20 Mar 2024

Decarbonisation: Climate Change

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The United Nations Framework Convention on Climate Change (UNFCCC) estimates that US$125 trillion in investment is needed to achieve net-zero on a global scale by 2050.

Why are they planning this spending?

Because scientific report after scientific report keeps warning on climate change.

For example, the WMO (World Meteorological Organisation) has just published that 2023 was the warmest year on record, global sea level have reached record high, Antarctica sea ice reduced further 1 million square kilometers from previous recorded low and increased extreme weather is threatening food security.

Click to read.

Pollution caused by humanity is at the the heart of this problem and the subsequent spending of US$125 trillion to achieve net-zero by 2050 will present enourmous investment opportunities.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

14 Mar 2024

Cryptocurrency: Bitcoin

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The printing of vast quantiles of money (issuing I-owe-you paper called notes, bills, bonds) by Central banks around the World has been the key driver behind Bitcoin and associated cryptocurrencies but remember that Bitcoin price relies on The Greater Fool Theory.

The Greater Fool Theory is where a purchaser/investor buys an item/asset in the belief that the next purchaser/investor will buy it from them at a higher price.

That fact about Bitcoin is that only 21 million can be mined in total and so far 19.6 million have been collected which makes it rare and as long as there is a group who want to trade in this limited edition rarity (think of it as a collator’s item) there will be a price.

Once there is no longer a group that wants to trade in this collector’s item the price will evaporate.

Don’t know how cryptocurrency will end but we do know what Benjamin Graham taught and that was to not speculate. Instead remain invested according to your appetite for volatility and when fear and panic take hold, react by buying more quality assets at discounted prices.

Click to read.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

5 Mar 2024

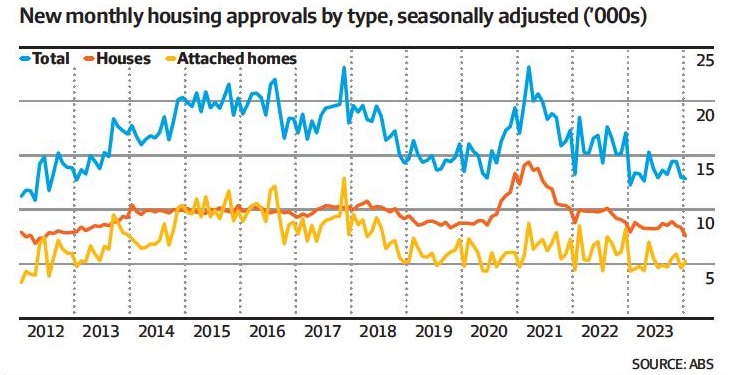

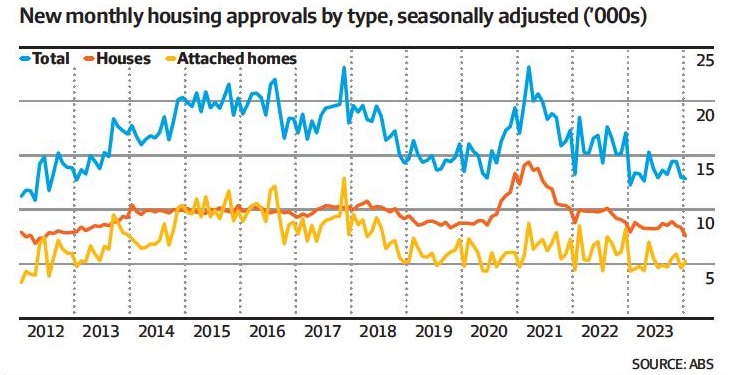

Australian Residential Property: 12 year low

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Residential property prices (especially Sydney and Melbourne) just keep increasing and everyone without property keeps complaining.

If the Federal Government wants to stop steep rises in residential property prices and steep rises in rents then it will need to either cut immigration immediately or streamline the building of more residential property which is currently at a 12 year low.

Building more residential property (increasing supply) is preferable because it brings economic benefits but it takes years to deliver supply of new residential property.

Click to read.

Ongoing reduction in residential property supply is not good because humans need shelter to live.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.