14 Dec 2023

Capital Markets Expectations for 2024

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Some good news.

Jerome Powell, Chair of US Federal Reserve did not increase interest rates over night in the United States which is another signal that interest rates have peaked and are likely to be cut in 2024.

If we assume that global interest rates have actually peaked then any reduction in 2024 will be good news for all asset classes.

Listed property and listed companies will benefit and are forecast to return 8% to 10% in 2024 if there is a reduction in interest rates because their borrowing costs reduce.

Existing fixed interest securities will gain in value and are forecast to return 4% to 6% in 2024 if new paper is issued a lower interest rate.

CAUTION, please remember that there cannot be any guarantees in regard to these capital markets forecasts because it is not possible to predict future returns with certainty.

Click for table.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

7 Dec 2023

RBA: Australian Interest Rates

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The RBA (Reserve Bank of Australia) held the Cash Rate at 4.35% per annum on Tuesday.

History implies that the current interest rate hiking cycle is done with this period being the second biggest increase in 40 years.

Click for chart.

What is the evidence for no more interest rate hikes?

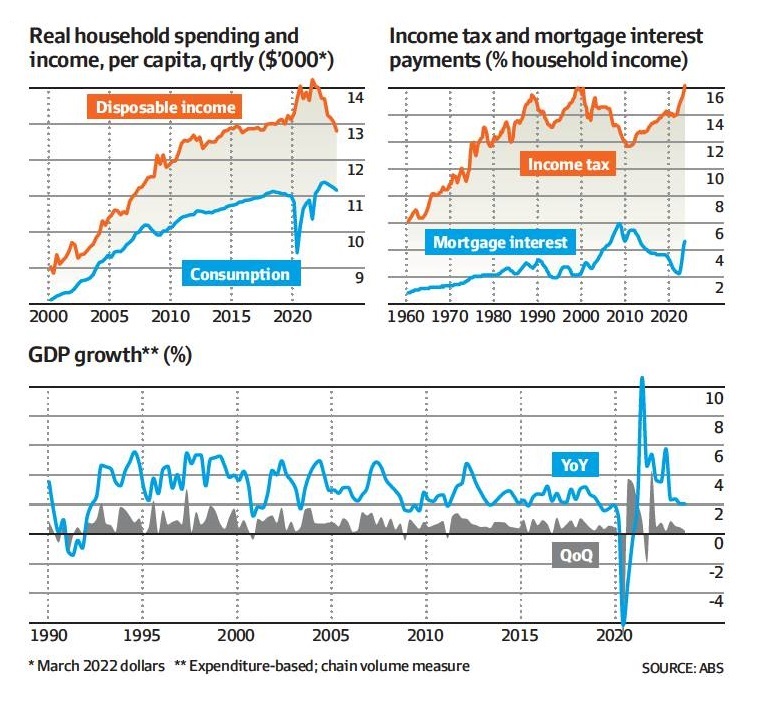

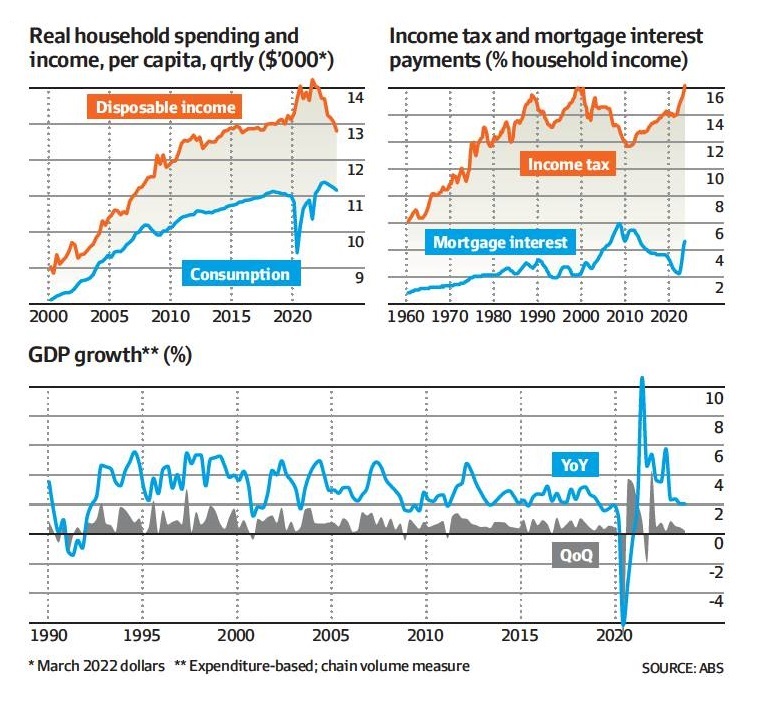

Real household spending has fallen, real household disposable income has fallen and GDP growth has fallen due to rising mortgage interest cost, rising personal income tax and the price rise for goods and services.

Will Australia fall drop into a recession in 2024?

Don’t know but even when Australia’s does go into its next recession, the outcome will be the same, investors will be presented with an opportunity to buy more quality asset at a discounted price.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

5 Dec 2023

Australia Taxation Office (ATO): GIC rates

- Posted by Dejan Pekic BCom DipFP CFP GAICD

We have received a number of inquiries from clients about General Interest Charge (GIC) which the ATO charges for failing to meet tax obligations.

As part of our investigation, we discovered that the GIC has now climbed to 11.15% per annum which is nearing its 2008 high of 14.75% per annum.

Click for GIC.

Bottom line, pay your tax and on time.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.