17 Sep 2019

Behavioral Finance: Time in the market

- Posted by Dejan Pekic BCom DipFP CFP GAICD, Senior Financial Planner

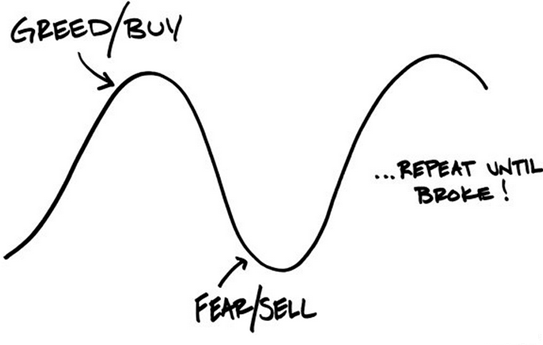

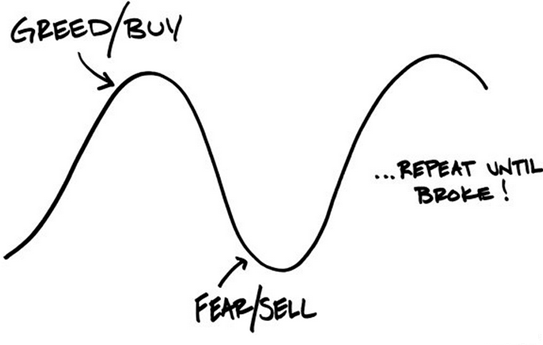

Investors are consistently bad at dealing with uncertainty, underestimating some risks and overestimating others.

This often results in attempts to time the market such as selling in the expectation of an imminent financial market crash.

Attached is research on the impact on total return if an investor investing in indices missed the 5 best performing days and the 30 best performing days versus just staying invested for the past 27 year period to 30 June 2019.

It is not surprising to see that the investor was better off staying fully invested versus missing out on being invested during both the 5 best days and the 30 best days.

Emotions are not our friend when investing.

In fact the times when an investor is feeling panic, capitulation, despondency, fear and or skepticism towards their investments is almost always the point of maximum financial opportunity.

Click for chart.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.