18 Mar 2022

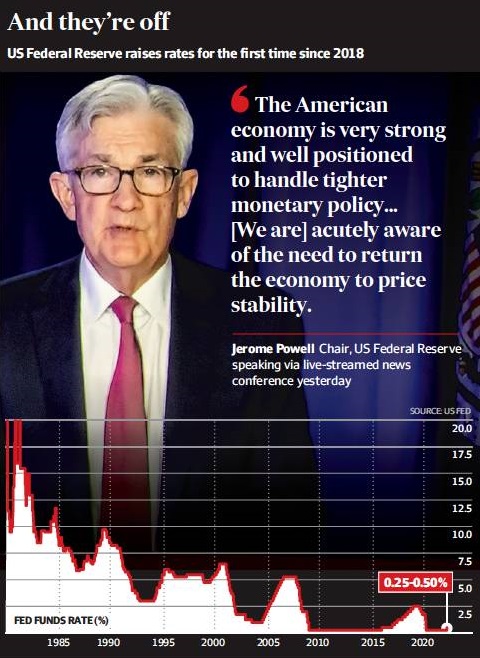

US Interest Rates: And they’re off

- Posted by Dejan Pekic BCom DipFP CFP GAICD, Senior Financial Planner

Finally, some good news.

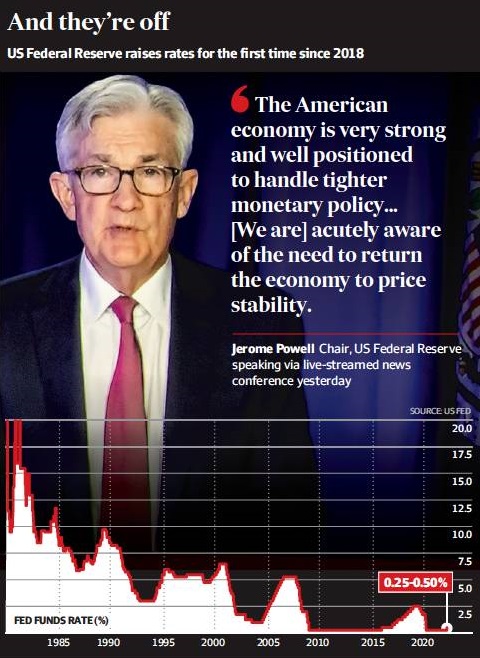

The US Federal Reserve lifted its benchmark interest rate by 0.25% which has been accepted as measured and pragmatic move.

The big concern was a repeat of 1994 when the US Federal Reserve just smashed out big interest rate hikes and collapsed the price of all financial assets.

This time, asset prices have not collapsed and financial markets now expect this to be a deliberately slow interest rate hiking cycle over the next two years which means that the current correction in asset prices maybe all over.

Please remember that even if asset prices do not crash in the next few days or weeks (defined as a 20% fall or more from recent peak) they most certainly will in the decade to come.

So when the next financial catastrophe does hit which it will, please remember these words from Benjamin Graham…

“Mr. Market’s job is to provide you with prices;

your job is to decide whether it is to your advantage to act on them.”

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.