28 Jul 2022

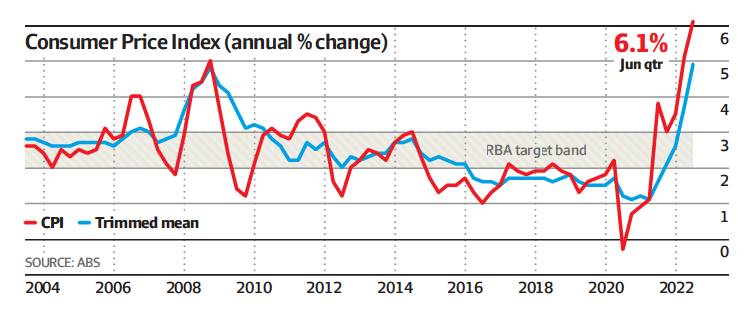

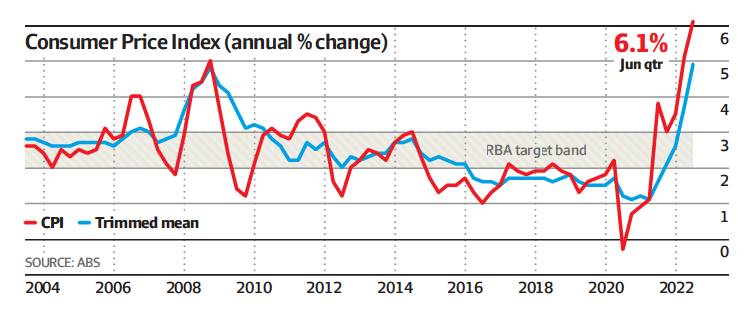

Australian Consumer Price Index (CPI)

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Overnight, Jerome Powell the Chair of Federal Reserve of the United States increased official interest rates by 0.75% for the second month in a row which has lifted the federal funds rate to 2.25% to 2.50%.

In Australia, the inflation rate increased to 6.1% for the year end 30 June 2022 (see chart above) and GDP grew 3.75% which was less than the forecast 4.25% but still positive.

Increased inflation plus positive GDP growth together with a 3.5% unemployment rate means that RBA will continue to increase the Cash Rate and lenders will continue to increase interest rates.

The positive outcome is that while this is happening, asset prices have been increasing over the past 3 to 4 weeks which could mean that the current market correction has ended.

Yes, it is true that we don’t actually know what Mr Market is thinking and will continue to wait and react if asset prices crash during this current period.

Right now the best course of action is to just remain invested according to your appetite for volatility and continue to buy more quality assets at discounted prices.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

27 Jul 2022

Technological Innovation: FluxJet

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The FluxJet is the fully electric offspring of when a plane and a train join in union and will be able to carry passengers at over 1,000 km per hour.

Click to watch.

This new age of technological innovation will deliver much in the way of investment returns. The key, as taught by Benjamin Graham Value Investment Principles is not to overpay.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

20 Jul 2022

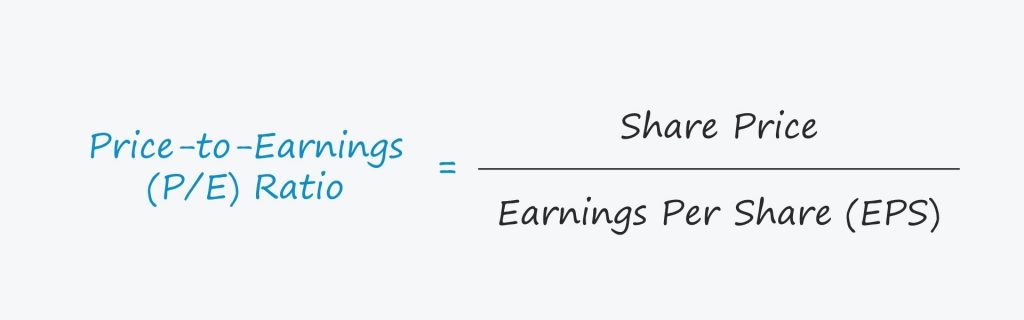

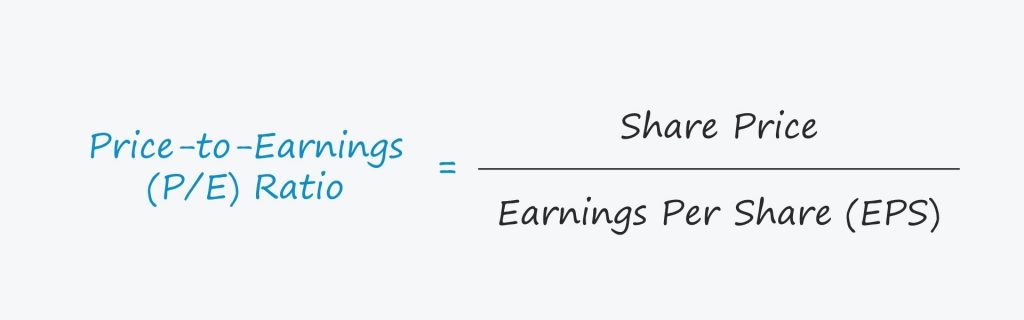

Market Metrics: S&P 500 Index

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The COVID-19 pandemic is still restricting supply of goods, War in Ukraine continues, inflation is at 40 year highs and interest rates are predicted to rise.

Are we there yet? Have asset prices valuations bottomed?

More likely than not because the Price to Earning (P/E) for the S&P500 has fallen below its 30 year average.

The other metric pointing to the correction in asset prices having bottomed is the US 10 year Treasury Yield which has crested at 3.47%.

Click for charts.

If this is the bottom then we will not see an asset price crash in 2022 but it is impossible to predict the future with accuracy.

Right now the best course of action is to just remain invested according to your appetite for volatility and continue to buy more quality assets at discounted prices.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

15 Jul 2022

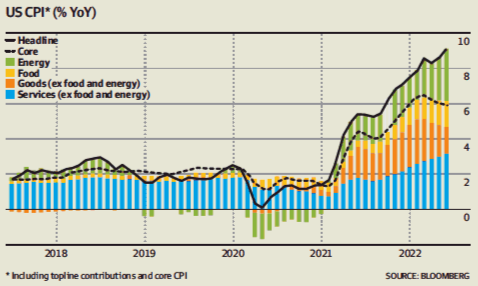

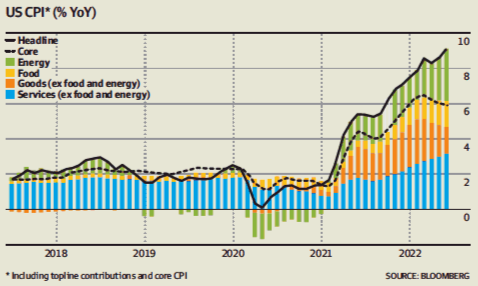

US Consumer Price Index (CPI)

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Annual CPI in the United States rose to 9.1% in June 2022 from last year.

The biggest drivers have been energy and services (see chart above).

Will inflation run away?

Yes it has in the short term but unlikey over the next decaded because of technological innovation.

The supply of goods will increase as the War in Ukraine and the COVID-19 virus are brought under control while robotics/artificial intelligence are combining to eliminate humans from the work force.

Fewer people working means less wages and it is the absence of wage pressure that will subdue inflation over the next decade.

Click to read.

Right now however it is key to remain invested according to your appetite for volatility and continue to buy more quality assets at discounted prices.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

13 Jul 2022

Global GDP: US$104 trillion

- Posted by Dejan Pekic BCom DipFP CFP GAICD

GDP (Gross Domestic Product) is a measure of the market value of all the final goods and services produced by a country.

The good news is that even with the war in Ukraine and the COVID-19 virus still with us the IMF (International Monetary Fund) is forecasting global GDP to reach a record high US$104 trillion by the end of 2022.

China is still in second place at US$19.9 trillion chasing the United States at US$25.3 trillion which has been the World’s largest economy since 1871.

What you may not know is that Australia at US$1.7 trillion is the World’s 13th largest economy which is thanks to our commodities.

Click for chart.

Increasing revenue means increasing profits more often than not adn that is good news for investors.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

8 Jul 2022

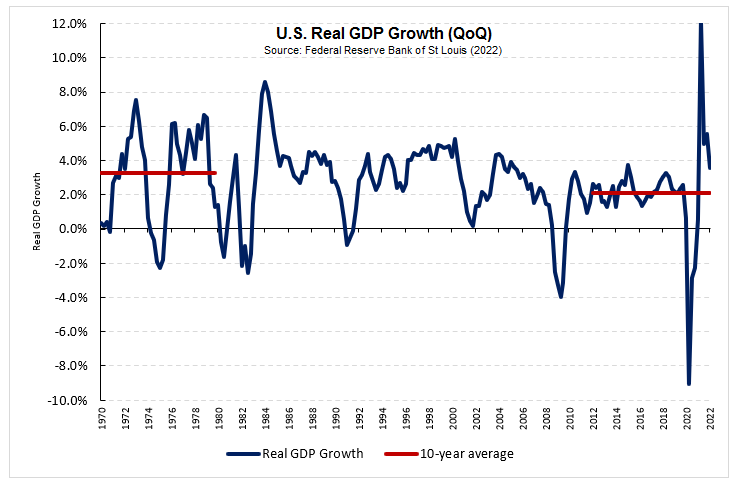

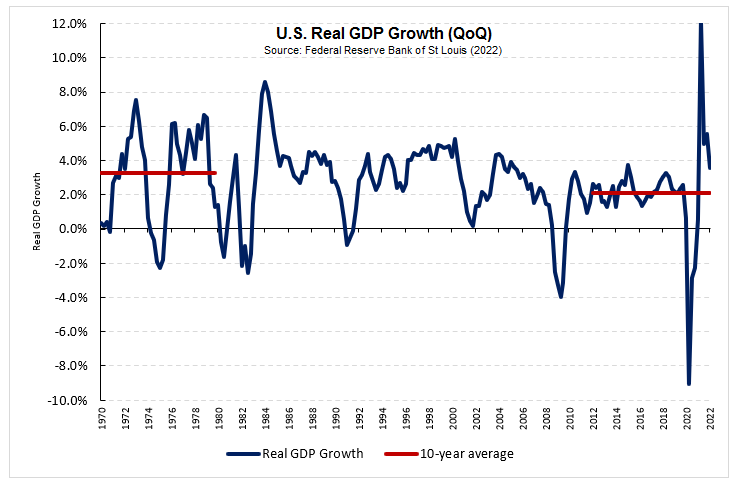

Real GDP Growth USA

- Posted by Dejan Pekic BCom DipFP CFP GAICD

If you ignore the impact of the COVID-19 Pandemic on GDP (first crashing due to supply shortages and then booming due to government money printing) a trend emerges.

The rate of real GDP growth has slowed over the past decade compared to the 1970’s.

Why? Deflation.

Deflation is when asset prices decrease over time and purchasing power increases which still remains the likely economic outcome over the next 10 years given the World has in excess of US$300 trillion in debt, an aging population and rapid technological automation.

When will the current period of inflation end?

Depends on when supply of goods is again free flowing and the war in Ukraine ends.

Right now, key is to remain invested according to your appetite for volatility and continue to buy more quality assets at discounted prices.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

7 Jul 2022

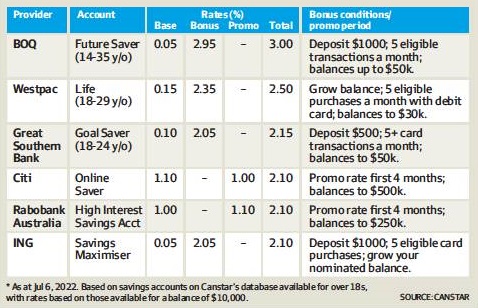

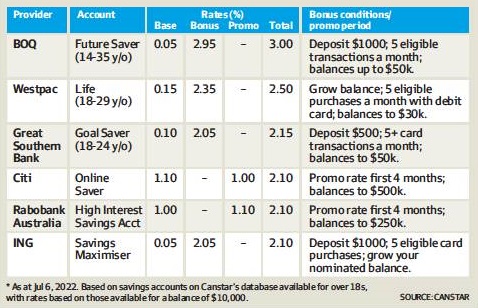

Australian Interest Rates: Bank saving accounts

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The RBA (Reserve Bank of Australia) increased the Cash Rate again this week and the one piece of good news from this decision is for savers.

Banks are now offering higher interest rates on savings accounts but there is always a catch (see examples in table above).

Yes it is likely that the RBA will increase the Cash Rate again next month but there will be a limit in how high they can go because the Federal Government cannot afford to financially bankrupt borrows who account for about 30% of Australian households.

Remember, now is the time to remain invested according to your appetite for volatility and continue to buy more quality assets at discounted prices. It is not the time to sell.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

1 Jul 2022

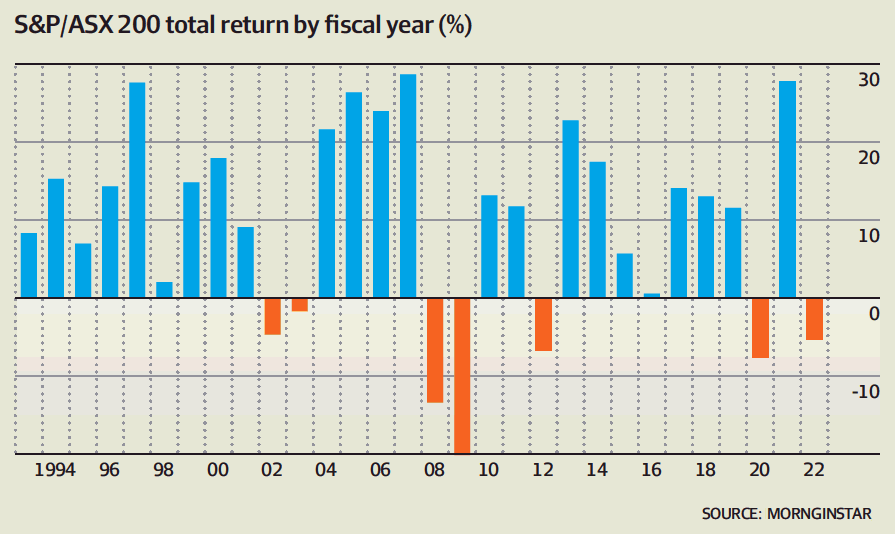

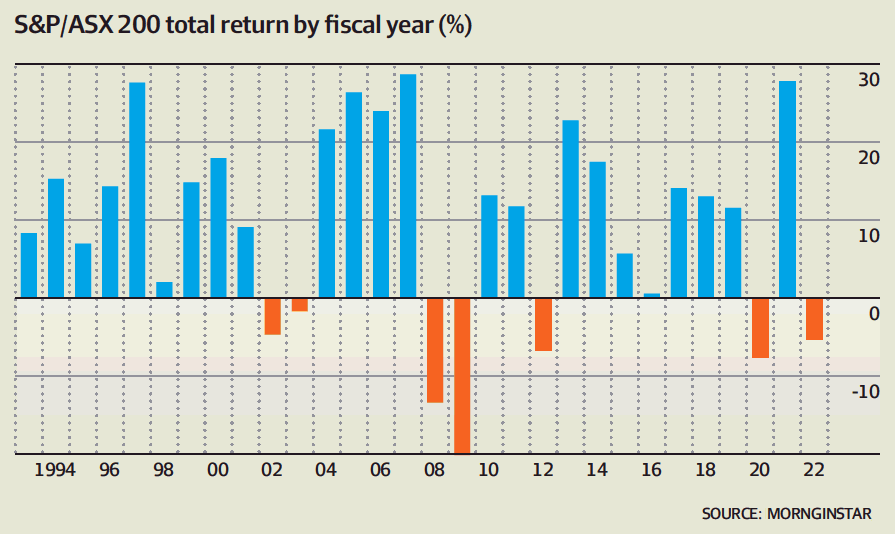

Market Metrics: S&P/ASX 200

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Welcome to the start of a brand new financial year and we are expecting financial asset prices to begin moving in the right direction.

Australian listed companies performed strongly in the second half of 2021 but it all unraveled over the past 6 months with the S&P/ASX total return posting a -5.86% for the 12 months to 30 June 2022.

The Down Jones Industrial Average has also posted a -11.14% for the 12 months to 30 June 2022.

The only good news is that there are always more up years than down years (see chart above) and the message from current fall in asset prices is clear.

Now is not the time to sell, instead it is the time to remain invested according to your appetite for volatility and continue to buy more quality assets at discounted prices.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how to best help them because now is the time.