28 Sep 2020

Australian Residential Property: Housing Affordability

- Posted by Dejan Pekic BCom DipFP CFP GAICD

‘Lies, dam lies and statistics’ is a phrase used to describe the persuasive power of numbers to support a view.

If numbers are to be believed then housing affordability (paying a mortgage) has not been this cheap since the 1990’s if you exclude 2008 Global Financial Crisis.

Click for chart.

The driver has been the collapsing interest rate.

The problem with a collapsing interest rate is that residential property prices have been driven to record high levels requiring ever larger dollar amounts to be borrowed to make the acquisition.

This recession was expected to deflate residential property prices so where is the forecast 20% plus price collapse?

Just like an elastic band, if you continue to stretch and stretch, the elastic band will eventually break and that also applies to asset prices.

Remember what Benjamin Graham taught as part of his value investing principles, stay invested according to your appetite for volatility and when fear and panic take hold, react by buying more quality assets at discounted prices.

24 Sep 2020

Aussie Tech VS American Tech

- Posted by Dejan Pekic BCom DipFP CFP GAICD

There is a great deal of noise and media about tech stocks which makes it difficult to know what to buy.

All investors want value but which past goes up?

Compare for example our own WAAAXN (WiseTech, Appen, Altium, Afterpay, Xero and Nearmap) against the FAANG (Facebook, Apple, Amazon, Netflix and Google) on cash revenue and valuation and the numbers could not be more startling.

The WAAAXN has been burning through investor capital for the past 5 years and not making any money while the average valuation is double the FAANG.

Click for charts.

This is not a recommendation to sell WAAAXN and buy the FAANG.

Instead it is a reminder that the price you pay when investing is what matters.

Overpay, even for a quality asset and it could be decades before you make a profit.

Benjamin Graham taught this as part of his value investing principles and the insight is to remain invested according to your appetite for volatility and when fear and panic take hold, react by buying more quality assets at discounted prices.

22 Sep 2020

Harvard Business Review: Democracy is in trouble

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The ancient Greeks built Democracy on four pillars- justice, equity, freedoms and representation.

- Justice for the fair treatment of individuals and groups.

- Equity for individuals and groups to have the same opportunities in life.

- Freedoms for people to have the right to think and speak as they wish.

- Representation for elected representatives to act on behalf of citizens.

This HBR Video talks about how to ensure the survival of Democracy.

Click to watch.

17 Sep 2020

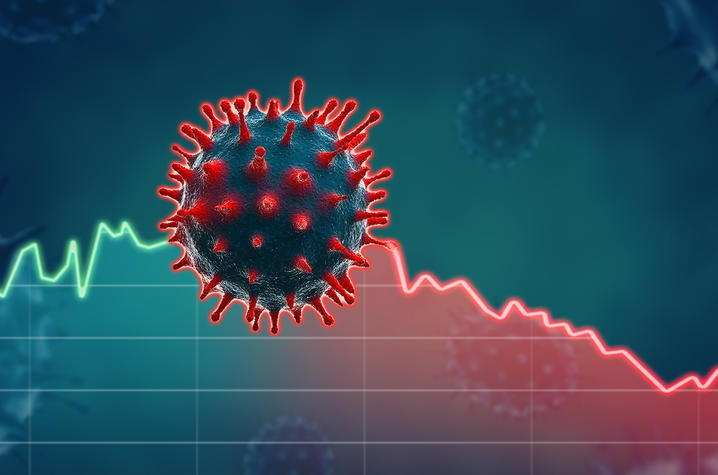

Economic Impact COVID-19: Australian Economic Forecast

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The OECD (Organisation for Economic Co-operation and Development) is expecting the Australian economy to contract 4.1% in 2020 which is an improvement on the 5.0% contraction forecast published back in June.

Worldwide GDP (Gross Domestic Product) is also forecast to contract less, the OECD is now forecasting 4.5% contraction instead of the 6.0% published in June.

Click to read.

What do you think?

15 Sep 2020

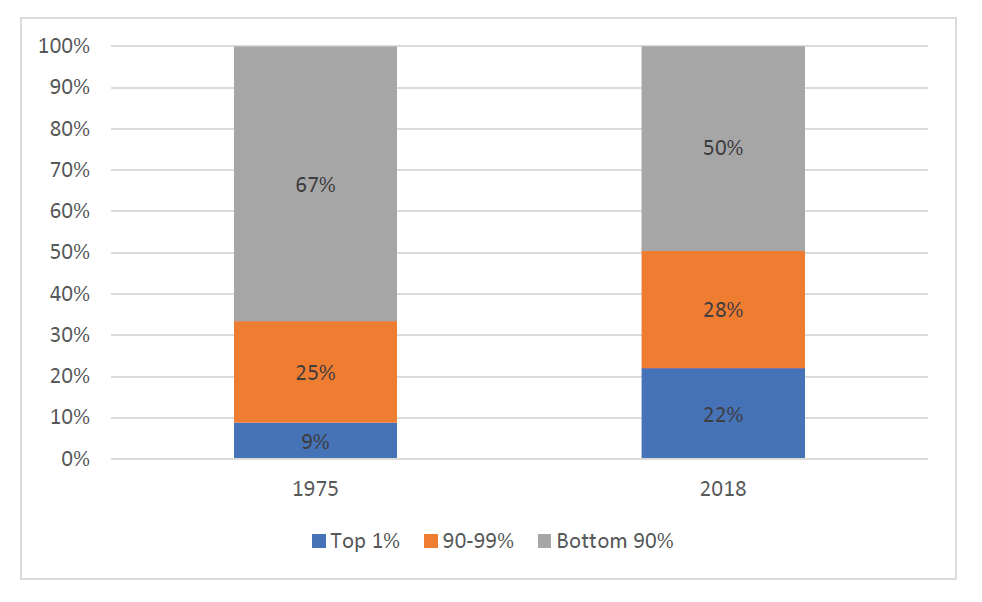

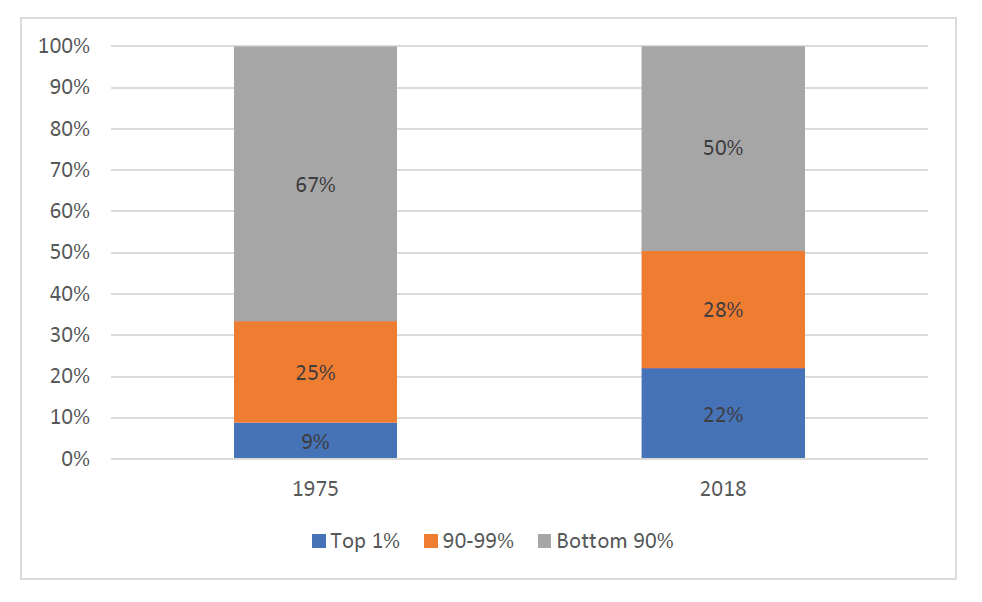

Middle Class Income: What went wrong?

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The attached paper calculates that the aggregate income for the American population below the 90th percentile would have been US$2.5 trillion or 67% higher in 2018 had income growth since 1975 remained as equitable as it was in the first two decades post World War II.

Click to read.

The middle class is barely holding on in the United States but it is not the fault of business.

And it is also not the fault of high net worth individuals who derive their income from business.

The fault is squarely with Government.

It is the role of Government to legislate for the people and to ensure that the income derived by business from society ultimately finds its way back into society.

Government makes the rules using legislation and business will play by the rules and yes business will also push the boundaries but ultimately comply with the law.

The problem with the current set of rules is that they will continue the trend of the past four decades which will result in even greater income inequality.

If the middle class disappears then so too does a countries economic prosperity.

10 Sep 2020

Market Metrics: Nasdaq Index

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Sector investing can be sexy and even euphoric right up until that sector blows up and wipes out your investment capital.

What’s not to love about the FAANGM (Facebook, Apple, Amazon, Netflix, Google and Microsoft) which have increased over 500% during the past 7 years but the price you are paying today to buy these listed companies is extremely high relative to earnings.

This level of crazy in the tech sector has happened before.

Just turn your mind back to the run up to the 2000 Tech Wreck (Dot-com bubble) which was then followed by the 2001 September 11 terrorism attach and the second Iraq Gulf War in 2003.

The result for the tech sector.

The Nasdaq Index fell by 75% and investors had to wait 15 years for prices to return back to the 2000 price level.

Click for chart.

The price you pay is what matters when investing.

Overpay, even for a quality asset and it could be decades before you make a profit.

As Benjamin Graham taught, don’t speculate. Instead remain invested according to your appetite for volatility and when fear and panic take hold, react by buying more quality assets at discounted prices.

4 Sep 2020

Electric Vehicles: Meet The Aviar R67

- Posted by Dejan Pekic BCom DipFP CFP GAICD

This is cool.

Russian based Aviar Motors is building a light-weight carbon fiber replica body of the first generation Ford Mustang on to a Tesla Model S.

The lighter weight means that the Aviar R67 can go from 0 to 100 km/h in just 2.2 seconds which is faster than the Tesla Model S.

The future is most definitely electric.

Click to view.

2 Sep 2020

Market Metrics: US High Yield Corporate Debt

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The pattern is repeating.

As the United States moves through this recession, the rate of debt defaults in corporate America has increased and will likely peak back above the 10% level.

As you can see from the chart- property, oil, airline, transportation and leisure sectors have all had a significant increase in the cost of borrowing. Airlines now have to pay 2.5 times more in interest to borrow money compared to December 2019.

Click for charts.

The point is to highlight that although the path to the current recession (COVID-19 Pandemic) is new the rhythm of this recession is not, it is still following the same routine as past recessions.

The market and investors are currently all waiting to see if financial assets will collapse a second time as they did back in the 2008 Global Financial Crisis before the bull market really takes hold.

As this recession plays out, we just patiently wait to react and take advantage when the opportunity presents.