26 Nov 2019

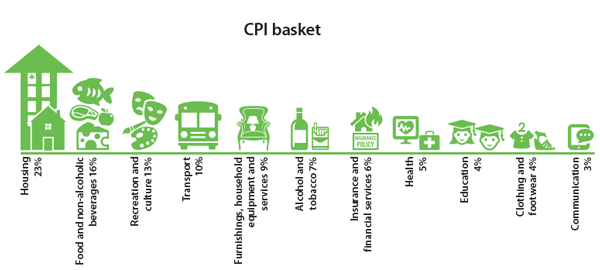

US Inflation: 1913-2019

- Posted by Dejan Pekic BCom DipFP CFP GAICD, Senior Financial Planner

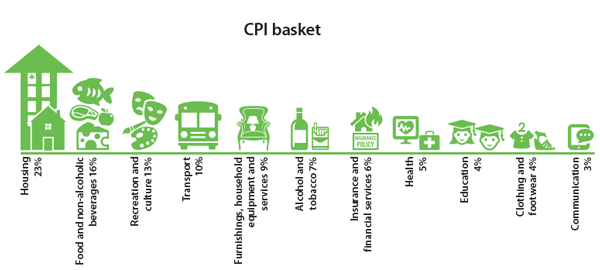

Inflation is defined by Investopedia as a quantitative measure of the rate at which the average price level of a basket of selected goods and services in an economy increases over a period of time.

During most of last century inflation has followed a cycle of steep rises and falls but since 1991 it has remained calm, almost peaceful (The great moderation).

Why?

The key drivers of inflation are the cost of raw materials and wages involved in producing goods and services. Wage growth on a mass level has definitely not presented this century.

Why?

And now we come to it, technology.

Technological advances are resulting in automation which is disrupting human employment and this is our professional guess for why inflation is dead.

And yes it is possible for inflation to remain non-existent for decades to come as more technological disruption continues to suppress mass wage growth.

The benefit of ongoing low inflation is that it will hold down interest rate rises to a trickle which then supports increasing growth asset prices (property and shares) which only becomes a problem when growth asset prices become stretched and unfortunately this is the current situation.

By conclusion, Mr Market (an allegory created by Benjamin Graham) must be thinking to himself that technology and innovation will deliver the increasing income (profit distribution) needed to support current and rising growth asset prices.

Click for chart.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.