25 Oct 2018

Interest Rates: Yield Curve

- Posted by Dejan Pekic BCom DipFP CFP GAICD, Senior Financial Planner

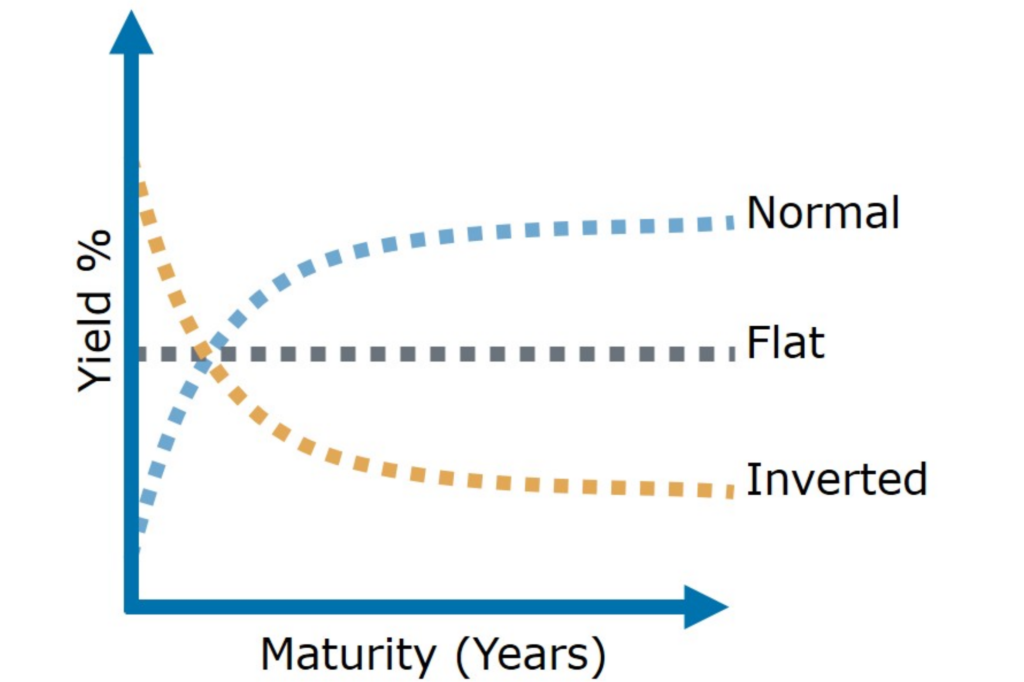

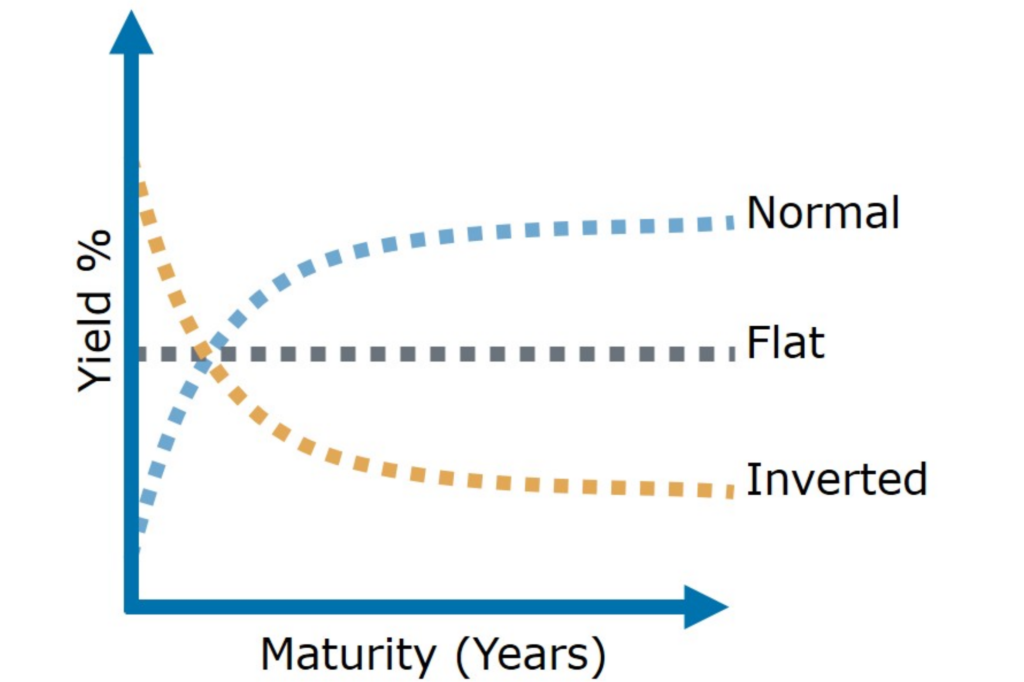

The normal is for long term interest rates to be higher than short term interest rates.

However short term interest rates are rising which is flattening the yield curve.

The concern is when the yield curve becomes inverted (short term interest rate are higher than long term interest rates) because in the past this has marked the beginning of an economic downturn.

Currently the US 3 month Treasury Bill Rate is 2.34% (was 1.09% 12 months ago) and the US 10 year US Treasury Bond Rate is 3.10% (was 2.39% 12 months ago).

The gap has narrowed from 1.3% to 0.76% which is why we are seeing the yield curve flatten.

Click for Yield Curve Basics.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.