28 Feb 2019

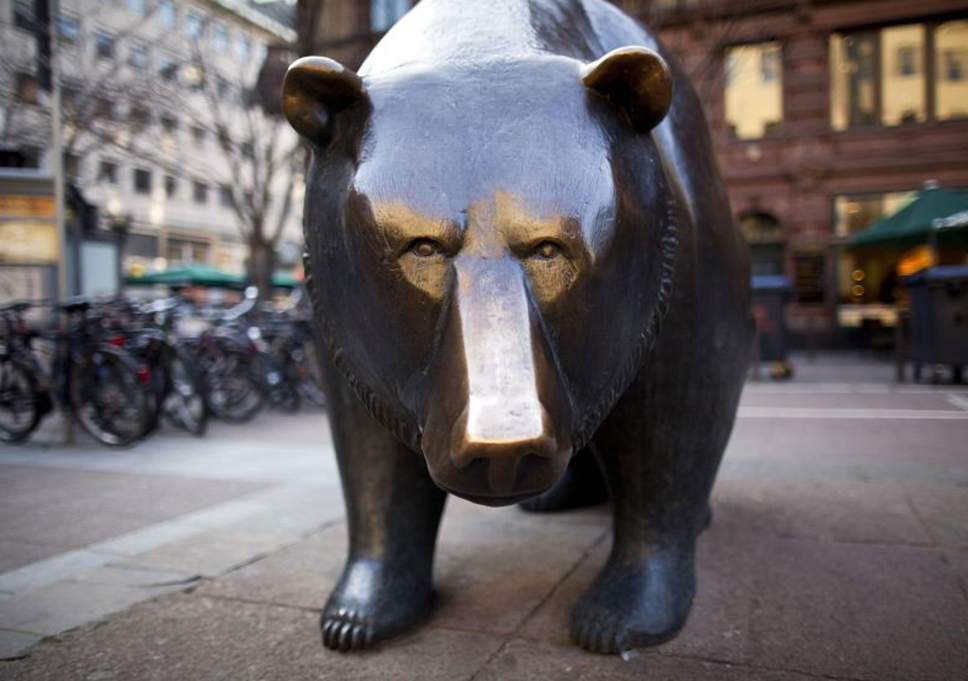

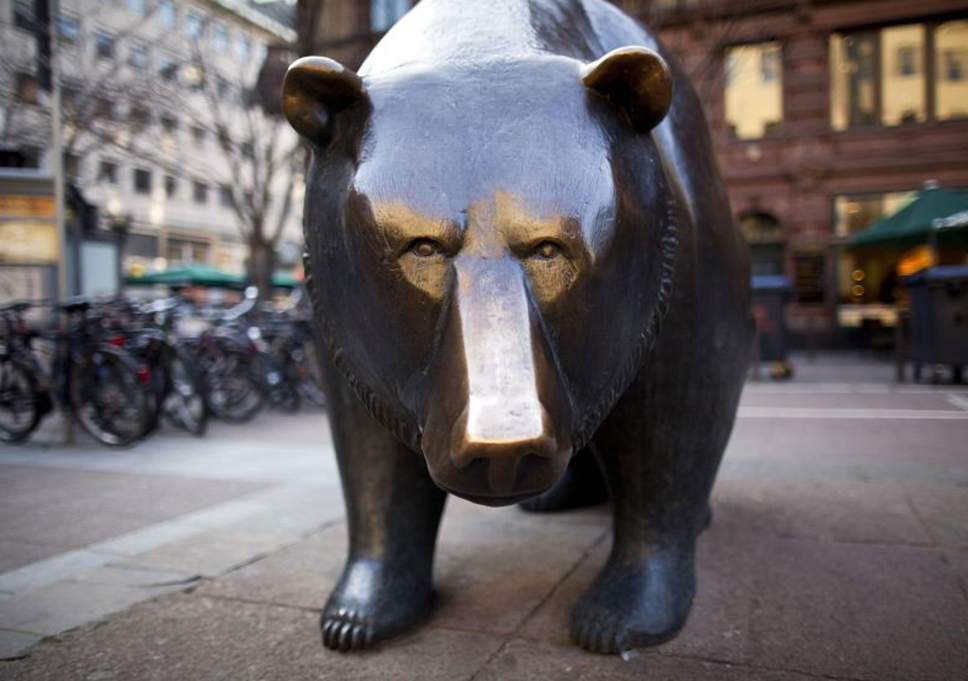

Market Cycles: Peak

- Posted by Dejan Pekic BCom DipFP CFP GAICD, Senior Financial Planner

The attached chart on Corporate Debt to GDP in the United States could be telling us that the United States has peaked and is staring into the eyes of a bear market.

However the same could have been said in 2016 which continued to go higher with no recession.

This is the problem with speculative investing.

Speculative selling or buying prior to a future predicted event does not work. It you somehow get the timing right then it is actually just good luck.

If you are now asking yourself, can the current bull run go longer? The answer is yes and will the current bull run bust? The answer is yes.

Attached is also research on the last 7 bear markets in the United States.

The lesson from the past is that all bear markets end and so remember, when fear and panic take hold during the next financial catastrophe, investors will be presented with the opportunity to buy more quality assets at discounted prices.

Click for chart.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.