31 Mar 2023

Friday Tidbit

- Posted by Dejan Pekic BCom DipFP CFP GAICD

In November 2006 we sent out our first eUpdate on electric vehicles which are now more commonly known as EVs.

The revolutionary vision for EVs was to drive for free by having battery kits and solar-powered chargers at home.

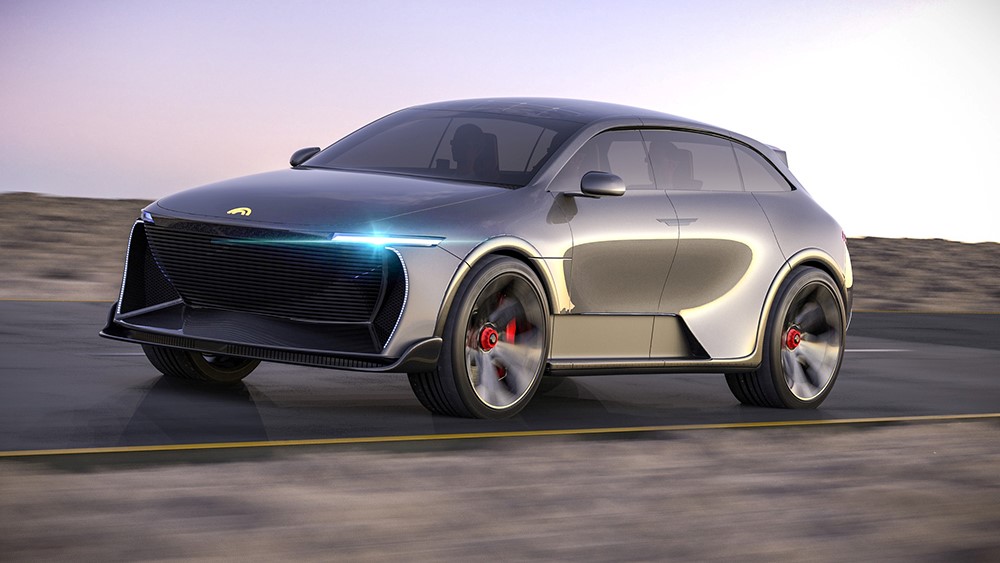

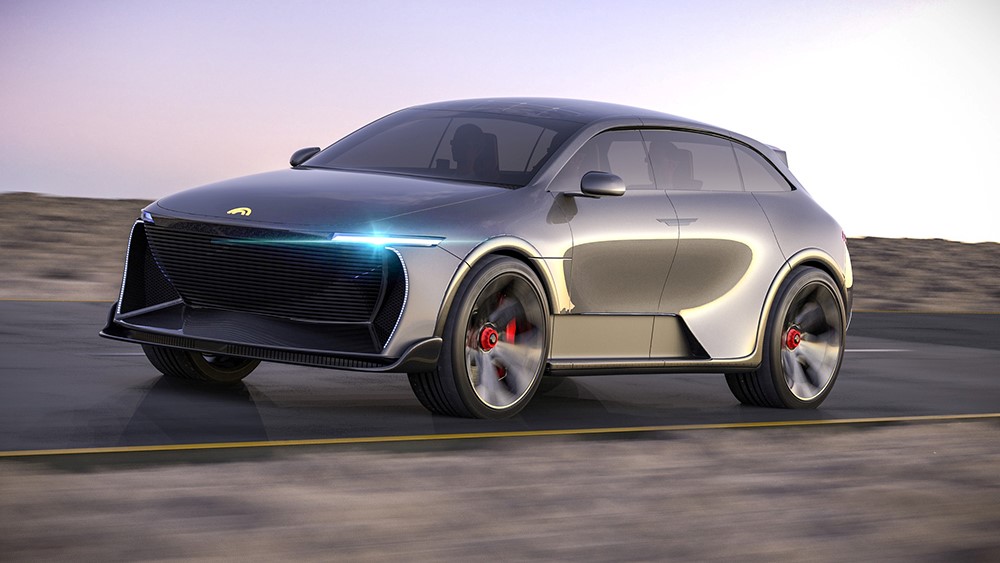

Humble Motors has just unveiled the “World’s first solar-powered SUV” with manufacturing planned to start in 2024.

This new EV concept is gorgeous.

Click to read.

The World is in an electrifying transition which will deliver investment opportunities.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

27 Mar 2023

Gates Notes: The Age of AI has begun

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Bill Gates, a billionaire philanthropist and one of the founders of Microsoft writes about when he viewed two demonstrations of technology that changed everything.

The first was the graphical user interface (Windows) in 1980 and the second is OpenAI (ChatGPT) in 2022.

In summation, ‘Software is consuming the World’ and this decade is when everything changes for all of us.

Click to read.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

24 Mar 2023

Market Metrics: MSCI All Country World Index

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The hits just keep coming.

March 2023 marks the 3 year anniversary of the 2020 COVID-19 crash which was then followed by the February 2022 Russian invasion of Ukraine.

Click for chart.

Two asset price crashes within 2 years is not normal and now the United States is expected to go into a recession in the coming months because of the US Federal Reserve keeps increasing interest rates.

Will a recession in the United States cause a third crash in asset price in as many years?

Don’t know with absolute certainty.

However we do know that Benjamin Graham value investment principles teach us not to speculate, to remain invested according to our appetite for volatility and to buy more quality assets when asset prices crash.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

14 Mar 2023

SVB Collapse: Cracks Emerge

- Posted by Dejan Pekic BCom DipFP CFP GAICD

If you are not aware, SVB (Silicon Valley Bank) has failed and the US Treasury and US Federal Reserve has stepped in to guarantee that depositors will continue to have access to their cash which is exactly what is needed.

SVB shareholders however will likely be wiped out.

Once again another cautionary reminder of the importance of diversification.

In respect of the US Federal Reserve current policy of increasing interest rates, we doubt they will stop increasing given their focus is on bringing inflation back down to 2%.

The following link is a good read on how it all went wrong for SVB.

Click to read.

Remember, remain invested according to your appetite for volatility and continue to look to buy more quality assets when discounted prices present.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

9 Mar 2023

US Headline Inflation

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Rising inflation has definitely caused a great deal of trouble over the past 12 months but is now being brought under control with rising interest rates.

Click for chart.

The structural issues however continue to persist which include lower global population growth, over US$300 trillion in World debt and rapid technology innovation continuing to reduce in cost which points to weaker global demand growth.

These are deflationary forces in the medium to long term.

Click for chart.

This means that the current fall in asset prices presents investors with an opportunity to buy more quality asset at a discounted prices.

WARNING, this does not constitute Personal Advice. To discuss if this is an appropriate strategy for your given circumstances please do not hesitate to contact us directly.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

2 Mar 2023

Market Metrics: Listed Companies Worldwide

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Just working through the Credit Suisse Global Investment Returns Yearbook 2023 and wanted to share a couple of observations.

Firstly, there are only 21 countries that have had a public exchange for companies to trade their shareholding since 1900.

Secondly, in 1900 the United Kingdom at 24.0% had the largest share of publically listed companies by market capitalisation followed by the United States at 15.0%. Fast forward to 2022 and the United States now has the largest share at 58.4% while United Kingdom has fallen to 4.1%.

Germany and France have also reduced significantly.

Thirdly, Australia has the best historical performance over this 122 year period at 6.7% per annum followed by the United States at 6.38% per annum.

Click for charts.

Australia truly is the lucky country.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.