20 Jul 2022

Market Metrics: S&P 500 Index

- Posted by Dejan Pekic BCom DipFP CFP GAICD, Senior Financial Planner

The COVID-19 pandemic is still restricting supply of goods, War in Ukraine continues, inflation is at 40 year highs and interest rates are predicted to rise.

Are we there yet? Have asset prices valuations bottomed?

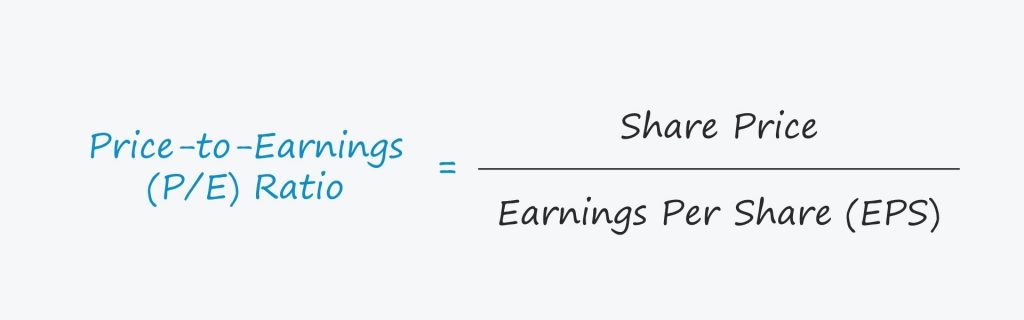

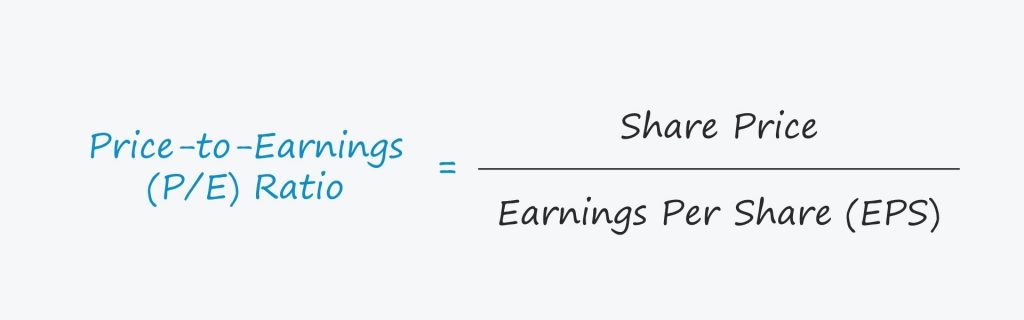

More likely than not because the Price to Earning (P/E) for the S&P500 has fallen below its 30 year average.

The other metric pointing to the correction in asset prices having bottomed is the US 10 year Treasury Yield which has crested at 3.47%.

Click for charts.

If this is the bottom then we will not see an asset price crash in 2022 but it is impossible to predict the future with accuracy.

Right now the best course of action is to just remain invested according to your appetite for volatility and continue to buy more quality assets at discounted prices.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.