Prime Property that you get for US$1m (AU$1.31m).

Sydney comes in 9th with US$1m (AU$1.31m) only buying you 45 square metres of Prime Property while Melbourne offers much better value at almost double the square metres for the same price.

Click for chart.

26 Mar 2021

The Wealth Report 2020: Insight 5 of 6

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The PIRI 100 (Prime International Residential Index) is used in The Wealth Report to track movements in luxury property prices across the World’s top residential markets.

It includes residential property in major financial centers, gateway cities, second home hotspots (both coastal and rural) and leading luxury ski resorts.

So which City topped the PIRI 100 with the biggest annual increase in 2020?

Auckland New Zealand beat all with a 17.5% increase while Sydney Australia was well down the PIRI 100 in 56th place at only 1.1% and was beaten by Perth, Gold Coast and Brisbane.

This is a surprise given the booming auction prices being reported for Sydney residential property.

Click for chart.

25 Mar 2021

The Wealth Report 2020: Insight 4 of 6

- Posted by Dejan Pekic BCom DipFP CFP GAICD

According to The Wealth Report, Russia & CIS (Commonwealth of Independent States) which unites Azerbaijan, Armenia, Belarus, Georgia, Kazakhstan, Kyrgyzstan, Moldova, Tajikistan, Turkmenistan, Uzbekistan and Ukraine is forecast to see the biggest rise of the mass affluent at 144% by 2025.

The mass affluent are defined as households earning an income of US$100,000 (AU$131,000) per annum or more.

This is closely followed by Africa at 139% and no doubt these numbers are coming of a relative low base.

Asia however is still forecast to see the biggest rise in the number of HNWI and UHNWI at 46% and 39% respectively by 2025.

Interestingly, Indonesia is expected to outpace India by 2025 in terms of the percentage increase in the number of UHNWI, defined as individuals who have over US$30m (AU$39m) in assets including their primary residence.

It is difficult to see a scenario for this not being the Asian Century.

Click for chart.

24 Mar 2021

The Wealth Report 2020: Insight 3 of 6

- Posted by Dejan Pekic BCom DipFP CFP GAICD

You may recall that according to The Wealth Report you meet the definition of an Ultra-High Net Worth Individual (UHNWI) once you have over US$30m (AU$39m) in assets including your primary residence.

Interestingly, 80% of UHNWI cite the ongoing disruption by the COVID-19 pandemic as their biggest worry when it comes to wealth creation while 87% of UHNWI see new investment opportunities in the post-pandemic world.

This is classic, is the glass half empty or half full and should come as no surprise because every crisis creates opportunities for those individuals that do not panic or freeze.

Click for charts.

23 Mar 2021

The Wealth Report 2020: Insight 2 of 6

- Posted by Dejan Pekic BCom DipFP CFP GAICD

According to The Wealth Report, you only need US$2.8m (AU$3.61m) in assets including your primary residence to meet the definition of being part of the top 1% of most wealthy individuals in Australia.

Surprisingly however, you only need US$4.4m (AU$5.67m) in assets including your primary residence to meet the definition of being part of the top 1% of most wealthy individuals in the United States.

Did think that number would be higher for both Australia and the United States.

Click for table.

22 Mar 2021

The Wealth Report 2020: Insight 1 of 6

- Posted by Dejan Pekic BCom DipFP CFP GAICD

According to The Wealth Report, you meet the definition of an Ultra-High Net Worth Individual (UHNWI) once you have over US$30m (AU$39m) in assets including your primary residence.

The definition for a High Net Worth Individual (HNWI) is assets over US$1m (AU$1.3m) including your primary residence.

Using the HNWI criteria there are an estimated 48.5 million that meet the definition globally (that’s all, just 48.5 million) with the United States having the most at 19 million while Australia comes in with just under 177,000.

Click for table.

By being part of this group you are in truly rarefied air when you consider that our planet hosts an estimated 7.8 billion people and the HNWI represent 0.62% by number.

18 Mar 2021

Superannuation: AWOTE Indexation

- Posted by Dejan Pekic BCom DipFP CFP GAICD

From 1 July 2021 the concessional and non-concessional superannuation contribution caps are set to increase due to Average Weekly Ordinary Time Earnings (AWOTE) indexation.

The concessional contribution cap was set at $25,000 from 1 July 2017 and will increase to $27,500 pa from 1 July 2021.

The non-concessional contribution cap is calculated as four times the concessional contribution cap and so will increase from $100,000 to $110,000 from 1 July 2021.

This also changes the maximum amount a member who was under 65 at the start of the year can contribute under the non-concessional contribution cap bring-forward rule from $300,000 to $330,000 from 1 July 2021.

The general transfer balance from superannuation accumulation to superannuation pension will also increase from $1.6m to $1.7m due to AWOTE indexation on the 1 July 2021.

Click to read.

This is excellent news because it allows each of us to contribute more money into a concessionally taxed environment called superannuation where the maximum tax rate on earnings is no more than 15% while the maximum personal marginal tax rate is 45% plus 2% Medicare plus 1.5% Medicare Surcharge.

16 Mar 2021

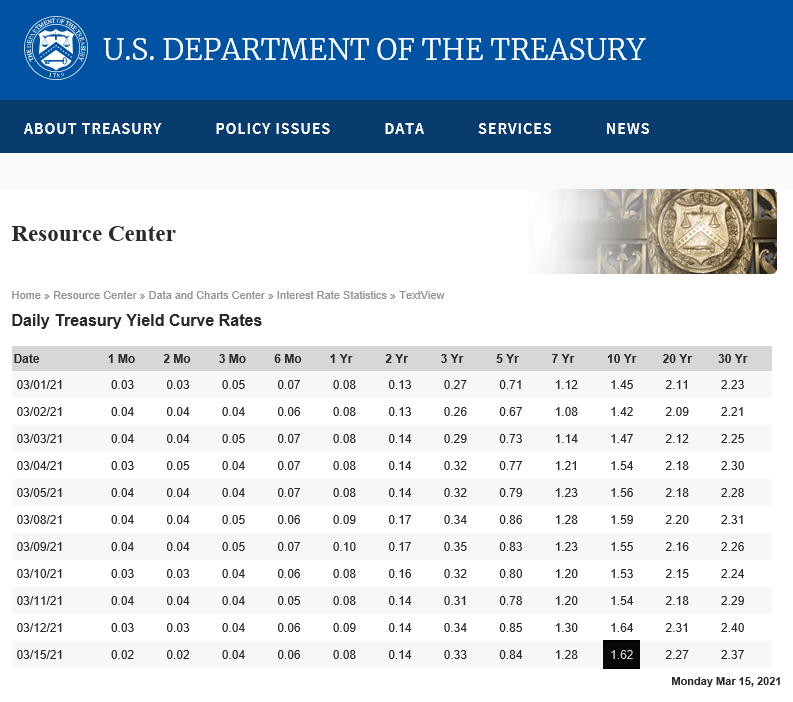

Market Metrics: Bond Yields

- Posted by Dejan Pekic BCom DipFP CFP GAICD

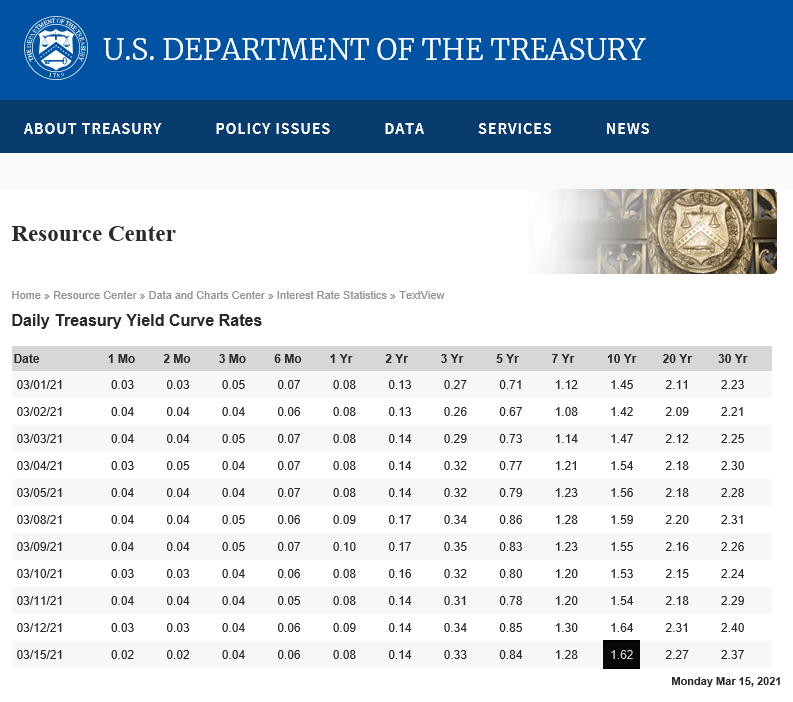

Why has the US 10 year bond yield risen from 0.52% on 4th August 2020 to 1.62% as at 15th March 2021 or 1.10%?

Answer, because the news for economic growth is positive.

The Purchasing Managers Index (PMI) has risen sharply back above 50 from the collapse in 2020 which indicates that World GDP is expected to rise through 2021 and consequently bond yields are rising.

Click for chart.

Rising bond yields are almost always bad news for growth assets prices (property and shares) and bad news for defensive assets prices (bonds).

The only positive news is for cash however it is difficult to see bond yields continuing their rapid rise because global debt is over US$277 trillion or 365% of World GDP as at the end of 2020.

The World is awash with debt, that is the elephant in the room and to take the US 10 year bond yield back up to even 4.00% would collapse prices for both growth assets and defensive assets.

As Benjamin Graham taught, remain invested according to your appetite for volatility and if bond yields do explode upwards causing fear and panic to take hold, then react by buying more quality assets at discounted prices.

WARNING, this does not constitute Personal Advice and is general in nature. To discuss if this is appropriate for your given circumstances please do not hesitate to contact us directly.

11 Mar 2021

Australian Residential Property: Prices

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The price volatility in houses and units is just breathtaking at present.

Demand for houses is high and is resulting in reporting on a weekly basis that auction bidding is significantly exceeding reserve prices.

Units however are a mess with both big gains and falls across the country. For example, high in demand suburbs such as Chatswood and St Leonard’s in NSW have posted 11% falls in median prices over the past 12 months.

Click for chart.

What is driving this price volatility? The COVID-19 pandemic impact on rental income.

Property investors are not excited about paying high prices for units when data from SQM Research is reporting that average rents in Melbourne CBD and Docklands are down 34.4% and 33.0% respectively over the past 12 months.

This is an important reminder for all investors that residential property just like listed companies is defined as a growth asset class which means that prices can and do move both up and down.

9 Mar 2021

Reserve Bank of Australia (RBA)

- Posted by Dejan Pekic BCom DipFP CFP GAICD

As JobKeeper comes to an end on the 28 March 2021 for the remaining 1 million workers the attention turns to the RBA and what is it going to do with interest rates.

The most likely answer is nothing.

If you have a look at the attached charts, investor credit and investor loan approvals are negligible compared to the past 15 years according to the Australian Bureau of Statistics (ABS) and similarly investor interest only lending has also fallen according to Australia Prudential Regulatory Authority (APRA).

Click for charts.

We agreed that there is increased demand for owner occupied housing but investors are largely absent.