24 Nov 2020

The Treasury: Retirement Income

- Posted by Dejan Pekic BCom DipFP CFP GAICD

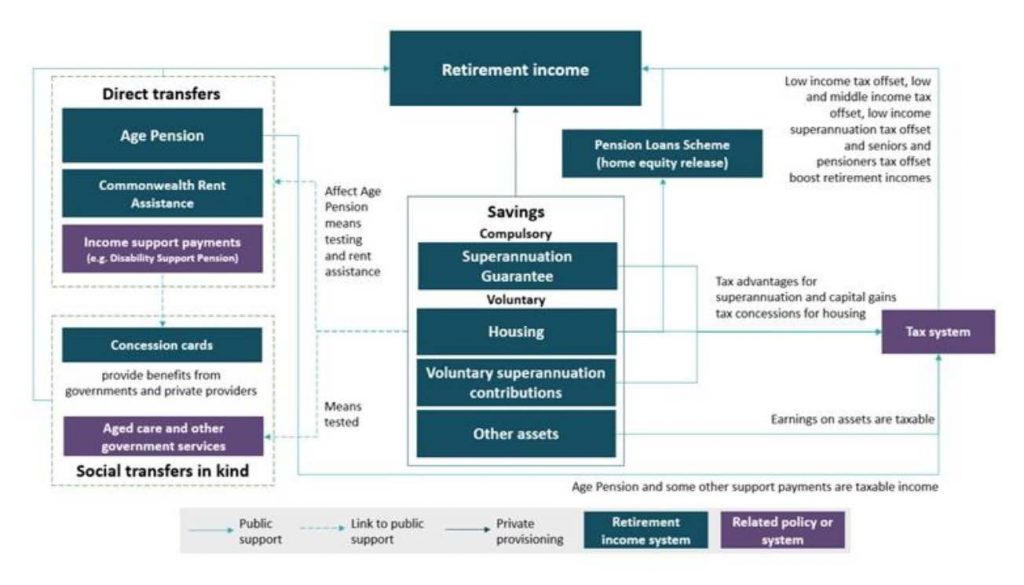

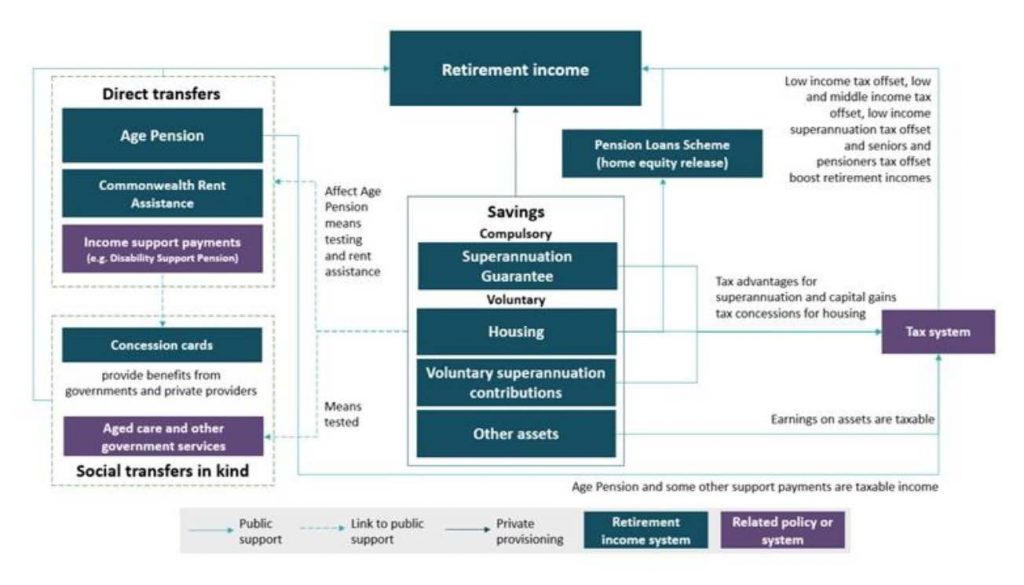

The Treasury published the Retirement Income Review – Final Report on the 20 November 2020.

You can see the interaction of our retirement income system in the above diagram, the full report is 648 pages long but we have attached the Key Observation and Overview document which is only 44 pages.

Click to read.

Why is the Retirement Income Review – Final Report an important document?

Because the Federal Government will use this report to help it argue that the compulsory 9.5% superannuation guarantee (SG) should not be increased to the legislated 12%.

The Federal Governments position is that higher SG contributions come at the cost of lower wage growth and increasing the SG rate benefits high income earners the most.

Both of these two points are supported by the findings in the Retirement Income Review – Final Report.

In terms of absolute retirement dollars, we agree that the SG does benefit high income earns the most. It is a fact.

However in reference to lowering wage growth, must disagree based on the past evidence.

The SG began in 1992 at the rate of 3.0%, has been increased to the current 9.5% and wages during the intervening 28 years have most definitely increased and significantly for many industries.

Disciplined saving is always good. For everyone.

20 Nov 2020

Friday Tidbit

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Real interest rates globally have been falling for 700 years according to research from the Bank of England.

The data shows that real interest rates have decreased by an average 0.016% per year since the 14th century to the record low today.

Global debt however, which is the sum of consumer, corporate, and government debt has risen to a record high of US$258 trillion or 331% of World GDP as at first quarter of 2020.

But wait, the US$258 trillion in global debt is forecast to rise further as a result of Government fiscal stimulus and falling tax revenues.

This quantum of debt will need to be dealt with eventually but in the interim it is a reason for why interest rates are expected to remain low for an extended period of time.

A rising interest rates now would just result in economic destruction globally and asset prices to collapse.

Click for chart.

17 Nov 2020

Harvard Business Review: LinkedIn

- Posted by Dejan Pekic BCom DipFP CFP GAICD

What’s the point of LinkedIn?

Good question.

This HBR Video talks about how to make LinkedIn work for you.

Click to watch.

10 Nov 2020

2020 US Presidential Election

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Joe Biden has been elected the 46th President of the United States of America.

How unlucky could he be when you consider that he takes over governing the United States during a pandemic which has already killed over 238,000 Americans and is not finished, a record US$27 trillion in outstanding Government debt that continues to soar out of control and a Federal budget deficit (spending exceeding revenue) that is showing no signs of a return to surplus.

What a disaster for the new President of the United States of America.

Click for chart.

On the plus side, the Dow Jones Industrial Average has just busted through its February 2020 peak this morning on news that Pfizer and BioNTech have a vaccine for COVID-19 that is 90% effective.

We are most definitely living in exciting times and look forward to seeing how it all plays out over the next decade.

6 Nov 2020

Friday Tidbit

- Posted by Dejan Pekic BCom DipFP CFP GAICD

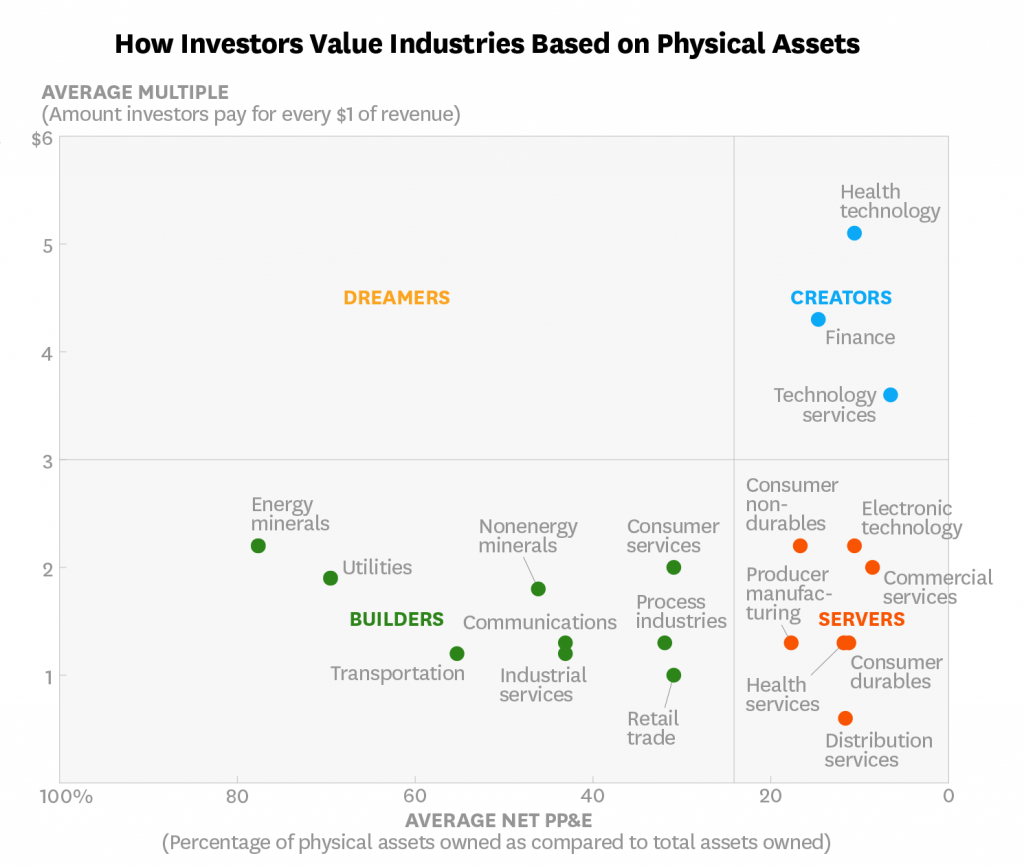

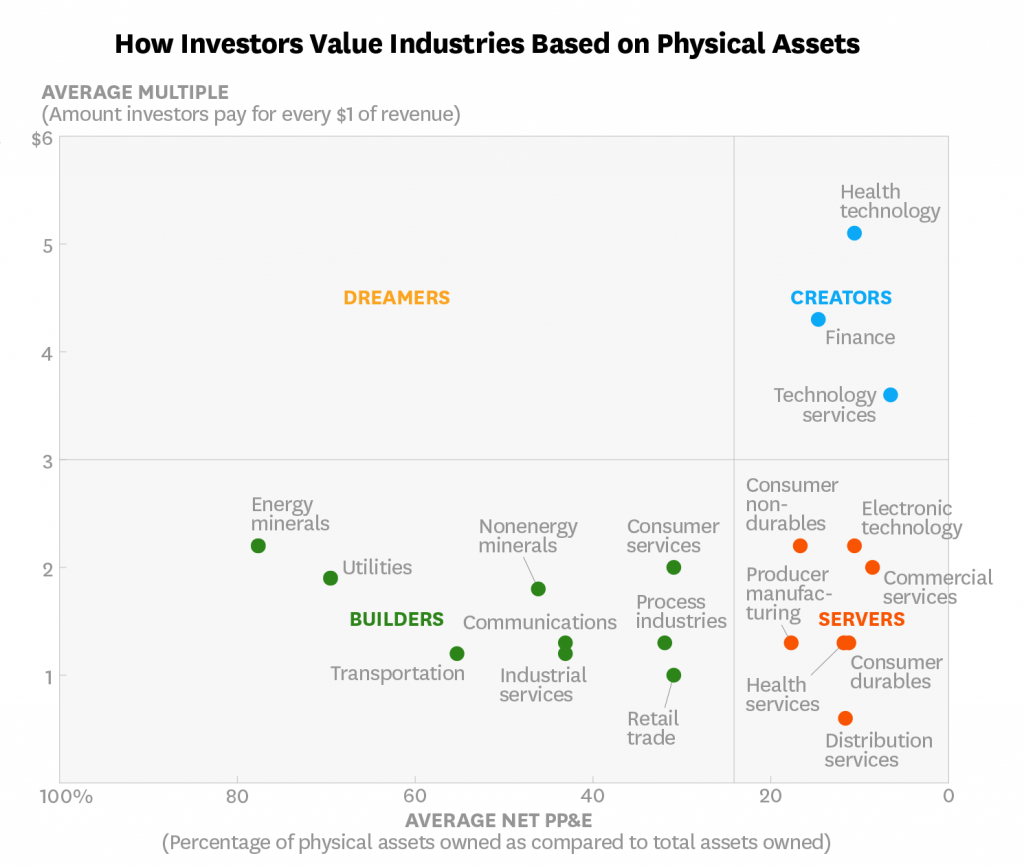

This is so accurate.

The speed of technological innovation is allowing companies to create enormous intangible value through patents, trademarks, software, information systems, artistic products and organisational capital and the existing legal, financial and regulatory framework is not keeping up.

This new asset-light capitalism is flipping economics on its head, making Accounting Standards obsolete for investors and allowing the winners to be more concentrated.

On the assumption that it is possible, we will just have to wait and see how long it will take the Governments of the World to catch this technological innovation phenomenon.

Click to read.

4 Nov 2020

RBA Cash Rate

- Posted by Dejan Pekic BCom DipFP CFP GAICD

It was inconceivable to forecast when we started this business in February 1991 that the RBA Cash Rate would be reduced from 12.00% to 0.10% today.

Click for chart.

The drop in the Cash Rate is good news for growth assets such as property and listed companies because reducing the cost of borrowing will fan their asset prices higher.

For defensive assets however, cash and fixed term deposit solutions no longer make any sense.

Need help, call us.