30 Apr 2020

China Money Trap

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The attached short video was sent to me by Gary Hahn who has been a client since 2017 and is meant to be amusing if it were not so thought provoking in its strategic thinking.

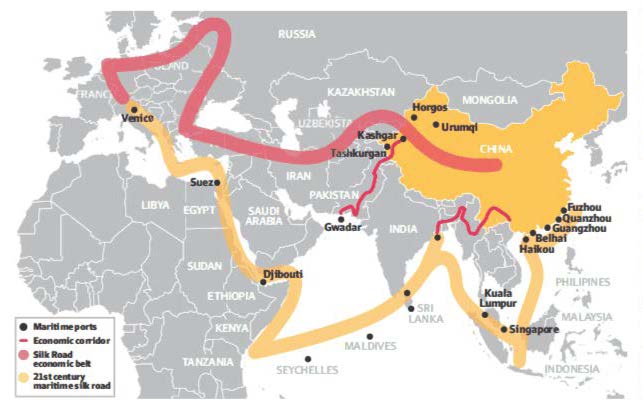

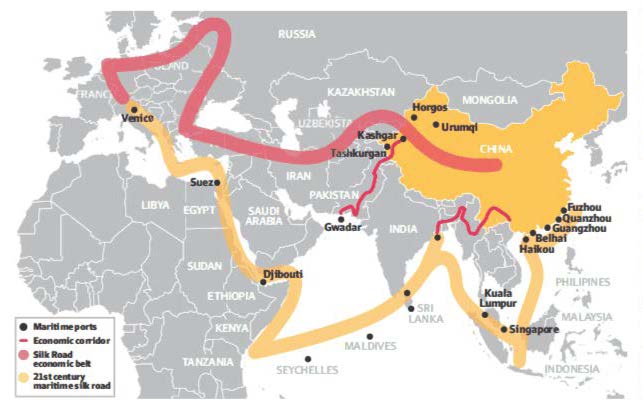

In 2013 the Chinese Government embarked on building a new Silk Road named the Belt and Road Initiative which involves infrastructure development and investments in nearly 70 countries and international organizations across Asia, Europe, and Africa.

None of this is new or unknown.

The objective, one of many is to control global trade infrastructure for the sale of its goods.

Is this really any different to past superpowers such as the United Kingdom of the 1800’s or the United States of the 1900’s?

No, China is pushing forward with just as much if not greater dominance.

Please do send me your thoughts.

Click to watch.

27 Apr 2020

The Boston Consulting Group: Things are changing

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Just look at how quickly consumer spending patterns have changed.

Groceries spending up 75% while travel is down over 50%.

There will definitely be winners and losers from the COVID-19 pandemic and as always, smart businesses will adapt and innovate to meet the need.

Click for charts.

21 Apr 2020

Principles of Investing: Power of Compounding

- Posted by Dejan Pekic BCom DipFP CFP GAICD

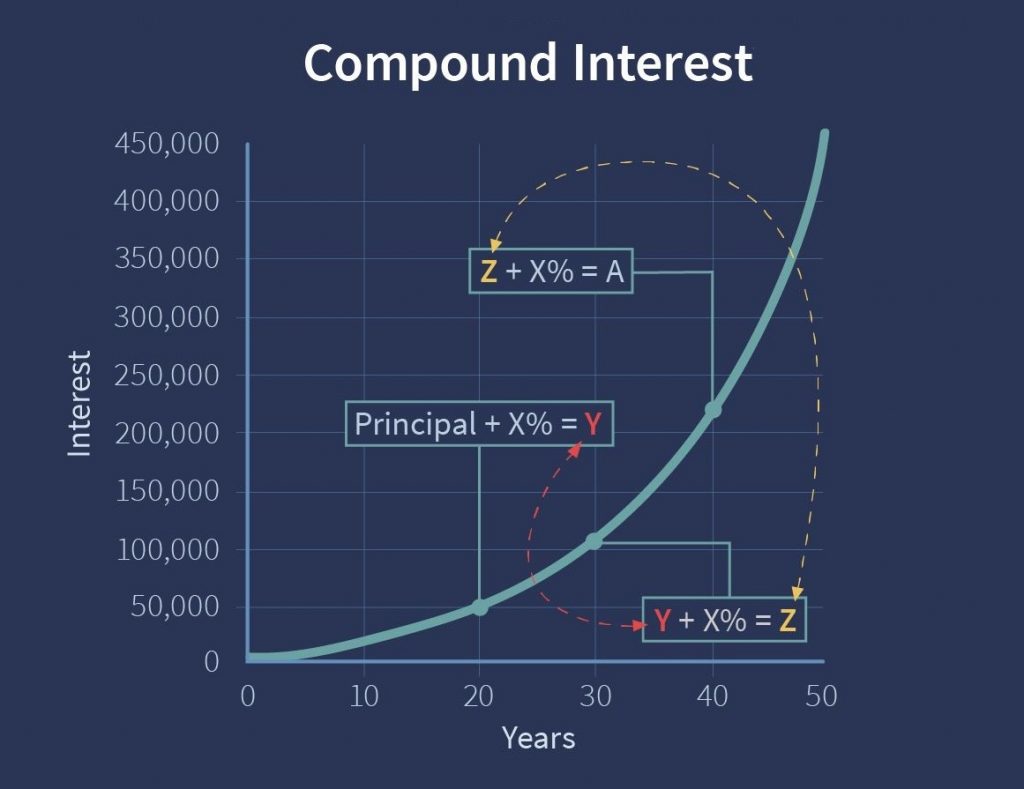

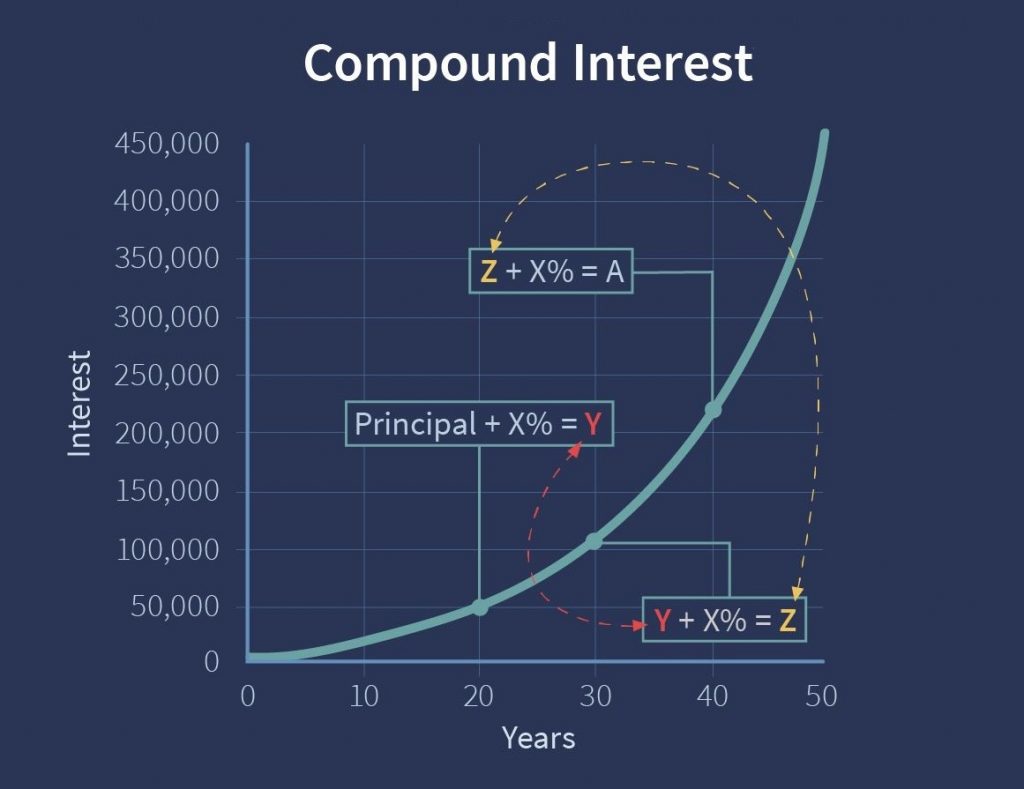

According to Albert Einstein…

“Compound interest is the eighth wonder of the world.

He who understands it, earns it…he who doesn’t, pays it.”

If you save and invest the same amount of money in the first 10 years and stop versus saving that same amount again over the subsequent 10 years, all things being equal, the first lot will be 1.7 times greater today.

Why? Because the first lot of savings has been allowed to continue to compound the earnings for a further decade.

Click for chart.

This now brings us to our point, withdrawing $20,000 from superannuation ($10,000 this financial year and $10,000 next financial year) as a result of the COVID-19 pandemic should only be done as an absolute last resort.

And only when all other financial resources are exhausted.

It is guaranteed to negatively impact the retirement capital of every individual who makes the withdrawal.

Now is the time to buy and take advantage of this market crash, it is not the time to sell.

WARNING, this does not constitute Personal Advice and to discuss if this is appropriate for your given circumstances please do not hesitate to contact us directly.

17 Apr 2020

New Pension Minimums

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The Federal Government has announced measures to help minimize the economic impact of COVID-19 on superannuation account based pensions.

One such measure is a temporary 50% reduction to the required minimum annual withdrawal amounts from superannuation account based pensions. The new minimums is voluntary only and can be accessed during both the current financial year and the upcoming 30 June 2021 financial year.

|

Age

|

Default minimum drawdown rates

|

Reduced by 50%

|

|

Under 65

|

4%

|

2%

|

|

65-74

|

5%

|

2.5%

|

|

75-79

|

6%

|

3%

|

|

80-84

|

7%

|

3.5%

|

|

85-89

|

9%

|

4.5%

|

|

90-94

|

11%

|

5.5%

|

|

95 and older

|

14%

|

7%

|

If you need any help to action this income reduction and allow more of the capital to remain invested for the next 14 months, please email or call us on 02 9267 2322.

14 Apr 2020

Market Metrics: GFC

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The 2008 Global Financial Crisis (GFC) began just after the Dow Jones Industrial Average (DJI) closed at an all time high of 14,164 points on 9th October 2007.

The GFC caused the DJI to fall to a 6,547 point low on 9th March 2009 which represented a drop of 53.8%.

An epic fall.

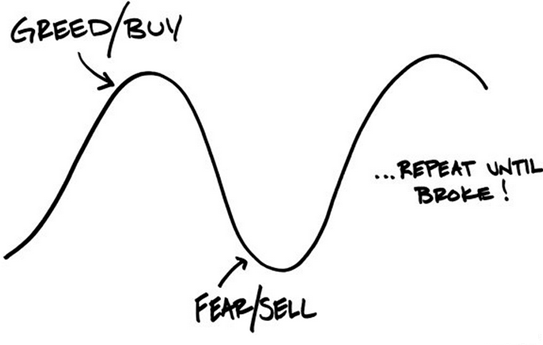

Some investors (more accurately speculators) sold and went to cash and some decided to buy back in after 12 months. Both strategies failed when compared to the investors that just did nothing.

Literally did nothing and remained invested.

It took until 5th March 2013 which is just over 5 years and 4 months for the DJI to reach the 2007 high once again and from there it just went higher and higher.

Click for chart.

Congratulations again to those clients who have taken advantage of this market crash and if you are an Active client that still has questions, please call me on 02 9267 2322.

9 Apr 2020

Social Security: JobSeeker

- Posted by Dejan Pekic BCom DipFP CFP GAICD

JobSeeker has replaced the Newstart Allowance and due to the economic impacts of the COVID-19 the eligibility criteria for the JobSeeker payment has been expanded from 25 March 2020 until 24 September 2020.

Effectively, the Federal Government has legislated that everybody who has become unemployed due to COVID-19 will qualify for the benefit.

The JobSeeker ($1,100 per fortnight) plus JobKeeper ($1,500 per fortnight) plus all the other measure will cost an estimated $320 billion which the Federal Government does not have and so will take from future tax payers.

Click for technical paper.

In the interim and while most are not watching, financial markets have bounced since the 23rd March 2020 low with the Dow Jones Industrial Average (DJI) closing at 23,433 points overnight which represents a 16.4% increase.

Our congratulations to all those clients who have taken advantage of this market crash and if you are an Active client who still has questions, please call me on 02 9267 2322.

Everyone else can wait.

3 Apr 2020

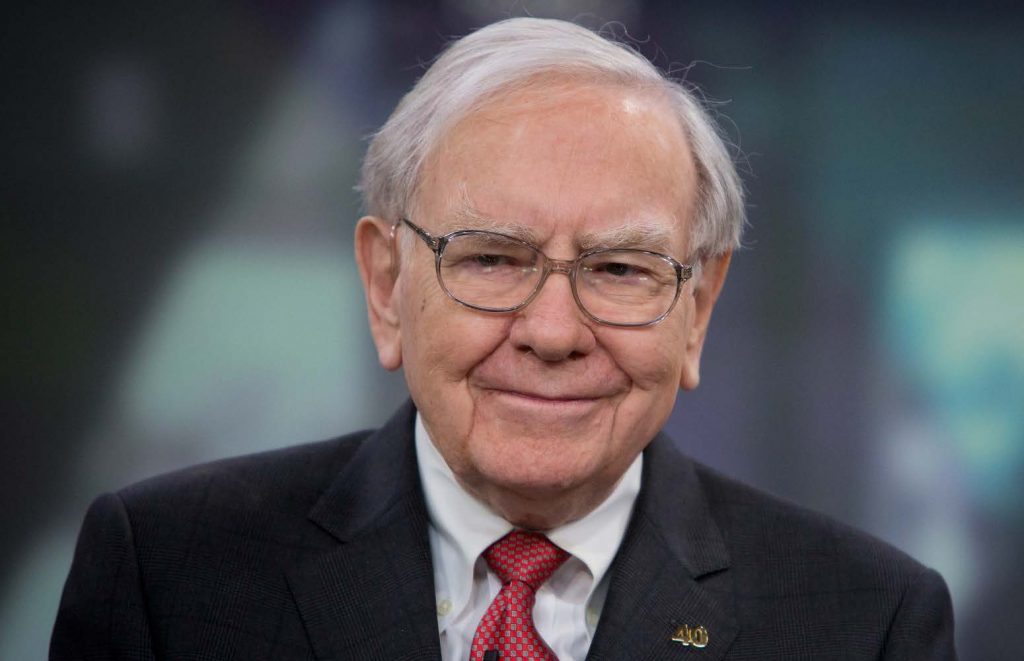

Friday Tidbit: Warren Buffett, The Oracle of Omaha

- Posted by Dejan Pekic BCom DipFP CFP GAICD

What else is there to say, this is smarts and wisdom from one of the great investors.

Click to read.

Warren Buffett’s single minded focus when it comes to investing has been to buy more quality assets when fear and panic take hold.

Remember to keep your head and if you are an Active client wanting to discuss how you can take advantage of this market crash, please call me on 02 9267 2322.

2 Apr 2020

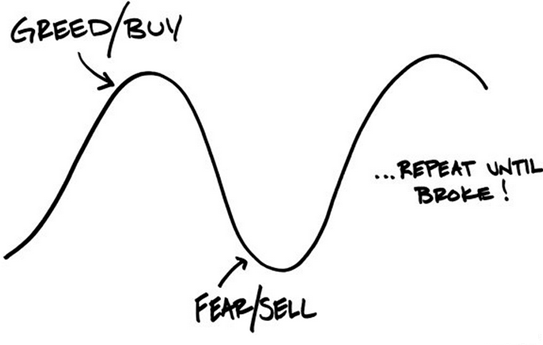

Bull vs Bear Market Cycles

- Posted by Dejan Pekic BCom DipFP CFP GAICD

We trust that you are all well and not overly anxious about the current bear that we are all experiencing.

History confirms that although bear markets occur at irregular intervals, they do in fact occur routinely.

The good news is that bear markets are always followed by significant bull markets and large positive returns.

Click for chart.

Remember to keep your head, never panic and if you are an Active client wanting to discuss how you can take advantage of this bear market, please call me on 02 9267 2322.