16 Aug 2017

Behavioral Finance: Rollercoaster of investment emotions

- Posted by Dejan Pekic BCom DipFP CFP GAICD, Senior Financial Planner

For investing, the facts are that the vast majority of individuals are consistently bad at dealing with uncertainty, underestimating some risks and overestimating others.

This led Daniel Kahneman a psychologist into researching the psychology of judgment and decision-making as well as behavioral economics for which he was awarded the 2002 Nobel Memorial Prize in Economic Sciences.

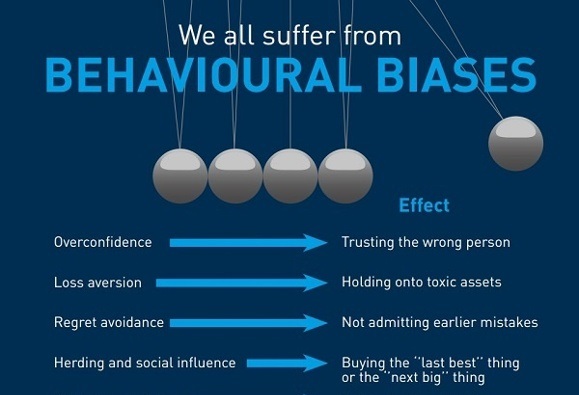

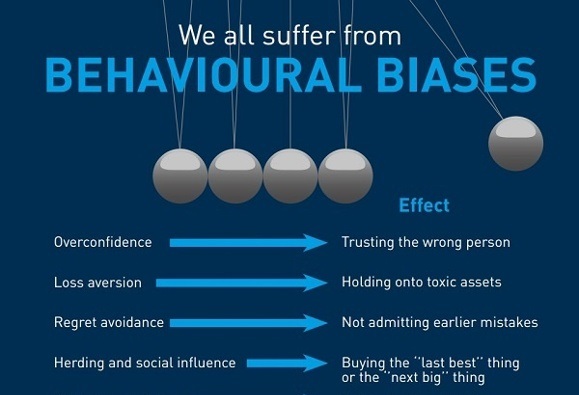

The field of behavioral finance and behavioral economics concludes that the roots of our poor decision making are far from being random, in fact these mistakes are systematic and predicable which implies that they can be greatly reduced.

Below is a series of short and entertaining videos on the behavioral biases that we face as investors and the skill is to take them into account before making a poor decision.

Please enjoy.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.