19 Feb 2021

Global Debt: Cryptocurrency

- Posted by Dejan Pekic BCom DipFP CFP GAICD, Senior Financial Planner

If you needed more proof about the debt elephant in the room just have a look at how much money the US Federal Reserve has printed during this COVID-19 crisis versus the past 100 years.

Click for chart.

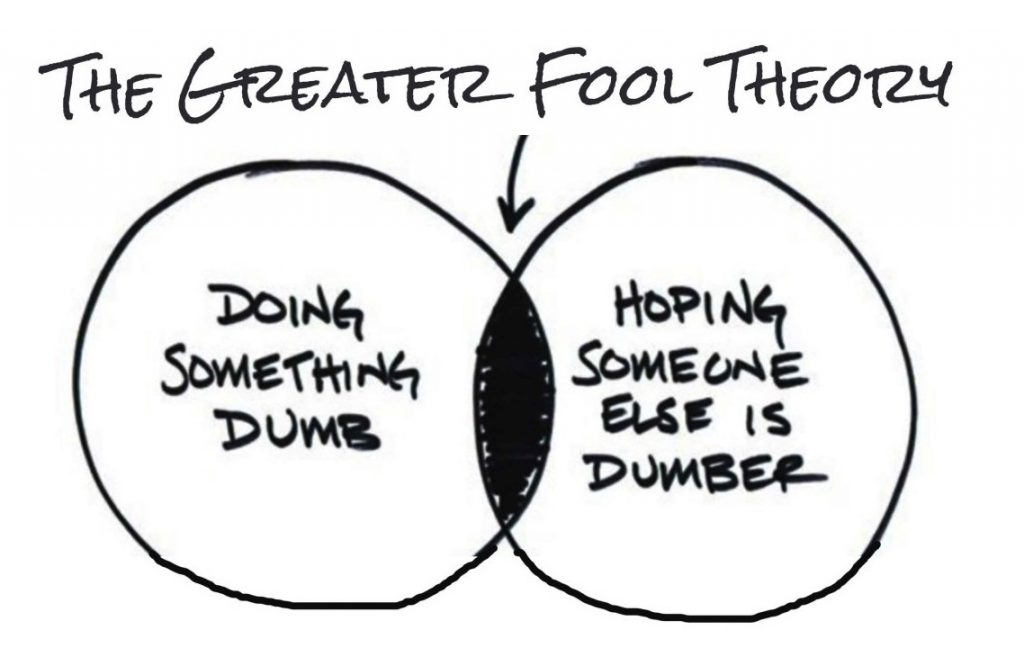

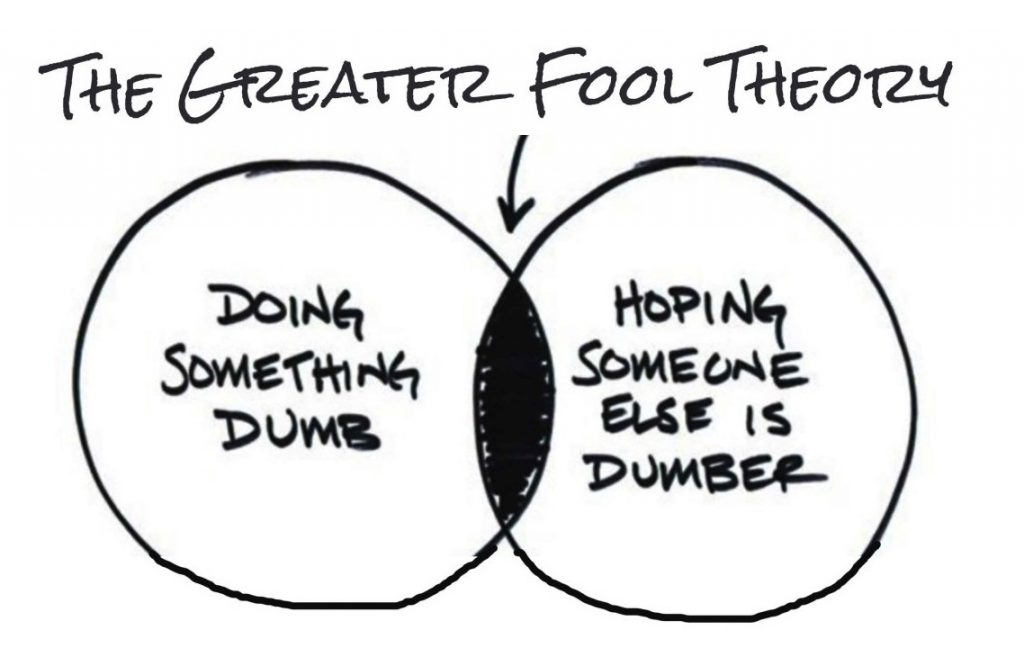

This printing of vast quantities of money (issuing I-owe-you paper called notes, bills, bonds) by Central banks around the World has helped drive the price for Bitcoin and associated cryptocurrencies but remember that Bitcoin price relies on The Greater Fool Theory.

The Greater Fool Theory is where a purchaser/investor buys an item/asset in the belief that the next purchaser/investor will buy it from them at a higher price.

That fact about Bitcoin is that only 21 million can be mined in total and so far 18.5 million have been collected which makes it rare and as long as there is a group who want to trade in this limited edition rarity, think of it as a collator’s item, there will be a price.

Once there is no longer a group that wants to trade in this collector’s item the price will evaporate.

Don’t know how this is going to end but we do know what Benjamin Graham taught and that was to not speculate. Instead remain invested according to your appetite for volatility and when fear and panic take hold, react by buying more quality assets at discounted prices.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.