6 Nov 2019

The Wisdom of Great Investors: Behavioral Finance

- Posted by Dejan Pekic BCom DipFP CFP GAICD, Senior Financial Planner

As Benjamin Graham taught, you are not right because Mr Market agrees with you, you are right because your numbers are right.

Graham and a couple of other great investors went on to highlight a few more truths about investing in growth assets.

- “Do not take yearly results so seriously. Instead focus on four or five year averages.” Benjamin Graham

- “Everyone has the brain power to make money in stocks. Not everyone has the stomach. If you are susceptible to selling everything in a panic, you ought to avoid stocks and [investment] funds.” Peter Lynch

- “If you have trouble imagining a 20% loss in the stock market, you shouldn’t be in stocks.” John Bogle

- “Compound interest is the eighth wonder of the world. He who understands it, earns it…he who doesn’t, pays it.” Albert Einstein

We have attached a chart on the MSCI AC World Index which is comprised of listed companies from 23 developed and 24 emerging countries to provide a broad measure of World stock market performance.

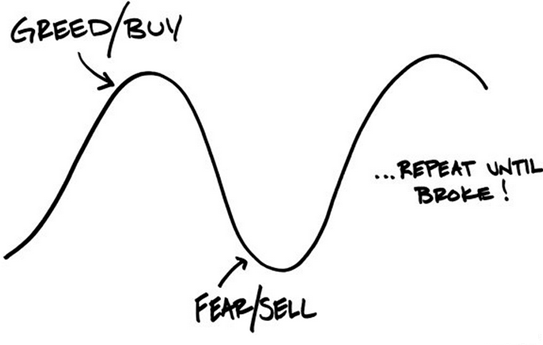

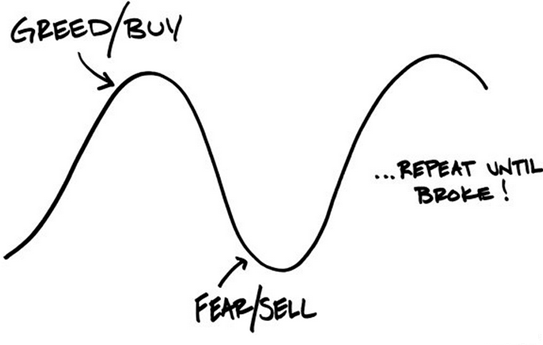

The results have been manic over the past 30 years and this is normal which is why the key lesson to remember is that the best opportunity to buy more quality growth assets at reasonable or better still discounted prices is when fear and panic take hold.

Click for chart.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.