23 Jan 2023

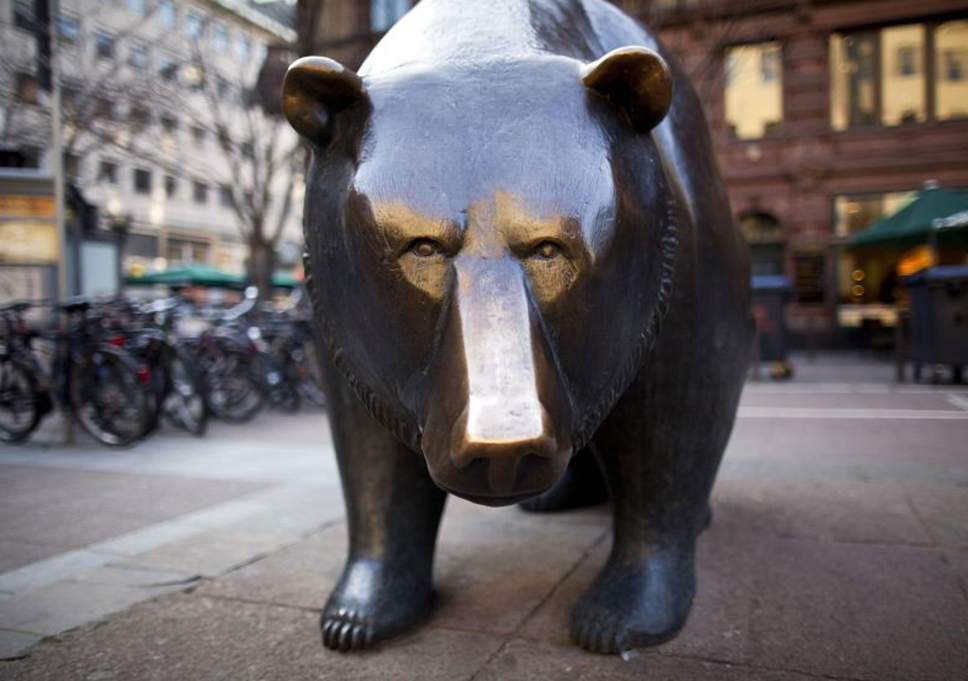

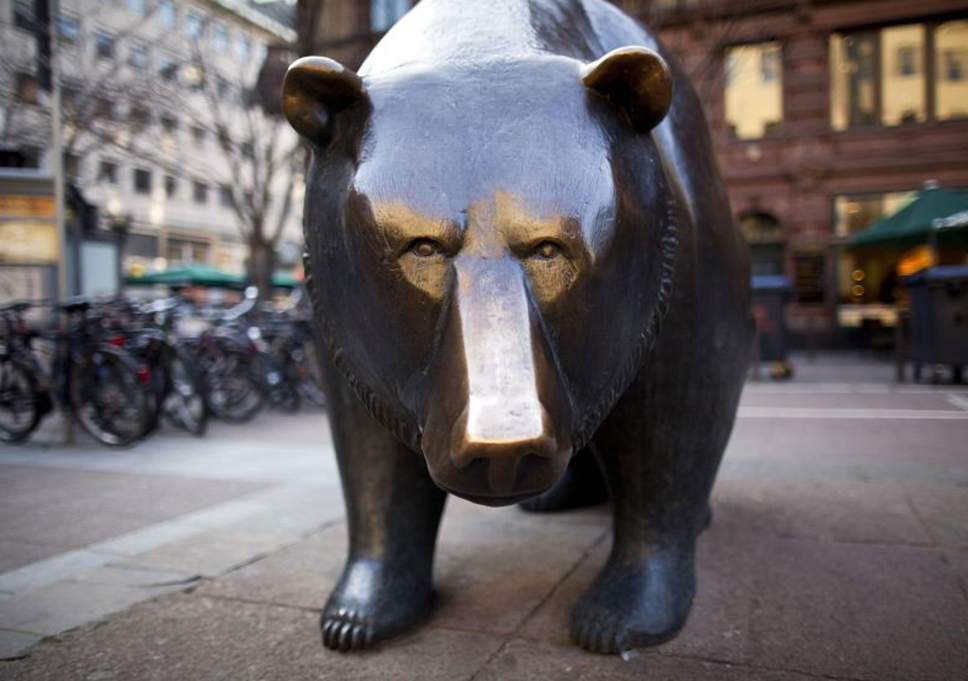

Recession Indicator: US interest rate cycles

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Economic history tells us that every time the United States begins increasing interest rates a recession follows afterwards more than 50% of the time.

The market believes that Jerome Powell, Chair of Federal Reserve is going to continue to increase interest rates to slow down the rate of inflation but it is coming to an end.

Click for chart.

Increasing interest rates should not be an investor’s focus.

Benjamin Graham taught that it is the buy price that matters when investing and now is a good time to buy beucase asset prices are discounted.

If a recession does follow in the United State then it will become an even better time for investors to buy more quality asset at a discounted price.

WARNING, this does not constitute Personal Advice. To discuss if this is an appropriate strategy for your given circumstances please do not hesitate to contact us directly.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

20 Jan 2023

Robotics Revolution: Atlas Gets a Grip

- Posted by Dejan Pekic BCom DipFP CFP GAICD

This is not science fiction and it is not CGI (Computer Generated Imagery) it is the here and now.

Boston Dynamics.

Is technology investment the smart money over the next decade? Absolutely.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

WARNING, this does not constitute Personal Advice. To discuss if this is an appropriate strategy for your given circumstances please do not hesitate to contact us directly.

18 Jan 2023

Asset Class Returns: The last 42 years…

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Morning all and a big welcome to 2023.

The pressing question at the start of 2022 was if it would be a repeat of 1994 when the US Federal Reserve rapidly increased interest rates and Australia followed causing financial markets chaos for both growth assets and defensive assets.

Well the numbers are in for calendar year ending 31 December 2022 and yes it most definitely has been a repeat of 1994.

There was nowhere to hide in 2022 other than cash at bank.

Click for index returns.

The returns for 2022 however do not reflect the opportunity for a investor to buy low and add to an investment holding when an asset class is out of favour which in turn accelerates the rate of return well above the index performance.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

WARNING, past performance is no guarantee of future performance and these index return figures do not reflect the ability of top professional investment management teams to outperform their respective index/benchmark. Most importantly, the above does not constitute Personal Advice.