25 Nov 2022

Friday Tidbit

- Posted by Dejan Pekic BCom DipFP CFP GAICD

By 2050, the OECD predicts that 30% of the World population will be aged 65 or over.

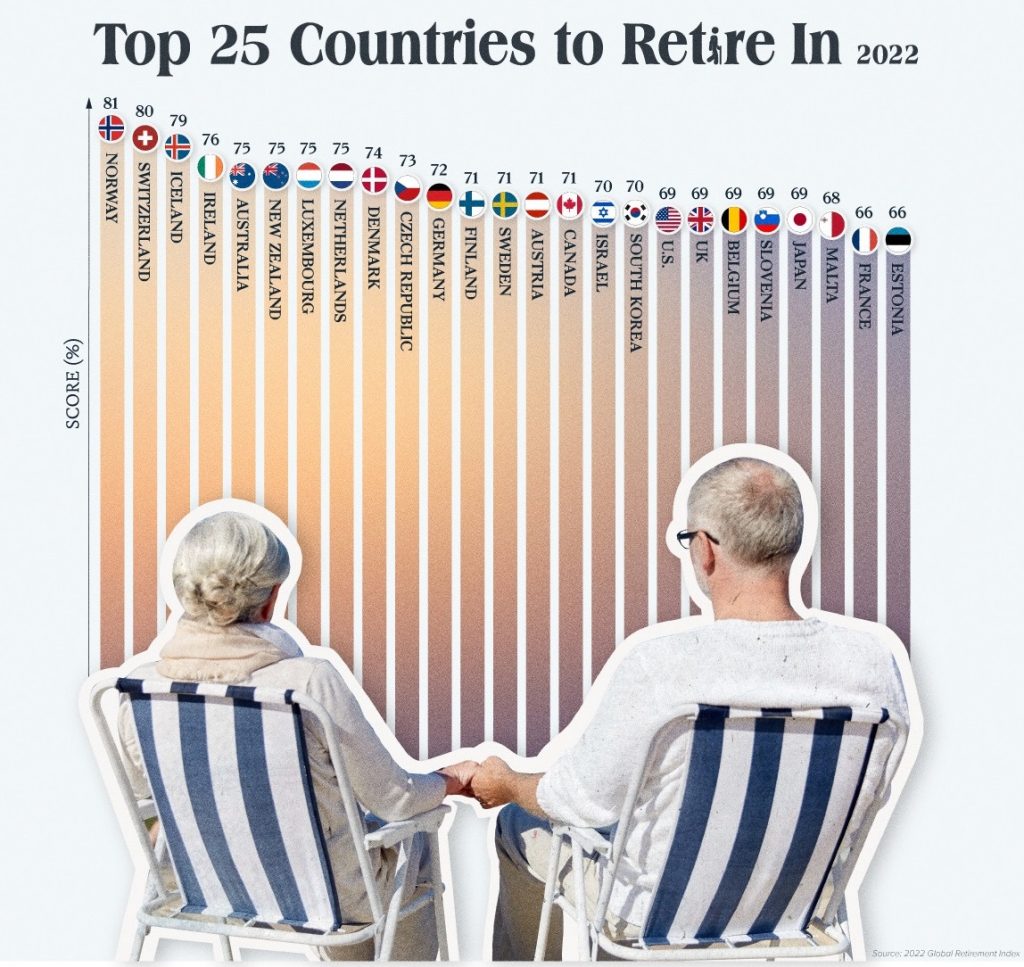

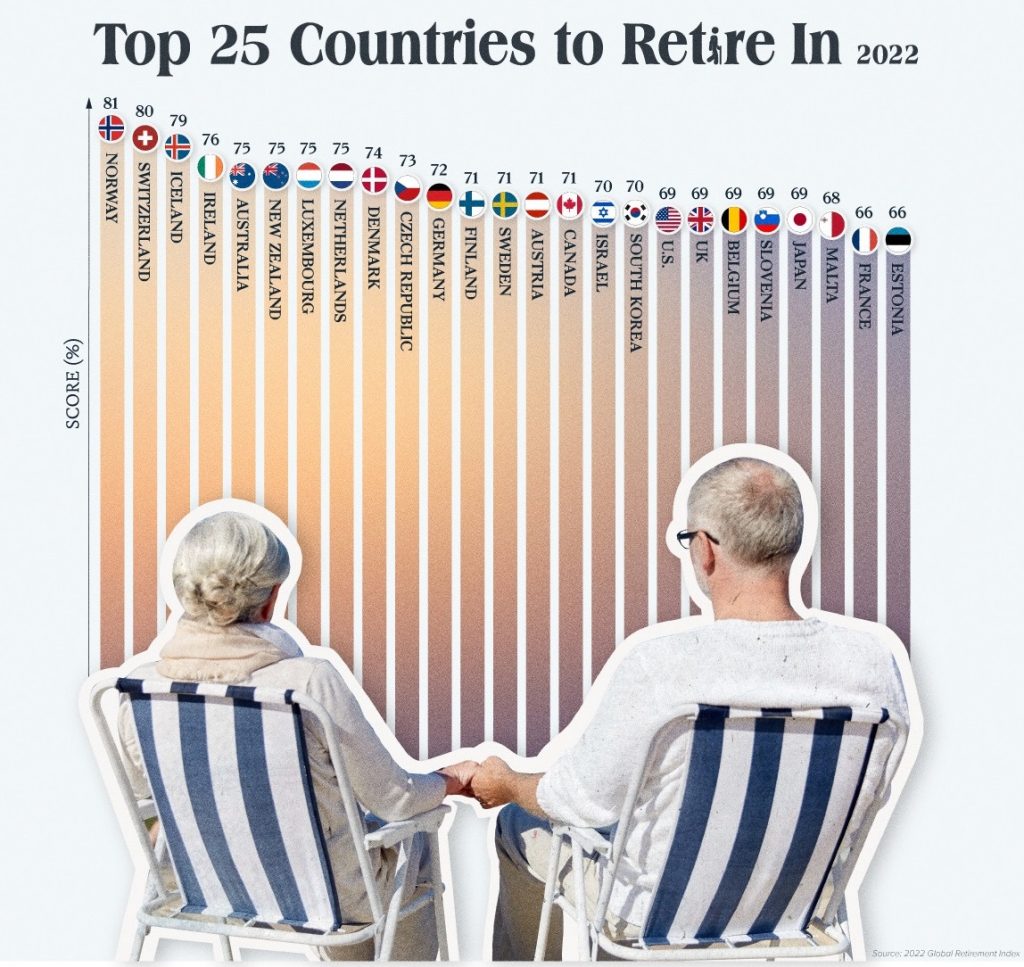

The 2022 Natixis Global Retirement Index ranks the best countries to retire in around the World.

The ranking is based on health, quality of life, material wellbeing and finances in retirement.

The good news is that Australia ranks fifth and the not so good news is that Australia does not rank first.

Click to read.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

23 Nov 2022

Economics: Opportunity Cost

- Posted by Dejan Pekic BCom DipFP CFP GAICD

This piece took me back to 1988 and my first year at UNSW (University of NSW).

The key concept in economics to get right is opportunity cost and this is exactly what we have been helping clients to understand in order to accelerate their wealth.

Enjoy.

Click to read.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

17 Nov 2022

Behavioral Finance: Deliberate Ignorance

- Posted by Dejan Pekic BCom DipFP CFP GAICD

This is a very good read and must agree that there is a definitely a need for some deliberate ignorance given the enormous magnitude of misinformation.

Enjoy and feel free to forward to family, friends and colleagues.

Also, if any want financial advice please ask them to contact us and we will work out how best to help.

Click to read.

9 Nov 2022

Recession Indicator: Australia

- Posted by Dejan Pekic BCom DipFP CFP GAICD

An interesting read on why Australia should be able to avoid a recession

The key to remember is that even if the United States and or Australia do go into recession then it will become an even better time for investors to buy more quality asset at a discounted price.

Click to read.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

1 Nov 2022

Market Metrics: Listed Property

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Melbourne Cup is always an exciting and fun day.

Thinking back over the past 3 plus decades, the worst asset price crash occurred during the 2008 GFC (Global Financial Crisis).

And the worst performing asset class was property, not residential but listed commercial, industrial and retail.

The fall was in the order of 70% to 80% from peak to trough. That is big.

Click for chart.

All asset prices fell during 2008 GFC apart from cash at bank but the key was not to panic and sell. Investors who bought more and or increased their allocation to growth assets went on to make a ton of accelerated profit.

The current crash in asset prices is receding quickly and it just might be all over but if you have family, friends and or colleagues that want to take advantage, please contact us.