28 Nov 2019

Market Metrics: US S&P 500 Index

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The current bull market is just nuts.

It has lasted over 10 years and has risen by over 400%.

A bull market is defined as a rise of 50% or more over a period lasting more than six months while a bear market is defined as a fall of 20% or more since the last peak.

In the following table we have detailed a brief history for the six biggest bull runs for the US S&P 500 index since 1962 and the crash following immediately afterwards (source Schroders).

| Period |

No. of Months |

Rise |

Reason |

Fall |

Reason |

| Jul-62 to May-70 |

77 |

143% |

President Kennedy promised to ‘get America moving again’. By 1966 the economy was strong and unemployment was 4%. |

33% |

Political instability and the Vietnam War coupled with a weakening economy and high inflation led to a minor recession and a bear market. |

|

|

|

|

|

|

| Jun-70 to Sep-74 |

31 |

68% |

In the early 1970’s McDonalds, IBM and Disney as part of the ‘Nifty Fifty’ helped carry the US stocks to new heights. |

44% |

Phase three of President Nixon’s economic plan triggered runaway inflation and caused stocks to fall. |

|

|

|

|

|

|

| Jul-82 to Nov-87 |

62 |

289% |

Reaganomics: President Ronald Reagan cut taxes, sending the stock market soaring. |

33% |

Relatively new computerised trading was partly to blame for ‘Black Monday’ when stocks fell 22% in one day. |

|

|

|

|

|

|

| Oct- 94 to Aug-02 |

71 |

266% |

The dawn of the Internet age brought prosperity. Economic growth and stable inflation drove the market higher. |

45% |

After recklessly buying so-called dotcom stocks, the bubble burst and stocks fell sharply. |

|

|

|

|

|

|

| Sep-02 to Feb-09 |

61 |

88% |

Low interest rates spurred excessive lending and the housing boom which triggered exuberant spending. |

51% |

The Great Recession. Falling house prices triggered a mass of defaults, causing banks who had made huge bets on the housing market to fail and the stock market plunged. |

|

|

|

|

|

|

| Mar-09 to Present |

128 |

405% |

Low interest rates and increased money supply support growth. The tech industry spurs the stock market rally. |

??? |

Unknown at this time. |

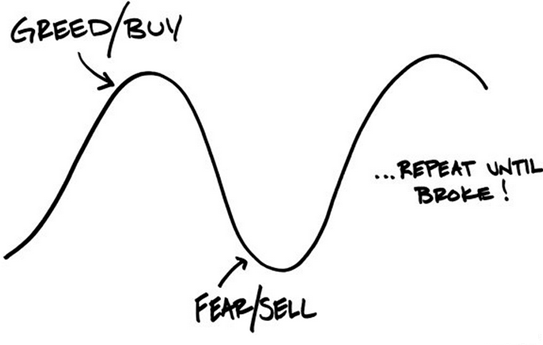

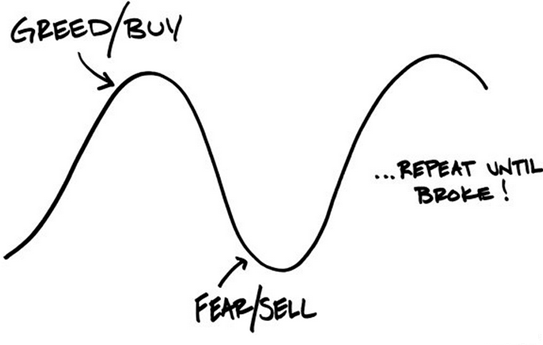

How long can it continue? No one knows is the answer.

The key for investors is to remain invested according to your appetite for volatility and when fear and panic take hold during the next financial catastrophe, to take advantage by buying more quality assets at discounted prices.

Click for chart.

26 Nov 2019

US Inflation: 1913-2019

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Inflation is defined by Investopedia as a quantitative measure of the rate at which the average price level of a basket of selected goods and services in an economy increases over a period of time.

During most of last century inflation has followed a cycle of steep rises and falls but since 1991 it has remained calm, almost peaceful (The great moderation).

Why?

The key drivers of inflation are the cost of raw materials and wages involved in producing goods and services. Wage growth on a mass level has definitely not presented this century.

Why?

And now we come to it, technology.

Technological advances are resulting in automation which is disrupting human employment and this is our professional guess for why inflation is dead.

And yes it is possible for inflation to remain non-existent for decades to come as more technological disruption continues to suppress mass wage growth.

The benefit of ongoing low inflation is that it will hold down interest rate rises to a trickle which then supports increasing growth asset prices (property and shares) which only becomes a problem when growth asset prices become stretched and unfortunately this is the current situation.

By conclusion, Mr Market (an allegory created by Benjamin Graham) must be thinking to himself that technology and innovation will deliver the increasing income (profit distribution) needed to support current and rising growth asset prices.

Click for chart.

19 Nov 2019

Life Insurance: TPD

- Posted by Dejan Pekic BCom DipFP CFP GAICD

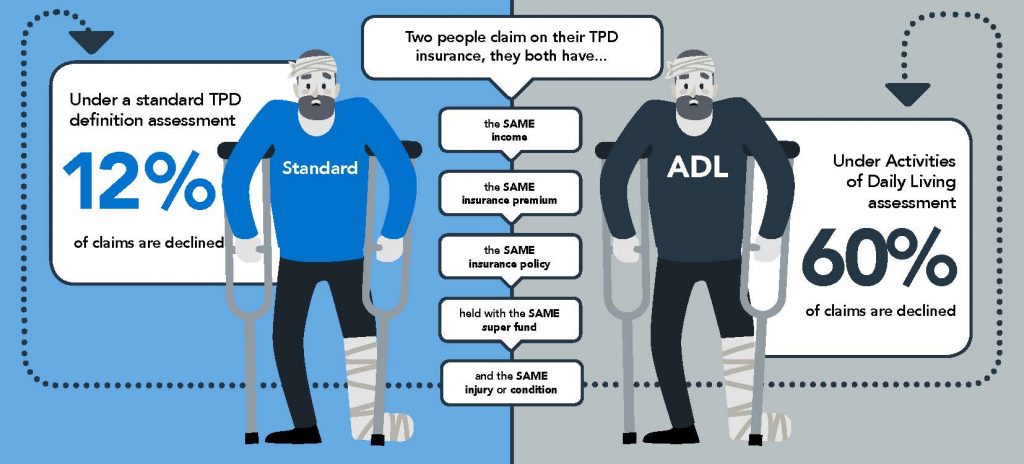

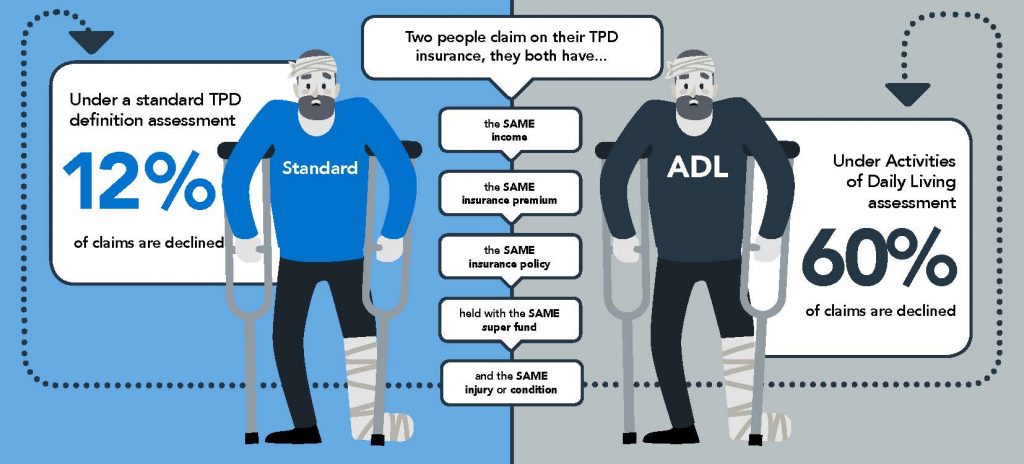

TPD stands for Total and Permanent Disability and it is employment related. There two common definition types for TPD insurance.

Any Occupation TPD insurance means you can claim if you are totally and permanently disabled and can’t work in any occupation that you are suited to by education, training or experience.

While the best definition is Own Occupation TPD insurance which means you will receive a payout if you are totally and permanently disabled and are unable to work in your usual occupation or chosen field of employment.

Unfortunately the only type of lump sum disability insurance that can be owned within superannuation is the Any Occupation definition or the even less favorable ADL (activities of daily living) definition which is where you are unable to do two things such as feeding, bathing, dressing or looking after yourself for a successful claim.

The point is that TPD insurance in superannuation is worse than bad with declined claims rates as high as 87%.

TPD insurance is a $3.5 billion annual premium business involving 13.4 million consumers and ASIC has finally undertaken an investigation into TPD claim payouts. The results are poor due to the TPD definition being applied by life insurance companies.

If you have any questions or need help please call us 02 9267 2322 to book in a time.

Click for report.

Click for declined claim rates.

14 Nov 2019

Australian Residential Property: First Home Buyers

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The First Home Loan Deposit Scheme has been legislated by the Federal Government and will commence on 1st January 2020.

It is designed to help Australian citizen over the age of 18 buy their first home with a minimum 5% deposit and not pay lenders mortgage insurance which is normally charged if the deposit is less than 20%.

In NSW, specifically Sydney it is capped at $700,000 purchase price.

The NSW Government will also waive (exempt) the stamp duty in full under the First Home Buyer Assistance Scheme if the purchase price is less than $650,000.

But wait, there is more.

If you’re a first home buyer and you’re buying a new home in NSW then you may also qualify for a $10,000 grant under the NSW Government First Home Owner Grant (New Homes) Scheme.

So, from 1st January 2020 an Australian citizen over the age of 18 can purchase a new $650,000 first home in Sydney with $32,500 deposit, pay no lenders mortgage insurance, pay no stamp duty and receive a $10,000 grant.

Yes they would have a $617,500 mortgage which at 3.0% per annum principal and interest would cost $2,600 per month (or $1,544 per month interest only) but they would stop paying rent.

This will present an opportunity for some.

WARNING, this does not constitute Personal Advice and to discuss if this is appropriate for your given circumstances please do not hesitate to contact us directly.

Click for Federal Government Scheme.

Click for NSW Government Scheme.

12 Nov 2019

Purchasing Manager Index (PMI)

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The Purchasing Managers Index (PMI) is a measure of the prevailing direction of economic trends in manufacturing through its monthly survey of supply chain managers across 19 industries, covering both upstream and downstream activity.

When the PMI falls it indicates that manufacturers are scaling down production because they are expecting reduced sales which can indicate slower economic growth.

Question.

Is the current falling PMI repeating the past weakness of 2016 and 2012 which means that it is due to turn back up or will it fall further this time?

Click for chart.

The key for investors with all of this market noise is to remain invested according to your appetite for volatility and when fear and panic take hold during the next financial catastrophe, to take advantage by buying more quality assets at discounted prices.

7 Nov 2019

Market Metrics: US Listed Companies

- Posted by Dejan Pekic BCom DipFP CFP GAICD

IPO stands for Initial Public Offering and refers to the process of offering shares of a private company to the public in a new stock issuance to raise capital.

Seriously, what is going on with US Initial Public Offerings?

Since 2017, the aggregate capital raising (IPO) of unprofitable private companies has exceeded that of profitable private companies coming to market and by a significant margin.

This is not normal when you look back over the past two decades and is most definitely being driven by technology companies coming to market with the promises of future rivers of gold.

Click for chart.

Consider, if a company is not making profit today, how does it make a profit in the future because no way that every one of these IPO’s becomes an Amazon???

We most defiantly live in interesting times.

6 Nov 2019

The Wisdom of Great Investors: Behavioral Finance

- Posted by Dejan Pekic BCom DipFP CFP GAICD

As Benjamin Graham taught, you are not right because Mr Market agrees with you, you are right because your numbers are right.

Graham and a couple of other great investors went on to highlight a few more truths about investing in growth assets.

- “Do not take yearly results so seriously. Instead focus on four or five year averages.” Benjamin Graham

- “Everyone has the brain power to make money in stocks. Not everyone has the stomach. If you are susceptible to selling everything in a panic, you ought to avoid stocks and [investment] funds.” Peter Lynch

- “If you have trouble imagining a 20% loss in the stock market, you shouldn’t be in stocks.” John Bogle

- “Compound interest is the eighth wonder of the world. He who understands it, earns it…he who doesn’t, pays it.” Albert Einstein

We have attached a chart on the MSCI AC World Index which is comprised of listed companies from 23 developed and 24 emerging countries to provide a broad measure of World stock market performance.

The results have been manic over the past 30 years and this is normal which is why the key lesson to remember is that the best opportunity to buy more quality growth assets at reasonable or better still discounted prices is when fear and panic take hold.

Click for chart.

1 Nov 2019

Friday Tidbit: US China Trade War

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The US China Trade War began on 22nd March 2018 when US President Donald Trump signed a memorandum under the Section 301 of the Trade Act of 1974 instructing the United States Trade Representative to apply tariffs of US$50 billion on Chinese goods due to Chinese theft of US intellectual property.

Theoretically the purpose of tariffs is to protect domestic business and domestic jobs but in practice everybody loses.

Interestingly, after 20 months US listed companies are posting a positive return for investors while Chinese listed company’s valuations are still negative in aggregate.

Click for chart.

Asia makes up more than half the World’s population and half of global gross domestic product (GDP) which means that China and the rest of the Asian region will not continue to under perform.

It is only a matter of time before performance bounces back and dramatically.