16 Sep 2021

Market Metrics: Commodity Prices

- Posted by Dejan Pekic BCom DipFP CFP GAICD, Senior Financial Planner

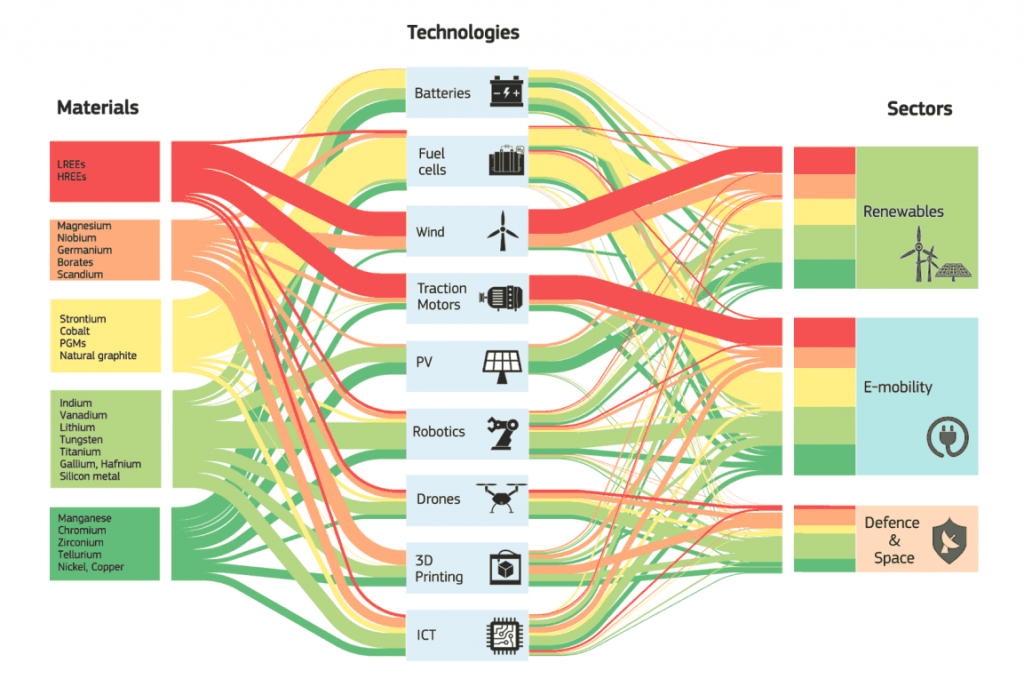

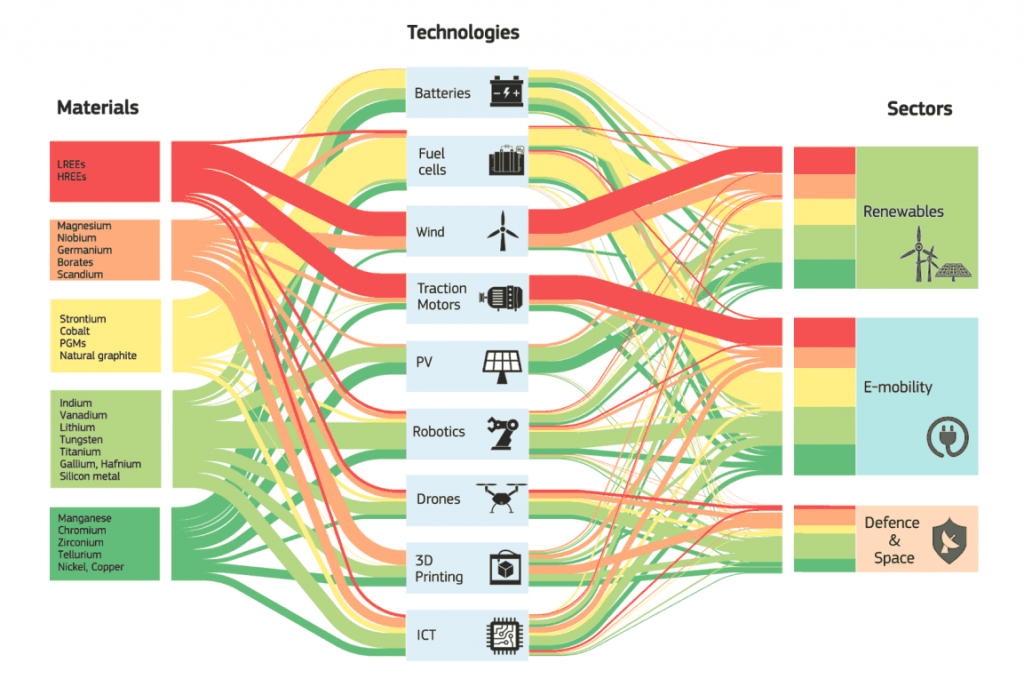

Commodities are forecast to be entering a new super cycle due to the demand for clean energy and electric vehicle technology. For example, a electric vehicle contains 4 to 10 times as much copper as a conventional car.

The Commodity Research Bureau (CRB) Index acts as a representative indicator of global commodity markets. This secular super cycle bull market in commodities is forecast to peak by 2045.

Click for chart.

The implication for the Australian dollar is that it is most likely to rise which reduces the return on internationally held investments in Australian dollar terms.

WARNING, this does not constitute Personal Advice and to discuss if this is appropriate for your given circumstances please do not hesitate to contact us directly.

As with all forecasts, they are just a hypothesis because no one can predict the future with certainty.

The real message is to remain invested according to your appetite for volatility and when fear and panic take hold, react by buying more quality assets at discounted prices.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.