14 Jul 2020

Cost of Living in Retirement (Part 2): How much do I need?

- Posted by Dejan Pekic BCom DipFP CFP GAICD, Senior Financial Planner

Yesterday’s ASFA Retirement Standard raised a number of questions including what number is needed to fund a ‘comfortable lifestyle’ in retirement starting from the earlier age of 60.

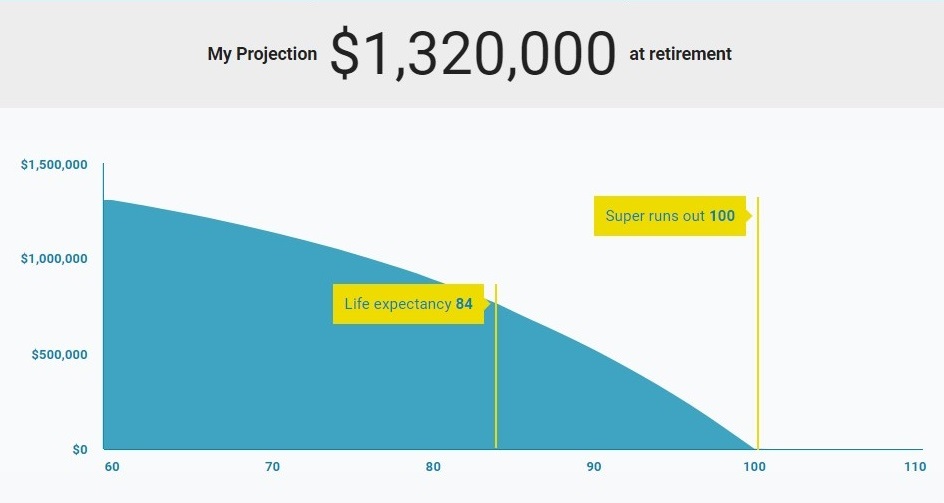

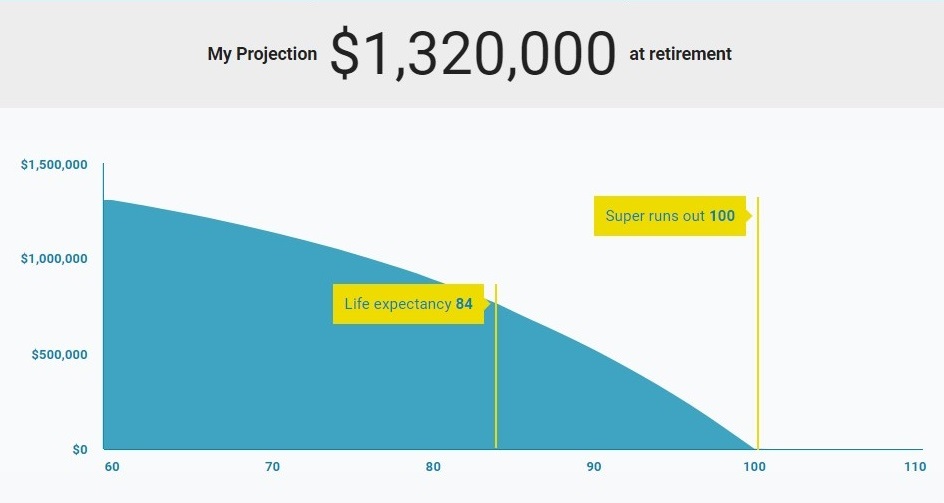

Again, assuming a 6.9% per annum rate of return and an inflation rate of 3.0% per annum (currently 2.2% per annum according to RBA) for a couple aged 60 today, they will need $1,320,000 in addition to owning their home to receive $62,435 per annum in real terms for 40 years after which time the capital will be exhausted.

See above chart of retirement balance projection for a couple age 60 today.

If you are an Active client and have questions about what else you can do to accumulate capital for retirement, please call me on 02 9267 2322.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.