30 Mar 2022

2022 Australian Federal Budget

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The Federal Treasurer Josh Frydenberg has handed down his fourth Budget and with all pre-election budges is it is focused on a cash splash.

A few of key opportunities include-

- Extension of reduction in superannuation pension minimum drawdown rates– The 50% minimum drawdown rate will continue to apply in the 30 June 2023 financial year.

- Removal of the Work Test from 1 July 2022– Individuals up to the age of 74 years can make non-concessional super contributions without meeting the Work Test.

- Downsizer contribution from 1 July 2022– The minimum age requirement for the downsizer contribution eligibility will reduce from 65 to 60.

Click to read.

23 Mar 2022

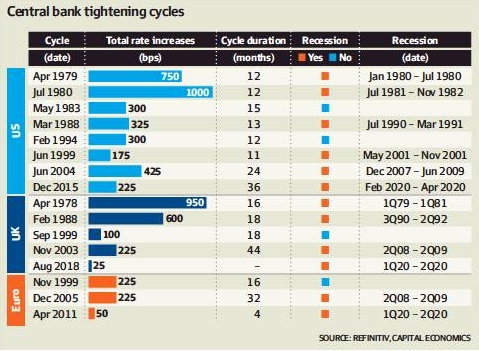

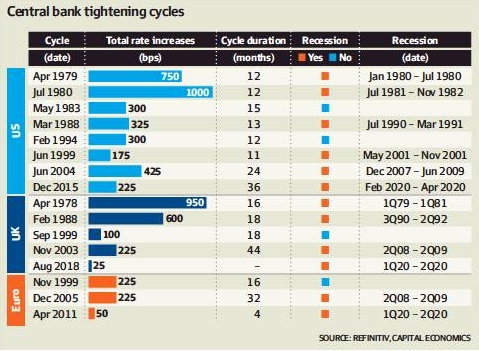

Interest Rates: Central Bank tightening cycles

- Posted by Dejan Pekic BCom DipFP CFP GAICD

History confirms that not all tightening cycles (which is when Central Banks increase interest rates) end in a recession.

The majority do end in a recession as you can see from the table above but not all.

Yes, the large and rapid increase in interest rates by the US Federal Reserve in 1994 did not end in a recession in the United States or in Australia but that still did not stop financial asset prices crashing in 1994.

Over the past week, financial asset prices have improved from correction levels because financial markets expect the US Federal Reserve to slowly increase interest rates over the next two years and not do anything violent.

Let’s see if this proves correct.

21 Mar 2022

Ukraine and Russia: Arnold Schwarzenegger

- Posted by Dejan Pekic BCom DipFP CFP GAICD

This is such a powerful message that needs to be shared.

This War is an abomination and needs to be stopped.

Click to watch.

18 Mar 2022

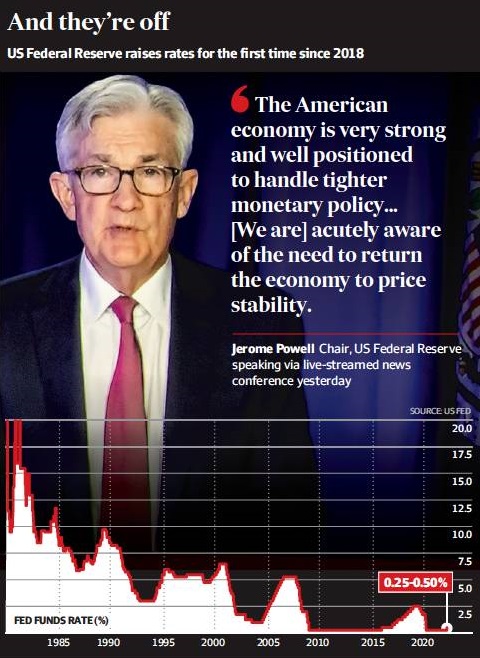

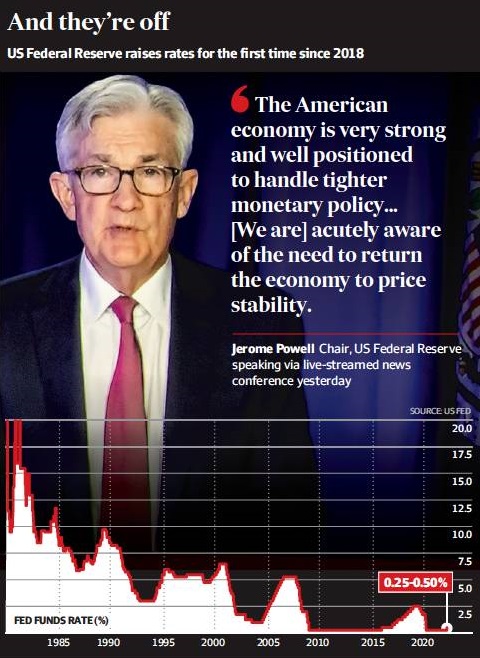

US Interest Rates: And they’re off

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Finally, some good news.

The US Federal Reserve lifted its benchmark interest rate by 0.25% which has been accepted as measured and pragmatic move.

The big concern was a repeat of 1994 when the US Federal Reserve just smashed out big interest rate hikes and collapsed the price of all financial assets.

This time, asset prices have not collapsed and financial markets now expect this to be a deliberately slow interest rate hiking cycle over the next two years which means that the current correction in asset prices maybe all over.

Please remember that even if asset prices do not crash in the next few days or weeks (defined as a 20% fall or more from recent peak) they most certainly will in the decade to come.

So when the next financial catastrophe does hit which it will, please remember these words from Benjamin Graham…

“Mr. Market’s job is to provide you with prices;

your job is to decide whether it is to your advantage to act on them.”

16 Mar 2022

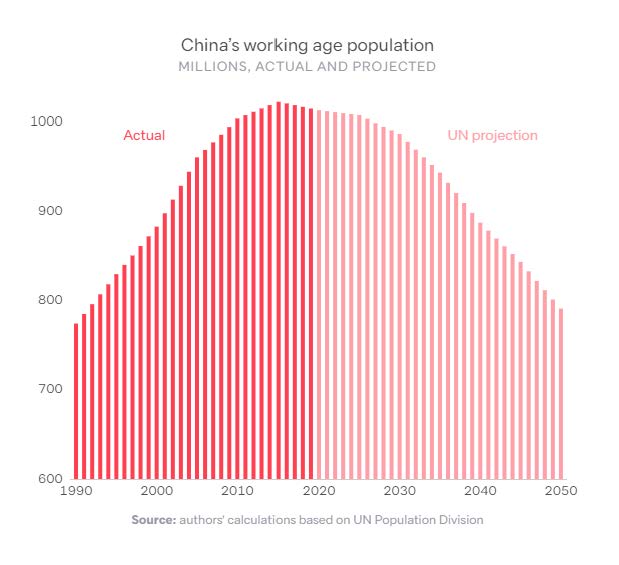

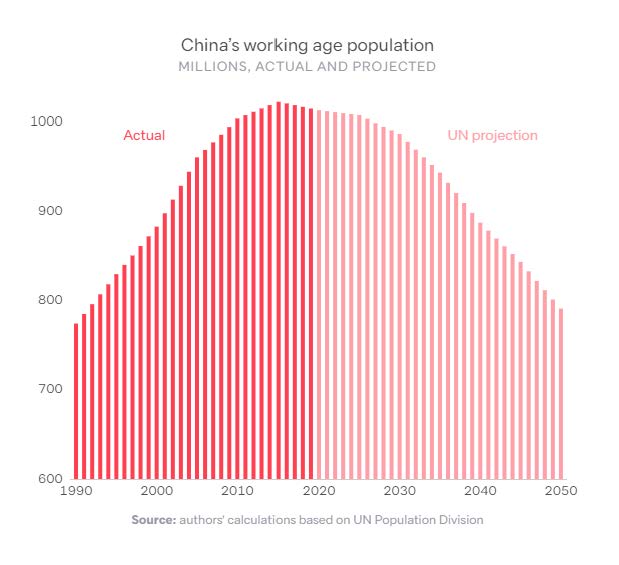

Asian Century: China

- Posted by Dejan Pekic BCom DipFP CFP GAICD

There is not much doubt that this will be the Asian Century given that half of the World’s population live in this region however China may not be as dominant as has been previously forecast.

The One-Child Policy implemented by China between 1980 and 2015 to curb the country’s population growth.

Restricting the majority of families to a single child will have a dramatic negative impact on China working age population over the next three decades and this is expected to limit China’s ability to dominate in the way that the United States of America has economically dominated all other nations.

An excellent research paper from Lowy Institute.

Click to read.

10 Mar 2022

Ukraine and Russia

- Posted by Dejan Pekic BCom DipFP CFP GAICD

We are surprised that asset prices have not collapsed.

Consider-

- COVID-19 pandemic then the delta variant and now the omicron variant have led to material supply side shortages of goods causing inflation to spike,

- Russia has declared War on Ukraine and been hit with the biggest economic sanctions in history and

- Jerome Powell Chair of Federal Reserve of the United States has confirmed that they are increasing interest rates by 1% in 2022 staring next week.

So why then have asset prices only corrected which is defined as a 10% fall or more from recent peak instead of crashed which is defined as a 20% fall or more from recent peak.

For example, the Down Jones Industrial Average closed at 33,418 points overnight which is only down 9.2% from its 5 January 2022 high.

All the ingredients are already present for financial market asset prices to crash but we are only at correction levels. Why?

If you know the answer please call or email us.

Looking foward over the next 3 years, inflation is forecast to reduce after peaking this year and GDP (Gross Domestic Product) will slow but is still forecast to be positive.

Click for table.

The investment thinking during times such as this is clear. Don’t speculate, instead remain invested according to your appetite for volatility and when fear and panic take hold, only then react by buying more quality assets at discounted prices.

3 Mar 2022

Newealth FSG (March 2022)

- Posted by Dejan Pekic BCom DipFP CFP GAICD

We have updated our Financial Services Guide.

For more details, click ‘Newealth FSG’ or alternatively go to the FINANCIAL SERVICES GUIDE link at bottom of the page.

2 Mar 2022

Australian Residential Property: Trophy Homes

- Posted by Dejan Pekic BCom DipFP CFP GAICD

This strategy is not new and we have employed it since starting the practice in 1991.

The primary residence is the centerpiece asset for the middle class in Australia.

The primary residence provides shelter without having to pay rent, access to capital by being able to borrow at the lowest interest rates in the market and tax free capital gains provided that prices increase.

The Ultra High Net Worth Individuals buy a trophy primary residence because it is the only asset on their balance sheet where they can invest tens of millions or hundreds of millions of dollars and not pay any tax on the capital gain.

It has been one of the most successful investment strategies for 30 consecutive years.

Will it continue?

More likely than not for Sydney and Melbourne because we have a housing shortfall given that migration level are set at 160,000 for 2021-22 according to Australian Goverment Depart of Home Affairs and likely to return back to 220,000 per annum.

Click to read.