30 May 2019

Interest Rates: US Yield Curve

- Posted by Dejan Pekic BCom DipFP CFP GAICD, Senior Financial Planner

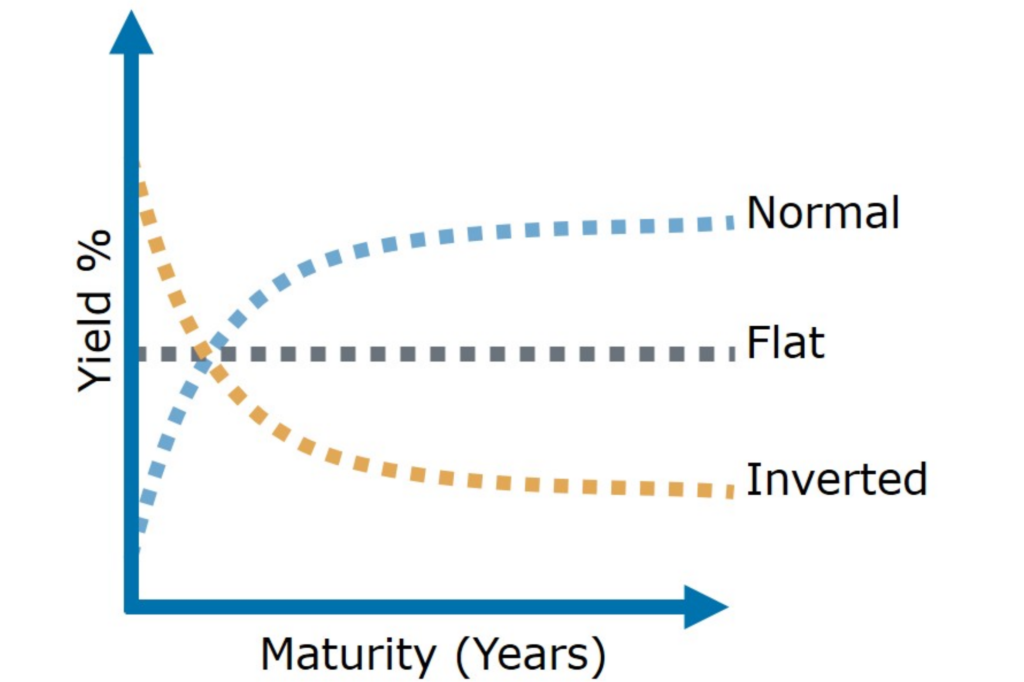

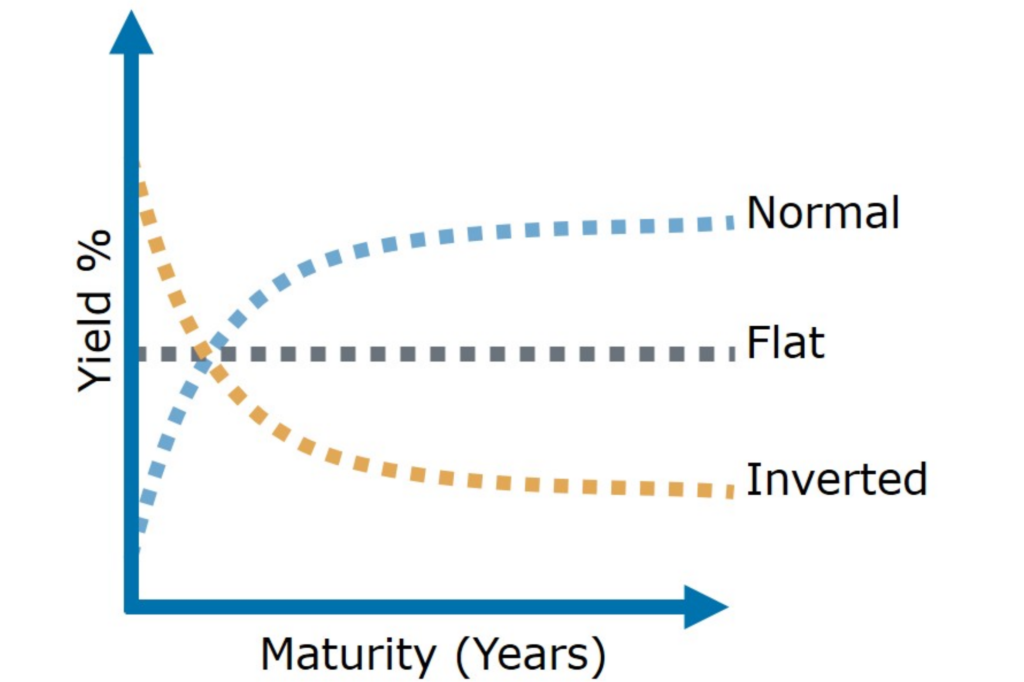

The normal is for long term interest rates to be higher than short term interest rates.

The concern is when the yield curve becomes inverted (short term interest rate are higher than long term interest rates) because in the past this has marked the beginning of an economic downturn.

Today the US 3 month Treasury Bill Rate is 2.37% and the US 10 year US Treasury Bond Rate is 2.25%.

The yield curve has been inverted since Monday, 13th May 2019 and historically the inversion has pointed to the start of the next US recession but the research shows that this is not always the case.

Click for chart.

The key for investors with all of this market noise is to remain invested according to your appetite for volatility and then, when fear and panic take hold during the next financial catastrophe, to take advantage by buying more quality assets at discounted prices.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.